1.

Journalize the transactions using special journals for August.

1.

Explanation of Solution

Special journal: It is a book which records some specific kinds of transactions such as cash receipts, cash payments, credit sales, and credit purchases. Special journal is created for any kind of transaction. A business uses special journals depending on the types of transactions that occur most repeatedly. If a specific type of transactions occur often, it is more likely a special journal of that type would be beneficial for the business.

Journalize the transactions using special journals.

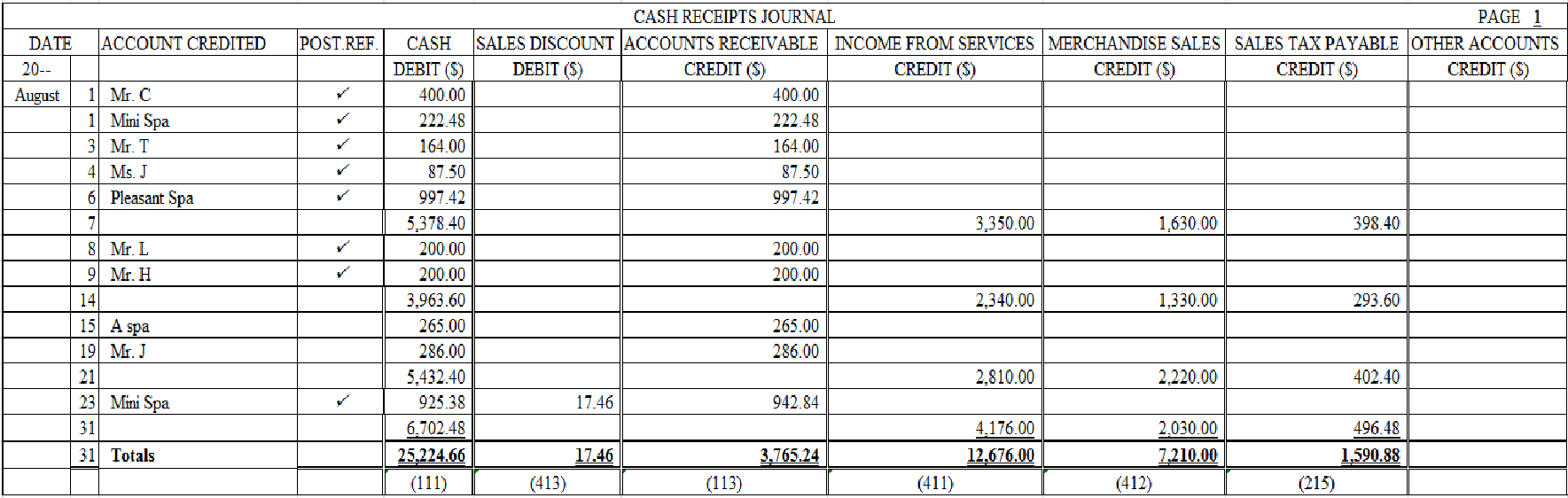

- Cash Receipts Journal

Table (1)

Equality of debits and credits for cash receipts journal.

| EQUALITY OF DEBITS AND CREDITS | |

| DEBITS ($) | CREDITS ($) |

| 25224.66 | 3765.24 |

| 17.46 | 12,676.00 |

| 7,210.00 | |

| 1,590.88 | |

| $25,242.12 | $25,242.12 |

Table (2)

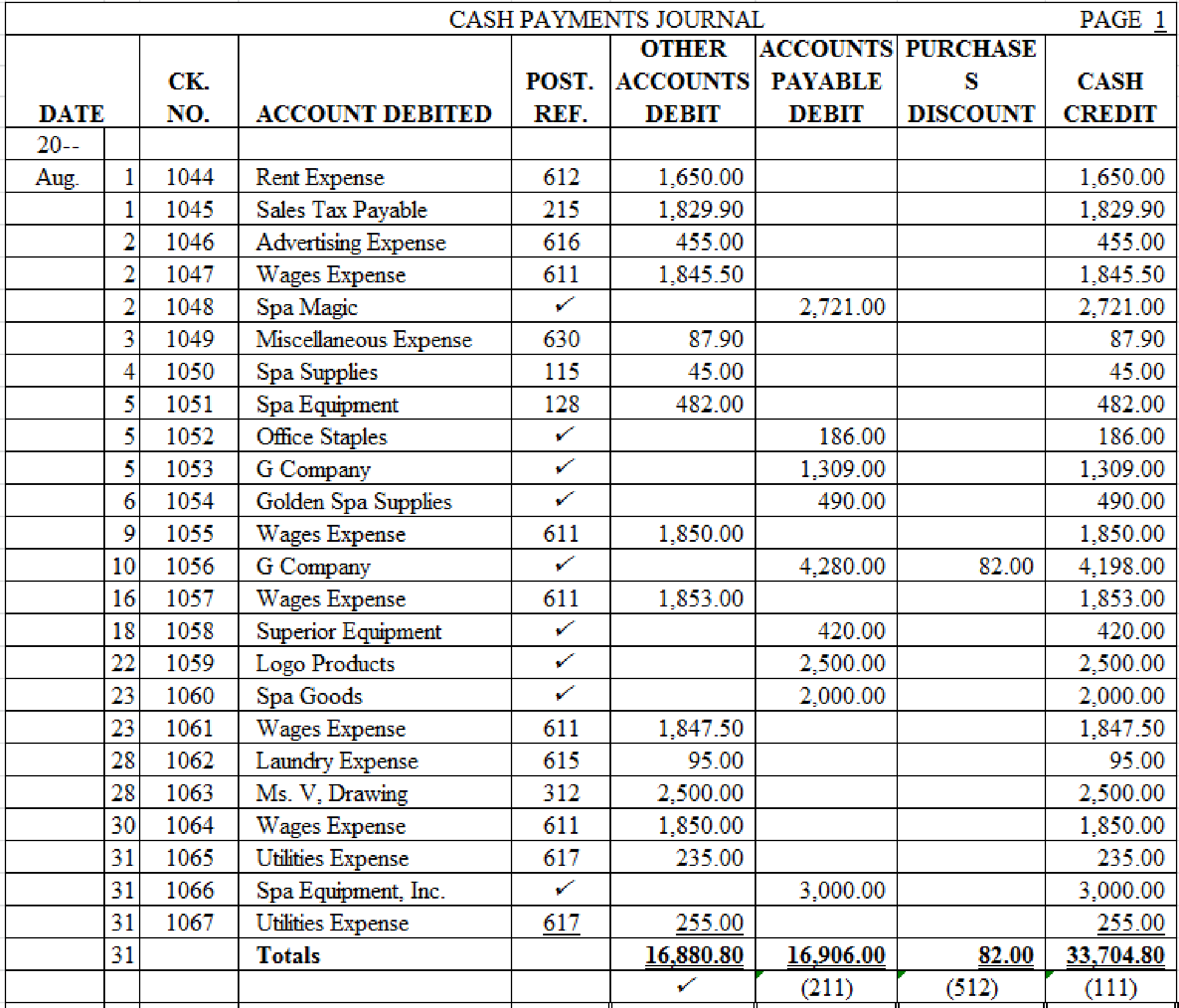

- Cash Payments Journal

Table (3)

Equality of debits and credits for cash payments journal:

| EQUALITY OF DEBITS AND CREDITS | |

| DEBITS ($) | CREDITS ($) |

| 16,649.66 | 33,867.7 |

| 17,300 | 82.00 |

| 33,949.66 | 33,949.66 |

Table (4)

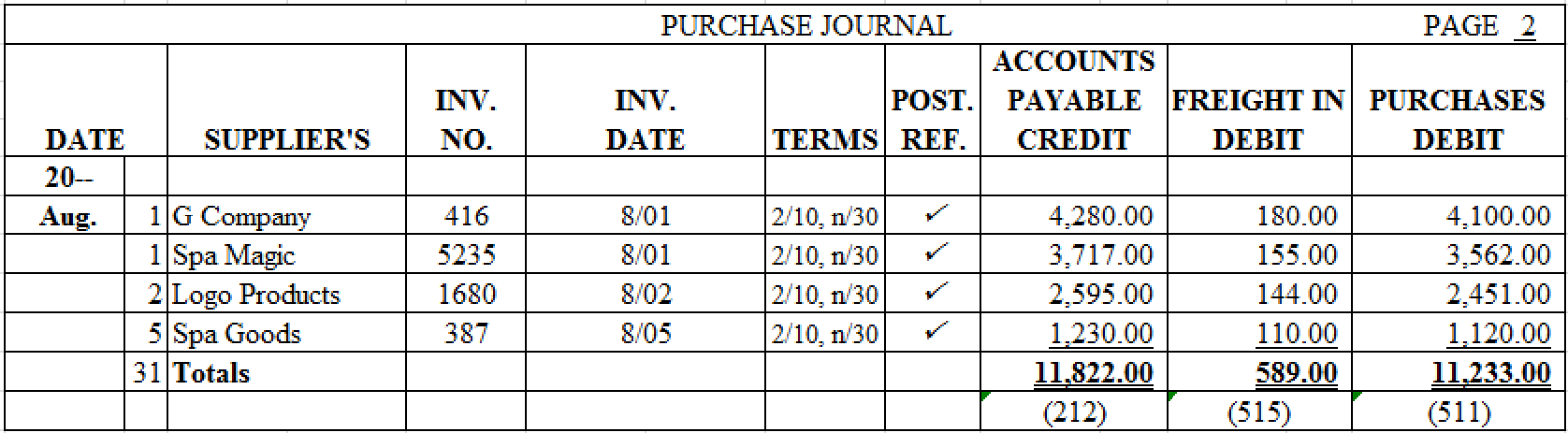

- Purchase Journal

Table (5)

Equality of debits and credits for purchase journal:

| EQUALITY OF DEBITS AND CREDITS | |

| DEBITS ($) | CREDITS ($) |

| 16,880 | 33704.80 |

| 16,906 | 82.00 |

| 33,786.80 | 33,786.80 |

Table (6)

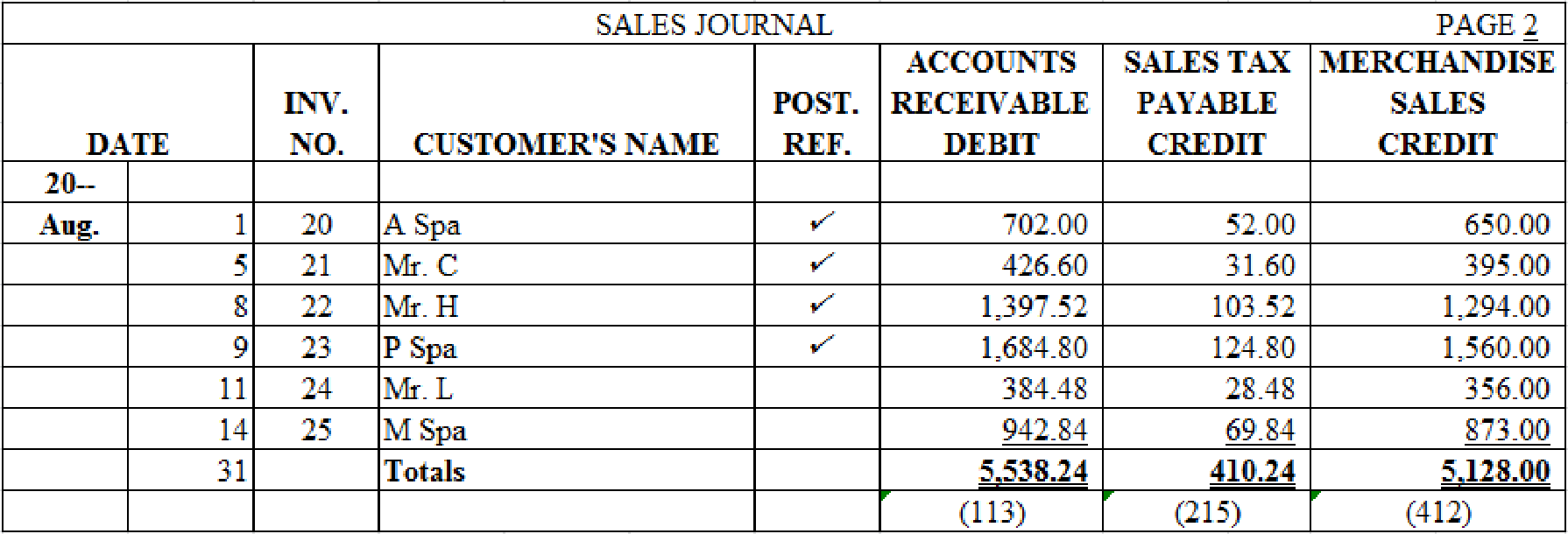

- Sales Journal

Table (7)

Equality of debits and credits for sales journal:

| EQUALITY OF DEBITS AND CREDITS | |

| DEBITS ($) | CREDITS ($) |

| 5,538.24 | 410.24 |

| 5,128.00 | |

| 5,538.24 | 5,538.24 |

Table (8)

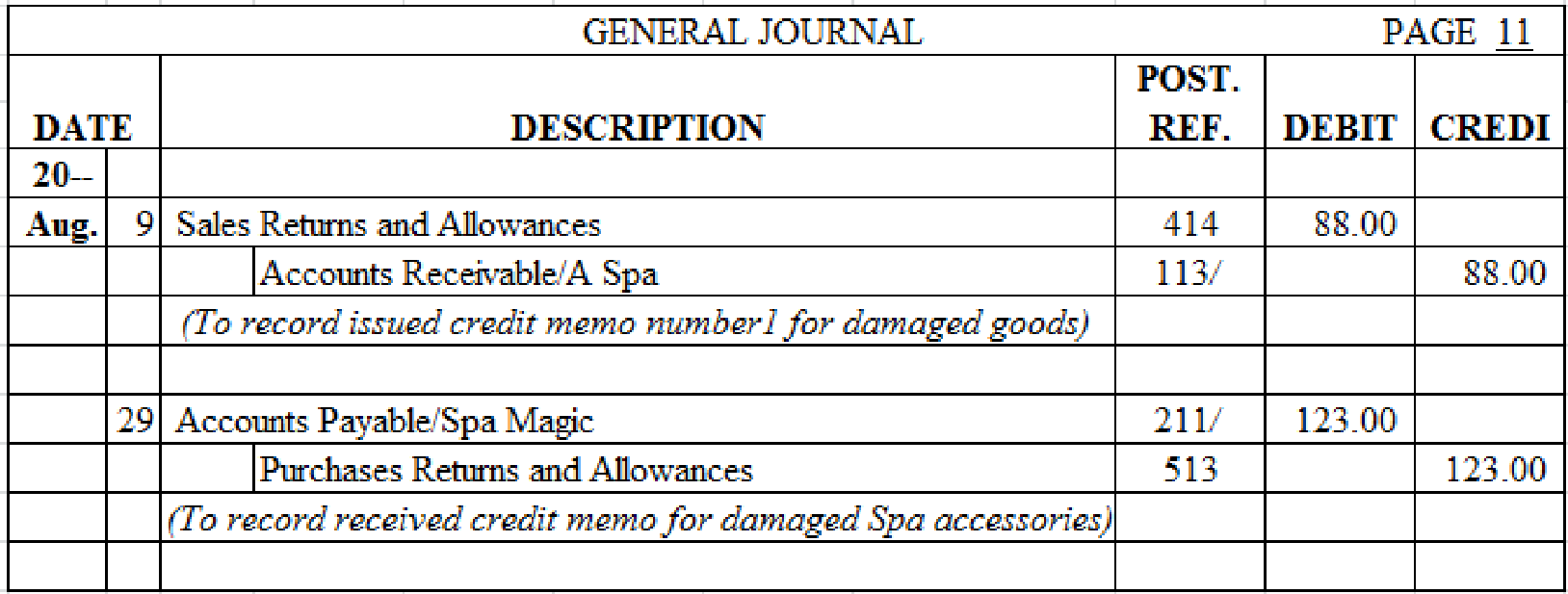

- General Journal

Table (9)

2.

Post the entries to the accounts receivable, accounts payable and general ledger.

2.

Explanation of Solution

Account receivable: The amount of money to be received by a company for the sale of goods and services to the customers is referred to as account receivable.

Account payable: The amount of money owned by a company to its creditor is referred to as accounts payable.

General ledger: General ledger is a record of all accounts of assets, liabilities, and

- Accounts Receivable Ledger

| Accounts Receivable Ledger | ||||||

| Name: A Spa | ||||||

| Address: | ||||||

| Date | Items | Post ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20___ | 1 | Balance | ✓ | 521.59 | ||

| August | 1 | S2 | 702.00 | 1,223.59 | ||

| 9 | J11 | 88.00 | 1,135.59 | |||

| 15 | CR1 | 265.00 | 870.59 | |||

| Name: Mr. J | ||||||

| Address: | ||||||

| Date | Items | Post ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20___ | ||||||

| August | 1 | Balance | ✓ | 175.00 | ||

| 4 | CR1 | 87.50 | 87.50 | |||

| Name: Mr. C | ||||||

| Address: | ||||||

| Date | Items | Post ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20___ | 1 | Balance | ✓ | 520.02 | ||

| August | 1 | CR1 | 400.00 | 120.02 | ||

| 5 | S2 | 426.60 | 546.62 | |||

| Name: Mr. T | ||||||

| Address: | ||||||

| Date | Items | Post ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20___ | ||||||

| August | 1 | Balance | ✓ | 164 | ||

| 3 | CR1 | 164 | 0 | |||

| Name: Mr. L | ||||||

| Address: | ||||||

| Date | Items | Post ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20___ | ||||||

| August | 1 | Balance | ✓ | 351 | ||

| 8 | CR1 | 200 | 151 | |||

| 11 | S2 | 384.48 | 535 | |||

| Name: Mini Spa | ||||||

| Address: | ||||||

| Date | Items | Post ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20___ | ||||||

| August | 1 | Balance | ✓ | 222 | ||

| 1 | CR1 | 222.48 | — | |||

| 14 | S2 | 942.84 | 942.84 | |||

| 23 | S2 | 942.84 | — | |||

| Name: Mr. J | ||||||

| Address: | ||||||

| Date | Items | Post ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20___ | ||||||

| August | 1 | Balance | ✓ | 286 | ||

| 19 | CR1 | 286 | ||||

| Name: Pleasant Spa | ||||||

| Address: | ||||||

| Date | Items | Post ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20___ | ||||||

| August | 1 | Balance | ✓ | 1,961 | ||

| 6 | CR1 | 997.00 | 963.81 | |||

| 9 | S2 | 1,684.80 | 2,648.61 | |||

| Name: Ms. J | ||||||

| Address: | ||||||

| Date | Items | Post ref. | Debit ($) | Credit ($) | Balance ($) | |

Table (10)

- Accounts Payable Ledger

| Accounts Payable Ledger | ||||||

| Name: A company | ||||||

| Address: | ||||||

| Date | Items | Post ref. | Debit ($) | Credit ($) | Balance ($) | |

| Name: G company | ||||||

| Address: | ||||||

| Date | Items | Post ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20___ | ||||||

| August | 1 | Balance | ✓ | 1,309.00 | ||

| 1 | P2 | 4,280.00 | 5,589.00 | |||

| 5 | CP1 | 1,309.00 | 4,280.00 | |||

| 10 | CP1 | 4,280.00 | ||||

| Name: G spa supplies | ||||||

| Address: | ||||||

| Date | Items | Post ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20___ | ||||||

| August | 1 | Balance | ✓ | 490 | ||

| 6 | CP1 | 490 | ||||

| Name: Logo products | ||||||

| Address: | ||||||

| Date | Items | Post ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20___ | 1 | Balance | ✓ | 3,796 | ||

| August | 2 | P2 | 2,595 | 6,391 | ||

| 22 | CP1 | 2,500 | 3,891 | |||

| Name: Office staples | ||||||

| Address: | ||||||

| Date | Items | Post ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20___ | ||||||

| August | 1 | Balance | ✓ | 304.00 | ||

| 5 | CP1 | 186.00 | 118.00 | |||

| Name: Spa equipment, Inc. | ||||||

| Address: | ||||||

| Date | Items | Post ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20___ | ||||||

| August | 1 | Balance | ✓ | 6,235 | ||

| 5 | CP1 | 3,000 | 3,235 | |||

| Name: Spa goods | ||||||

| Address: | ||||||

| Date | Items | Post ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20___ | 1 | Balance | ✓ | 27,221 | ||

| August | 1 | P2 | 3,717 | 6,438 | ||

| 2 | CP1 | 2,721 | 3,717 | |||

| 29 | J11 | 123 | 3,594 | |||

| Name: Superior equipment | ||||||

| Address: | ||||||

| Date | Items | Post ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20___ | ||||||

| August | 1 | Balance | ✓ | 420 | ||

| 5 | CP1 | 420 | ||||

Table (11)

- General Ledger

| General ledger | ||||||||

| Account: Cash | Account No:111 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| August | 31 | CR1 | 25,224.66 | 70,193.92 | ||||

| 31 | CP1 | 33,704.80 | 36,489.12 | |||||

| Account: Accounts receivable | Account No:113 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| August | 31 | CR1 | CR1 | 3,765.24 | 715.55 | |||

| 31 | S2 | S2 | 6,253.79 | |||||

| Account: Office Supplies | Account No:114 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| August | 1 | Balance | ✓ | 248.00 | ||||

| Account: Spa Supplies | Account No:115 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| August | 1 | Balance | ✓ | 695.00 | ||||

| 4 | J12 | 45 | 740.00 | |||||

| Account: Prepaid insurance | Account No:116 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| August | 1 | Balance | ✓ | 800 | ||||

| Account: Office Equipment | Account No:121 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| August | 1 | Balance | ✓ | 1,570.00 | ||||

| Account: Accumulated | Account No:129 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| August | 1 | Balance | ✓ | 10.00 | ||||

| Account: Spa Equipment | Account No:128 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| August | 1 | Balance | ✓ | 17,601.00 | ||||

| 5 | J11 | 482 | 18,083.00 | |||||

| Account: Accumulated Depreciation, Spa Equipment | Account No:129 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| August | 1 | Balance | ✓ | 64.88 | ||||

| Account: Accounts Payable | Account No:211 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| August | 31 | CP1 | 16,906.00 | 3,691.00 | ||||

| 31 | P2 | 11,822.00 | 15,513.00 | |||||

| Account: Wages Payable | Account No:212 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| Account: Sales Tax Payable | Account No:215 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| August | 31 | CR1 | 1,590.88 | 1,590.88 | ||||

| 31 | S2 | 410.24 | 2,001.12 | |||||

| Account: Ms. V, Capital | Account No:311 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| August | 1 | Balance | ✓ | 50,219.62 | ||||

| Account: Ms. V, Drawing | Account No:312 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| August | 1 | Balance | ✓ | 2,500.00 | ||||

| 28 | CP1 | 2,500.00 | 5,000.00 | |||||

| Account: Income Summary | Account No:313 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| ($) | ($) | Debit ($) | Credit($) | |||||

| Account: Income from Service | Account No:411 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| ($) | ($) | Debit ($) | Credit($) | |||||

| 31 | CR1 | 12,676.00 | 25,398.00 | |||||

| Account: Merchandise Sales | Account No:411 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| August | 31 | CR1 | 7,210.00 | 17,361.65 | ||||

| 31 | S2 | 5,128.00 | 22,489.65 | |||||

| Account: Sales discounts | Account No:413 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| August | 23 | CR1 | 17.46 | 17.46 | ||||

| Account: Sales return and allowance | Account No:414 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| August | 9 | J11 | 88 | 88 | ||||

| Account: Purchases | Account No:511 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| August | 31 | P2 | 11,233 | 11,233 | ||||

| Account: Purchase discount | Account No:512 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| August | 10 | CP1 | 82 | 82 | ||||

| Account: Purchase returns and allowances | Account No:513 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| August | 29 | J11 | 123 | 123 | ||||

| Account: Freight in | Account No:515 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| August | 31 | P2 | 589 | 992 | ||||

| Account: Wages expense | Account No:611 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| August | 1 | Balance | ✓ | 7,004.00 | ||||

| 2 | CP1 | 1,845.50 | 8,849.50 | |||||

| 9 | CP1 | 1,850.00 | 10,699.50 | |||||

| 16 | CP1 | 1,853.00 | 12,552.50 | |||||

| 23 | CP1 | 1,847.50 | 14,400.00 | |||||

| 30 | CP1 | 1,850.00 | 16,250.00 | |||||

| Account: Rent expense | Account No:612 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| August | 1 | Balance | ✓ | 1,650.00 | ||||

| 1 | CP1 | 1,650.00 | 3,300.00 | |||||

| Account: Office supplies expense | Account No:613 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| ($) | ($) | Debit ($) | Credit($) | |||||

| Account: Spa supplies expense | Account No:614 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| ($) | ($) | Debit ($) | Credit($) | |||||

| Account: Laundry expense | Account No:615 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| August | 1 | ✓ | 84 | |||||

| 28 | CP1 | 95 | 179 | |||||

| Account: Advertising expense | Account No:616 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| August | 2 | CP1 | 455 | 455 | ||||

| Account: Utilities expense | Account No:617 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| August | 1 | Balance | ✓ | 473 | ||||

| 31 | CP1 | 235 | 708 | |||||

| 31 | CP1 | 235 | 963.00 | |||||

| Account: Insurance expense | Account No:618 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| ($) | ($) | Debit ($) | Credit($) | |||||

| Account: Depreciation expense, Office Equipment | Account No:619 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| August | ||||||||

| Account: Depreciation expense, Spa Equipment | Account No:620 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| August | ||||||||

| Account: Miscellaneous expense | Account No:630 | |||||||

| Date | Item | Post ref | Debit | Credit | Balance | |||

| 20___ | ($) | ($) | Debit ($) | Credit($) | ||||

| August | 1 | Balance | ✓ | 284 | ||||

| 3 | CP1 | 87.9 | 371.9 | |||||

Table (12)

3.

Prepare a

3.

Explanation of Solution

Trial balance: Trial balance is a summary of all the ledger accounts balances presented in a tabular form with two column, debit and credit. It checks the mathematical accuracy of the

Prepare a trial balance.

| A Spa | ||

| Trail balance | ||

| August 31, 20__ | ||

| Account Name | Debit ($) | Credit($) |

| Cash | 36,489.12 | |

| Accounts Receivable | 6,253.79 | |

| Office Supplies | 248.00 | |

| Spa Supplies | 740.00 | |

| Prepaid Insurance | 800.00 | |

| Office Equipment | 1,570.00 | |

| Accumulated Depreciation, Office Equipment | 10.00 | |

| Spa Equipment | 18,083.00 | |

| Accumulated Depreciation, Spa Equipment | 64.88 | |

| Accounts Payable | 15,513.00 | |

| Sales Tax Payable | 2,001.12 | |

| A. V, Capital | 50,219.62 | |

| A. V, Drawing | 5,000.00 | |

| Income from Services | 25,398.00 | |

| Merchandise Sales | 22,489.65 | |

| Sales Discounts | 17.46 | |

| Sales Returns and Allowances | 88.00 | |

| Purchases | 24,101.00 | |

| Purchases Discounts | 82.00 | |

| Purchases Returns and Allowances | 123.00 | |

| Freight In | 992.00 | |

| Wages Expense | 16,250.00 | |

| Rent Expense | 3,300.00 | |

| Laundry Expense | 179.00 | |

| Advertising Expense | 455.00 | |

| Utilities Expense | 963.00 | |

| Miscellaneous Expense | 371.90 | |

| Totals | 115,901.27 | 115,901.27 |

Table (13)

4.

Prepare a schedule of accounts receivable for 31st August.

4.

Explanation of Solution

Accounts receivable schedule: This is the schedule which is prepared to verify that the total balances of all the customers in the accounts receivable ledger, equals the balance of Accounts Receivable in the general ledger.

Schedule of accounts receivable:

| A Spa | ||

| Schedule of Accounts Receivable | ||

| August 31, 20__ | ||

| Particulars | Amount($) | |

| A Spa | 870.59 | |

| Mr. J | 87.50 | |

| Mr. C | 546.62 | |

| Mr. H | 1,564.99 | |

| Mr. L | 535.48 | |

| Pleasant Spa | 2,648.61 | |

| Total accounts receivable | 6,253.79 | |

Table (14)

Therefore, the total accounts receivable is $6,253.79.

5.

Prepare a schedule of accounts payable for 31st August.

5.

Explanation of Solution

Schedule of accounts payable: This is the schedule which is prepared to verify that the total balances of all the suppliers in the accounts payable ledger, equals the balance of Accounts Payable in the general ledger.

Schedule of accounts payable:

| A Spa | ||

| Schedule of Accounts Payable | ||

| August 31, 20__ | ||

| Particulars | Amount($) | |

| Logo products | 3,891.00 | |

| Office staples | 118.00 | |

| Spa equipment, Inc. | 3,235.00 | |

| Spa goods | 4,675.00 | |

| Spa magic | 3,594.00 | |

| Total accounts payable | 15,513.00 | |

Table (15)

Therefore, the total accounts payable is $15,513.

Want to see more full solutions like this?

Chapter 10 Solutions

College Accounting - With Quickbooks 2015 CD and Access

- I am searching for the right answer to this financial accounting question using proper techniques.arrow_forwardUsing machine hours as a base, what is the amount of overhead applied during the year if actual machine hours for the year were 185,8000 hours?arrow_forwardPlease provide answerarrow_forward

- I am looking for the most effective method for solving this financial accounting problem.arrow_forwardPlease provide the solution to this general accounting question using proper accounting principles.arrow_forwardCan you help me solve this general accounting problem with the correct methodology?arrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage