Geoff and Sandy Harland own and operate Wayward Kennel and Pet Supply. Their motto is, “If your pet is not becoming to you, he should be coming to us.” The Harlands maintain a sales tax payable account throughout the month to account for the 6% sales tax. They use a general journal, general ledger, and

Sept. 2 Sold a fish aquarium on account to Ken Shank, $125 plus tax of $7.50, terms n/30. Sale No. 101.

3 Sold dog food on account to Nancy Truelove, $68.25 plus tax of $4.10, terms n/30. Sale No. 102.

5 Sold a bird cage on account to Jean Warkentin, $43.95 plus tax of $2.64, terms n/30. Sale No. 103.

8 Cash sales for the week were $2,332.45 plus tax of $139.95.

10 Received cash for boarding and grooming services, $625 plus tax of $37.50.

11 Jean Warkentin stopped by the store to point out a minor defect in the bird cage purchased in Sale No. 103. The Harlands offered a sales allowance of $10 plus tax on the price of the cage which satisfied Warkentin.

12 Sold a cockatoo on account to Tully Shaw, $1,200 plus tax of $72, terms n/30. Sale No. 104.

14 Received cash on account from Rosa Alanso, $256.

15 Rosa Alanso returned merchandise, $93.28 including tax of $5.28.

15 Cash sales for the week were $2,656.85 plus tax of $159.41.

16 Received cash on account from Nancy Truelove, $58.25.

18 Received cash for boarding and grooming services, $535 plus tax of $32.10.

19 Received cash on account from Ed Cochran, $63.25.

20 Sold pet supplies on account to Susan Hays, $83.33 plus tax of $5, terms n/30. Sale No. 105.

21 Sold three Labrador Retriever puppies to All American Day Camp, $375 plus tax of $22.50, terms n/30. Sale No. 106.

22 Cash sales for the week were $3,122.45 plus tax of $187.35.

23 Received cash for boarding and grooming services, $515 plus tax of $30.90.

25 Received cash on account from Ken Shank, $132.50.

26 Received cash on account from Nancy Truelove, $72.35.

27 Received cash on account from Joe Gloy, $273.25.

28 Borrowed cash to purchase a pet limousine, $11,000.

29 Cash sales for the week were $2,835.45 plus tax of $170.13.

30 Received cash for boarding and grooming services, $488 plus tax of $29.28.

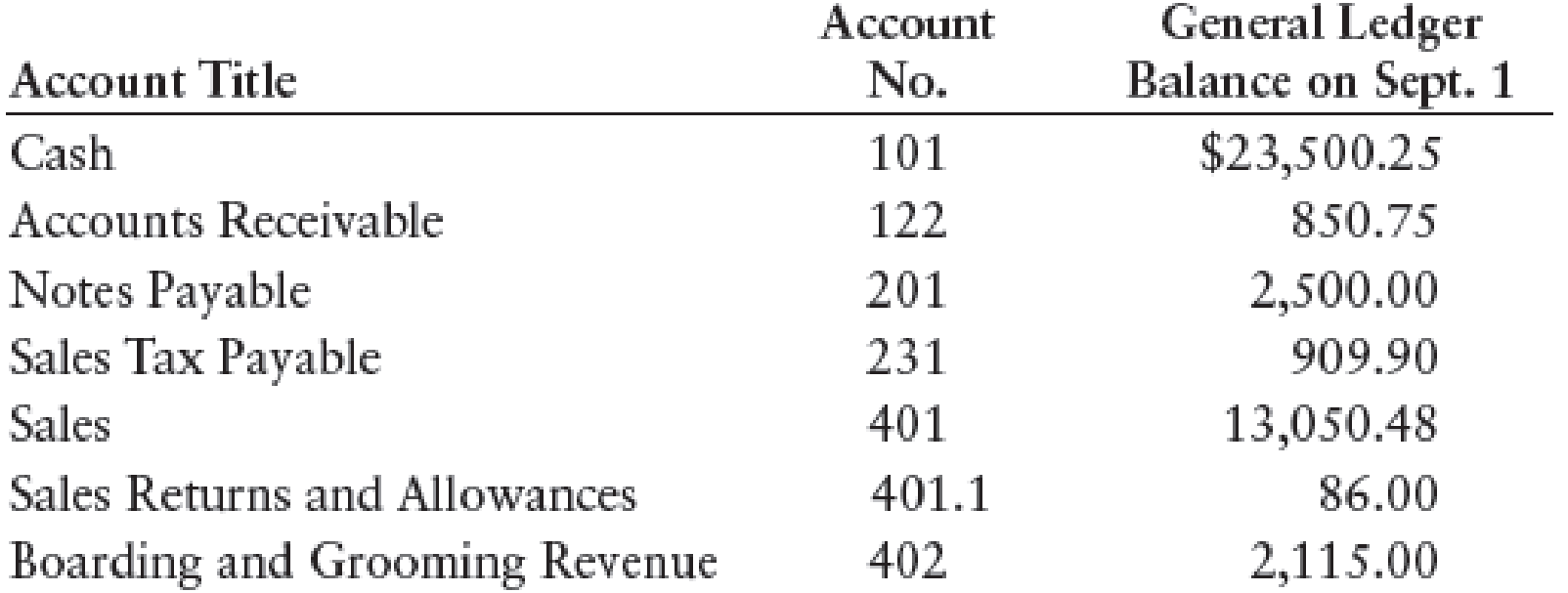

Wayward had the following general ledger account balances as of September 1:

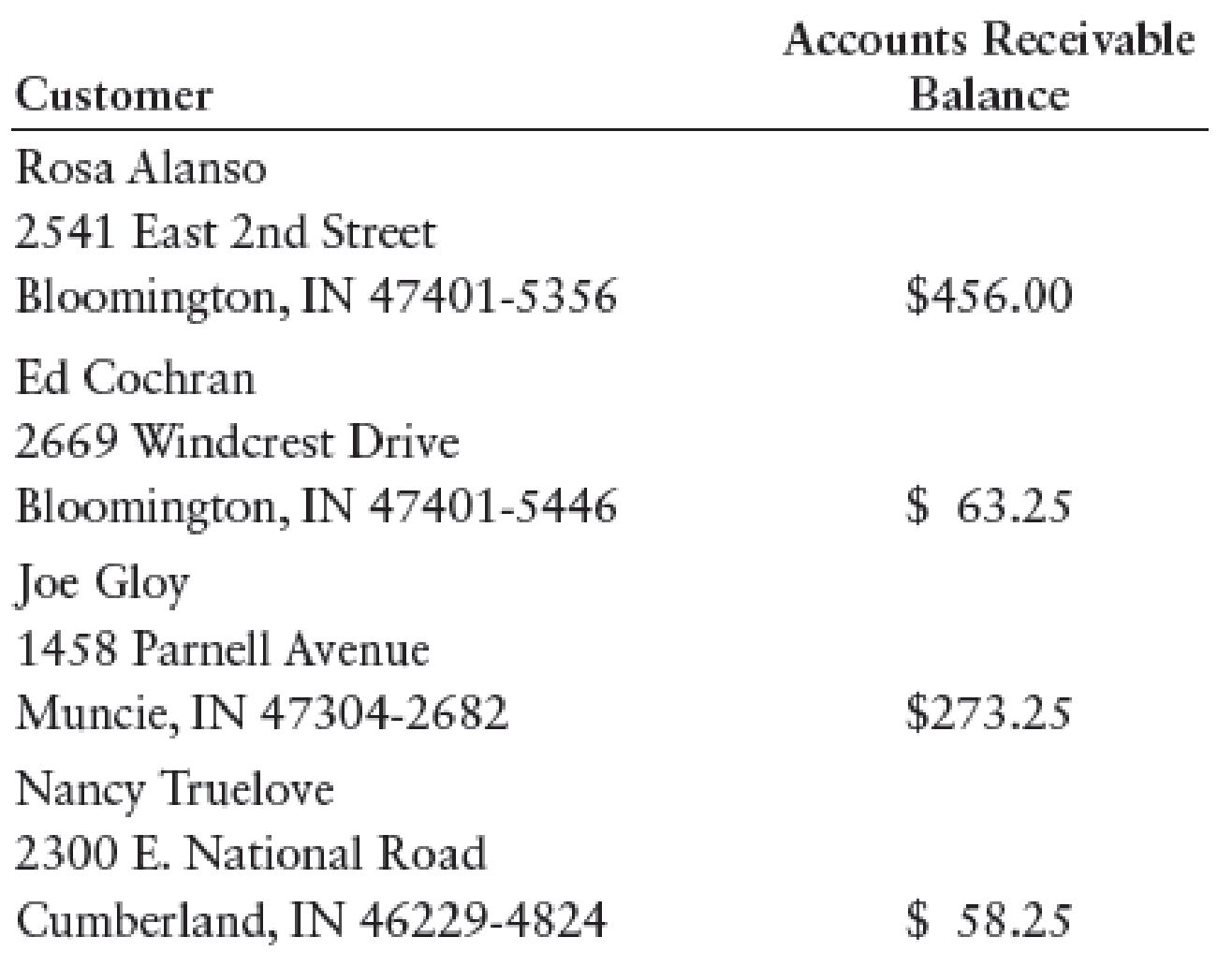

Wayward also had the following accounts receivable ledger balances as of September 1:

New customers opening accounts during September were as follows:

All American Day Camp

3025 Old Mill Run

Bloomington, IN 47408-1080

Tully Shaw

3315 Longview Avenue

Bloomington, IN 47401-7223

Susan Hays

1424 Jackson Creek Road

Nashville, IN 47448-2245

Jean Warkentin

1813 Deep Well Court

Bloomington, IN 47401-5124

Ken Shank

6422 E. Bender Road

Bloomington, IN 47401-7756

REQUIRED

- 1. Enter the transactions for the month of September in a general journal. (Begin with page 7.)

- 2. Post the entries to the general and subsidiary ledgers. Open new accounts for any customers who did not have a balance as of September 1.

- 3. Prepare a schedule of accounts receivable.

- 4. Compute the net sales for the month of September.

1.

Journalize the transactions for the month of September.

Explanation of Solution

Journal entry: Journal entry is a set of economic events which can be measured in monetary terms. These are recorded chronologically and systematically.

Debit and credit rules:

- Debit an increase in asset account, increase in expense account, decrease in liability account, and decrease in stockholders’ equity accounts.

- Credit decrease in asset account, increase in revenue account, increase in liability account, and increase in stockholders’ equity accounts.

Journalize the transactions for the month of September.

Transaction on September 2:

| Page: 7 | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| September | 2 | Accounts Receivable, KS | 122/✓ | 132.50 | ||

| Sales | 401 | 125.00 | ||||

| Sales Tax Payable | 231 | 7.50 | ||||

| (Record credit sale) | ||||||

Table (1)

Description:

- Accounts Receivable, KS is an asset account. Since sales is made on account, the receivables increased, and an increase in asset is debited.

- Sales is a revenue account. Since revenues and gains increase equity, equity value is increased, and an increase in equity is credited.

- Sales Tax Payable is a liability account. Since the payable increased, the liability increased, and an increase in liability is credited.

Transaction on September 3:

| Page: 7 | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| September | 3 | Accounts Receivable, NT | 122/✓ | 72.35 | ||

| Sales | 401 | 68.25 | ||||

| Sales Tax Payable | 231 | 4.10 | ||||

| (Record credit sale) | ||||||

Table (2)

Description:

- Accounts Receivable, NT is an asset account. Since sales is made on account, the receivables increased, and an increase in asset is debited.

- Sales is a revenue account. Since revenues and gains increase equity, equity value is increased, and an increase in equity is credited.

- Sales Tax Payable is a liability account. Since the payable increased, the liability increased, and an increase in liability is credited.

Transaction on September 5:

| Page: 7 | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| September | 5 | Accounts Receivable, JW | 122/✓ | 46.59 | ||

| Sales | 401 | 43.95 | ||||

| Sales Tax Payable | 231 | 2.64 | ||||

| (Record credit sale) | ||||||

Table (3)

Description:

- Accounts Receivable, JW is an asset account. Since sales is made on account, the receivables increased, and an increase in asset is debited.

- Sales is a revenue account. Since revenues and gains increase equity, equity value is increased, and an increase in equity is credited.

- Sales Tax Payable is a liability account. Since the payable increased, the liability increased, and an increase in liability is credited.

Transaction on September 8:

| Page: 7 | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| September | 8 | Cash | 101 | 2,472.40 | ||

| Sales | 401 | 2,332.45 | ||||

| Sales Tax Payable | 231 | 139.95 | ||||

| (Record cash sales) | ||||||

Table (4)

Description:

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Sales is a revenue account. Since revenues and gains increase equity, equity value is increased, and an increase in equity is credited.

- Sales Tax Payable is a liability account. Since the payable increased, the liability increased, and an increase in liability is credited.

Transaction on September 10:

| Page: 7 | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| September | 10 | Cash | 101 | 662.50 | ||

| Boarding and Grooming Revenue | 402 | 625.00 | ||||

| Sales Tax Payable | 231 | 37.50 | ||||

| (Record cash sales) | ||||||

Table (5)

Description:

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Boarding and Grooming Revenue is a revenue account. Since revenues and gains increase equity, equity value is increased, and an increase in equity is credited.

- Sales Tax Payable is a liability account. Since the payable increased, the liability increased, and an increase in liability is credited.

Transaction on September 11:

| Page: 7 | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| September | 11 | Sales Returns and Allowances | 401.1 | 10.00 | ||

| Sales Tax Payable | 231 | 0.60 | ||||

| Accounts Receivable, JW | 122/✓ | 10.60 | ||||

| (Record grant of sales allowance) | ||||||

Table (6)

Description:

- Sales Returns and Allowances is a contra-revenue account, and contra-revenue accounts decrease the equity value, and a decrease in equity is debited.

- Sales Tax Payable is a liability account. Since the payable decreased due to returns, the liability decreased, and a decrease in liability is debited.

- Accounts Receivable, JW is an asset account. Since sales allowance is granted, amount to be received has decreased, asset account is decreased, and a decrease in asset is credited.

Working Note 1:

Compute sales tax payable amount.

Working Note 2:

Compute accounts receivable amount (Refer to Working Note 1 for value of sales tax payable).

Transaction on September 12:

| Page: 7 | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| September | 12 | Accounts Receivable, TS | 122/✓ | 1,272 | ||

| Sales | 401 | 1,200 | ||||

| Sales Tax Payable | 231 | 72 | ||||

| (Record credit sale) | ||||||

Table (7)

Description:

- Accounts Receivable, TS is an asset account. Since sales is made on account, the receivables increased, and an increase in asset is debited.

- Sales is a revenue account. Since revenues and gains increase equity, equity value is increased, and an increase in equity is credited.

- Sales Tax Payable is a liability account. Since the payable increased, the liability increased, and an increase in liability is credited.

Transaction on September 14:

| Page: 7 | ||||||

| Date | Account Titles and Explanation | Post. Ref. | Debit ($) | Credit ($) | ||

| September | 14 | Cash | 101 | 256 | ||

| Accounts Receivable, RA | 122/✓ | 256 | ||||

| (Record cash received for sales on account) | ||||||

Table (8)

Description:

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Accounts Receivable, RA is an asset account. Since amount to be received has decreased, asset account decreased, and a decrease in asset is credited.

Transaction on September 15:

| Page: 7 | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| September | 15 | Sales Returns and Allowances | 401.1 | 88.00 | ||

| Sales Tax Payable | 231 | 5.28 | ||||

| Accounts Receivable, RA | 122/✓ | 93.28 | ||||

| (Record goods returned) | ||||||

Table (9)

Description:

- Sales Returns and Allowances is a contra-revenue account, and contra-revenue accounts decrease the equity value, and a decrease in equity is debited.

- Sales Tax Payable is a liability account. Since the payable decreased due to returns, the liability decreased, and a decrease in liability is debited.

- Accounts Receivable, RA is an asset account. Since inventory is returned, amount to be received has decreased, asset account is decreased, and a decrease in asset is credited.

Transaction on September 15:

| Page: 7 | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| September | 15 | Cash | 101 | 2,816.26 | ||

| Sales | 401 | 2,656.85 | ||||

| Sales Tax Payable | 231 | 159.41 | ||||

| (Record cash sales) | ||||||

Table (10)

Description:

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Sales is a revenue account. Since revenues and gains increase equity, equity value is increased, and an increase in equity is credited.

- Sales Tax Payable is a liability account. Since the payable increased, the liability increased, and an increase in liability is credited.

Transaction on September 16:

| Page: 7 | ||||||

| Date | Account Titles and Explanation | Post. Ref. | Debit ($) | Credit ($) | ||

| September | 16 | Cash | 101 | 58.25 | ||

| Accounts Receivable, NT | 122/✓ | 58.25 | ||||

| (Record cash received for sales on account) | ||||||

Table (11)

Description:

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Accounts Receivable, NT is an asset account. Since amount to be received has decreased, asset account decreased, and a decrease in asset is credited.

Transaction on September 18:

| Page: 7 | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| September | 18 | Cash | 101 | 567.10 | ||

| Boarding and Grooming Revenue | 402 | 535.00 | ||||

| Sales Tax Payable | 231 | 32.10 | ||||

| (Record cash sales) | ||||||

Table (12)

Description:

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Boarding and Grooming Revenue is a revenue account. Since revenues and gains increase equity, equity value is increased, and an increase in equity is credited.

- Sales Tax Payable is a liability account. Since the payable increased, the liability increased, and an increase in liability is credited.

Transaction on September 19:

| Page: 7 | ||||||

| Date | Account Titles and Explanation | Post. Ref. | Debit ($) | Credit ($) | ||

| September | 19 | Cash | 101 | 63.25 | ||

| Accounts Receivable, EC | 122/✓ | 63.25 | ||||

| (Record cash received for sales on account) | ||||||

Table (13)

Description:

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Accounts Receivable, EC is an asset account. Since amount to be received has decreased, asset account decreased, and a decrease in asset is credited.

Transaction on September 20:

| Page: 7 | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| September | 20 | Accounts Receivable, SH | 122/✓ | 88.33 | ||

| Sales | 401 | 83.33 | ||||

| Sales Tax Payable | 231 | 5.00 | ||||

| (Record credit sale) | ||||||

Table (14)

Description:

- Accounts Receivable, SH is an asset account. Since sales is made on account, the receivables increased, and an increase in asset is debited.

- Sales is a revenue account. Since revenues and gains increase equity, equity value is increased, and an increase in equity is credited.

- Sales Tax Payable is a liability account. Since the payable increased, the liability increased, and an increase in liability is credited.

Transaction on September 21:

| Page: 7 | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| September | 21 | Accounts Receivable, AD Camp | 122/✓ | 397.50 | ||

| Sales | 401 | 375.00 | ||||

| Sales Tax Payable | 231 | 22.50 | ||||

| (Record credit sale) | ||||||

Table (15)

Description:

- Accounts Receivable, AD Camp is an asset account. Since sales is made on account, the receivables increased, and an increase in asset is debited.

- Sales is a revenue account. Since revenues and gains increase equity, equity value is increased, and an increase in equity is credited.

- Sales Tax Payable is a liability account. Since the payable increased, the liability increased, and an increase in liability is credited.

Transaction on September 22:

| Page: 7 | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| September | 22 | Cash | 101 | 3,309.80 | ||

| Sales | 401 | 3,122.45 | ||||

| Sales Tax Payable | 231 | 187.35 | ||||

| (Record cash sales) | ||||||

Table (16)

Description:

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Sales is a revenue account. Since revenues and gains increase equity, equity value is increased, and an increase in equity is credited.

- Sales Tax Payable is a liability account. Since the payable increased, the liability increased, and an increase in liability is credited.

Transaction on September 23:

| Page: 7 | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| September | 23 | Cash | 101 | 545.90 | ||

| Boarding and Grooming Revenue | 402 | 515.00 | ||||

| Sales Tax Payable | 231 | 30.90 | ||||

| (Record cash sales) | ||||||

Table (17)

Description:

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Boarding and Grooming Revenue is a revenue account. Since revenues and gains increase equity, equity value is increased, and an increase in equity is credited.

- Sales Tax Payable is a liability account. Since the payable increased, the liability increased, and an increase in liability is credited.

Transaction on September 25:

| Page: 7 | ||||||

| Date | Account Titles and Explanation | Post. Ref. | Debit ($) | Credit ($) | ||

| September | 25 | Cash | 101 | 132.50 | ||

| Accounts Receivable, KS | 122/✓ | 132.50 | ||||

| (Record cash received for sales on account) | ||||||

Table (18)

Description:

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Accounts Receivable, KS is an asset account. Since amount to be received has decreased, asset account decreased, and a decrease in asset is credited.

Transaction on September 26:

| Page: 7 | ||||||

| Date | Account Titles and Explanation | Post. Ref. | Debit ($) | Credit ($) | ||

| September | 26 | Cash | 101 | 72.35 | ||

| Accounts Receivable, NT | 122/✓ | 72.35 | ||||

| (Record cash received for sales on account) | ||||||

Table (19)

Description:

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Accounts Receivable, NT is an asset account. Since amount to be received has decreased, asset account decreased, and a decrease in asset is credited.

Transaction on September 27:

| Page: 7 | ||||||

| Date | Account Titles and Explanation | Post. Ref. | Debit ($) | Credit ($) | ||

| September | 27 | Cash | 101 | 273.25 | ||

| Accounts Receivable, JG | 122/✓ | 273.25 | ||||

| (Record cash received for sales on account) | ||||||

Table (20)

Description:

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Accounts Receivable, JG is an asset account. Since amount to be received has decreased, asset account decreased, and a decrease in asset is credited.

Transaction on September 28:

| Page: 7 | ||||||

| Date | Account Titles and Explanation | Post. Ref. | Debit ($) | Credit ($) | ||

| September | 28 | Cash | 101 | 11,000 | ||

| Notes Payable | 201 | 11,000 | ||||

| (Record cash borrowed) | ||||||

Table (21)

Description:

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Notes Payable is a liability account. Since the payable increased, the liability increased, and an increase in liability is credited.

Transaction on September 29:

| Page: 7 | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| September | 29 | Cash | 101 | 3,005.58 | ||

| Sales | 401 | 2,835.45 | ||||

| Sales Tax Payable | 231 | 170.13 | ||||

| (Record cash sales) | ||||||

Table (22)

Description:

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Sales is a revenue account. Since revenues and gains increase equity, equity value is increased, and an increase in equity is credited.

- Sales Tax Payable is a liability account. Since the payable increased, the liability increased, and an increase in liability is credited.

Transaction on September 30:

| Page: 7 | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| September | 30 | Cash | 101 | 517.28 | ||

| Boarding and Grooming Revenue | 402 | 488.00 | ||||

| Sales Tax Payable | 231 | 29.28 | ||||

| (Record cash sales) | ||||||

Table (23)

Description:

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Boarding and Grooming Revenue is a revenue account. Since revenues and gains increase equity, equity value is increased, and an increase in equity is credited.

- Sales Tax Payable is a liability account. Since the payable increased, the liability increased, and an increase in liability is credited.

2.

Post the journalized entries into the accounts of the general ledger, and the customer accounts in accounts receivable ledger.

Explanation of Solution

Posting transactions: The process of transferring the journalized transactions into the accounts of the ledger is known as posting the transactions.

Post the journalized entries into the accounts of the general ledger.

| ACCOUNT Cash ACCOUNT NO. 101 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| September | 1 | Balance | ✓ | 23,500.25 | |||

| 8 | J7 | 2,472.40 | 25,972.65 | ||||

| 10 | J7 | 662.50 | 26,635.15 | ||||

| 14 | J7 | 256.00 | 26,891.15 | ||||

| 15 | J7 | 2,816.26 | 29,707.41 | ||||

| 16 | J7 | 58.25 | 29,765.66 | ||||

| 18 | J7 | 567.10 | 30,332.76 | ||||

| 19 | J7 | 63.25 | 30,396.01 | ||||

| 22 | J7 | 3,309.80 | 33,705.81 | ||||

| 23 | J7 | 545.90 | 34,251.71 | ||||

| 25 | J7 | 132.50 | 34,384.21 | ||||

| 26 | J7 | 72.35 | 34,456.56 | ||||

| 27 | J7 | 273.25 | 34,729.81 | ||||

| 28 | J7 | 11,000.00 | 45,729.81 | ||||

| 29 | J7 | 3,005.58 | 48,735.39 | ||||

| 30 | J7 | 517.28 | 49,252.67 | ||||

Table (24)

| ACCOUNT Accounts Receivable ACCOUNT NO. 122 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| September | 1 | Balance | ✓ | 850.75 | |||

| 2 | J7 | 132.50 | 983.25 | ||||

| 3 | J7 | 72.35 | 1,055.60 | ||||

| 5 | J7 | 46.59 | 1,102.19 | ||||

| 11 | J7 | 10.60 | 1,091.59 | ||||

| 12 | J7 | 1,272.00 | 2,363.59 | ||||

| 14 | J7 | 256.00 | 2,107.59 | ||||

| 15 | J7 | 93.28 | 2,014.31 | ||||

| 16 | J7 | 58.25 | 1,956.06 | ||||

| 19 | J7 | 63.25 | 1,892.81 | ||||

| 20 | J7 | 88.33 | 1,981.14 | ||||

| 21 | J7 | 397.50 | 2,378.64 | ||||

| 25 | J7 | 132.50 | 2,246.14 | ||||

| 26 | J7 | 72.35 | 2,173.79 | ||||

| 27 | J7 | 273.25 | 1,900.54 | ||||

Table (25)

| ACCOUNT Notes Payable ACCOUNT NO. 201 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| September | 1 | Balance | ✓ | 2,500 | |||

| 28 | J7 | 11,000 | 13,500 | ||||

Table (26)

| ACCOUNT Sales Tax Payable ACCOUNT NO. 231 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| September | 1 | Balance | ✓ | 909.90 | |||

| 2 | J7 | 7.50 | 917.40 | ||||

| 3 | J7 | 4.10 | 921.50 | ||||

| 5 | J7 | 2.64 | 924.14 | ||||

| 8 | J7 | 139.95 | 1,064.09 | ||||

| 10 | J7 | 37.50 | 1,101.59 | ||||

| 11 | J7 | 0.60 | 1,100.99 | ||||

| 12 | J7 | 72.00 | 1,172.99 | ||||

| 15 | J7 | 5.28 | 1,167.71 | ||||

| 15 | J7 | 159.41 | 1,327.12 | ||||

| 18 | J7 | 32.10 | 1,359.22 | ||||

| 20 | J7 | 5.00 | 1,364.22 | ||||

| 21 | J7 | 22.50 | 1,386.72 | ||||

| 22 | J7 | 187.35 | 1,574.07 | ||||

| 23 | J7 | 30.90 | 1,604.97 | ||||

| 29 | J7 | 170.13 | 1,775.10 | ||||

| 30 | J7 | 29.28 | 1,804.38 | ||||

Table (27)

| ACCOUNT Sales ACCOUNT NO. 401 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| September | 1 | Balance | ✓ | 13,050.48 | |||

| 2 | J7 | 125.00 | 13,050.48 | ||||

| 3 | J7 | 68.25 | 13,243.73 | ||||

| 5 | J7 | 43.95 | 13,287.68 | ||||

| 8 | J7 | 2,332.45 | 15,620.13 | ||||

| 12 | J7 | 1,200.00 | 16,820.13 | ||||

| 15 | J7 | 2,656.85 | 19,476.98 | ||||

| 20 | J7 | 83.33 | 19,560.31 | ||||

| 21 | J7 | 375.00 | 19,935.31 | ||||

| 22 | J7 | 3,122.45 | 23,057.76 | ||||

| 29 | J7 | 2,835.45 | 25,893.21 | ||||

Table (28)

| ACCOUNT Sales Returns and Allowances ACCOUNT NO. 401.1 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| September | 1 | Balance | ✓ | 86.00 | |||

| 11 | J7 | 10.00 | 96.00 | ||||

| 15 | J7 | 88.00 | 184.00 | ||||

Table (29)

| ACCOUNT Boarding and Grooming Revenue ACCOUNT NO. 402 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| September | 1 | Balance | ✓ | 2,115.00 | |||

| 10 | J7 | 625.00 | 2,740.00 | ||||

| 18 | J7 | 535.00 | 3,275.00 | ||||

| 23 | J7 | 515.00 | 3,790.00 | ||||

| 30 | J7 | 488.00 | 4,278.00 | ||||

Table (30)

Post the journalized entries into the customer accounts in accounts receivable ledger.

| NAME AD Camp | ||||||

| ADDRESS 3025, OM Run, City B, State IN 47408-1080 | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| September | 21 | J7 | 397.50 | 397.50 | ||

Table (31)

| NAME RA | ||||||

| ADDRESS 2541, E Street, City B, State IN 47401-5356 | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| September | 1 | Balance | ✓ | 456.00 | ||

| 14 | J7 | 256.00 | 200.00 | |||

| 15 | J7 | 93.28 | 106.72 | |||

Table (32)

| NAME EC | ||||||

| ADDRESS 2669, W Drive, City B, State IN 47401-5446 | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| September | 1 | Balance | ✓ | 63.25 | ||

| 19 | J7 | 63.25 | 0 | |||

Table (33)

| NAME JG | ||||||

| ADDRESS 1458, P Avenue, City B, State IN 47304-2682 | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| September | 1 | Balance | ✓ | 273.25 | ||

| 27 | J7 | 273.25 | 0 | |||

Table (34)

| NAME SH | ||||||

| ADDRESS 1424, JC Road, City N, State IN 47448-2245 | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| September | 20 | J7 | 88.33 | 88.33 | ||

Table (35)

| NAME KS | ||||||

| ADDRESS 6422, EB Road, City B, State IN 47401-7756 | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| September | 2 | Balance | J7 | 132.50 | 132.50 | |

| 19 | J7 | 132.50 | 0 | |||

Table (36)

| NAME TS | ||||||

| ADDRESS 3315, L Avenue, City N, State IN 47401-7223 | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| September | 12 | J7 | 1,272.00 | 1,272.00 | ||

Table (37)

| NAME NT | ||||||

| ADDRESS 2300, EN Road, City C, State IN 46229-4824 | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| September | 1 | Balance | ✓ | 58.25 | ||

| 3 | J7 | 72.35 | 130.60 | |||

| 16 | J7 | 58.25 | 72.35 | |||

| 26 | J7 | 72.35 | 0 | |||

Table (38)

| NAME JW | ||||||

| ADDRESS 1813, DP Court, City B, State IN 47401-5124 | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| September | 5 | J7 | 46.59 | 46.59 | ||

| 3 | J7 | 10.60 | 35.99 | |||

Table (39)

3.

Prepare the schedule of accounts receivable for W Kennel and P Supply as at September 30, 20--.

Explanation of Solution

Accounts receivable schedule: This is the schedule which is prepared to verify that the total balances of all the customers in the accounts receivable ledger, equals the balance of Accounts Receivable in the general ledger.

Prepare the schedule of accounts receivable for W Kennel and P Supply as at September 30, 20--.

| W Kennel and P Supply | |

| Schedule of Accounts Receivable | |

| September 30, 20-- | |

| AD Camp | $397.50 |

| RA | 106.72 |

| SH | 88.33 |

| TS | 1,272.00 |

| JW | 35.99 |

| Total | $1,900.54 |

Table (40)

Note: Refer to Requirement 2 for the value and computation of customer balances.

Thus, the schedule of accounts receivable of W Kennel and P Supply shows a balance of $1,900.54, as of September 30, 20--.

4.

Ascertain the net sales for W Kennel and P Supply for the month of September.

Explanation of Solution

Net sales: The amount of price of merchandise sold during a certain period is referred to as sales revenue. Net sales is the gross sales, minus sales returns and allowances, and sales discounts.

Formula to compute net sales:

Ascertain the net sales for W Kennel and P Supply for the month of September.

Note: Refer to Requirement 2 for the value and computation of the balances.

Thus, net sales for W Kennel and P Supply for the month of September is $12,744.73.

Want to see more full solutions like this?

Chapter 10 Solutions

College Accounting, Chapters 1-27 (New in Accounting from Heintz and Parry)

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT