Engineering Economy

16th Edition

ISBN: 9780133582819

Author: Sullivan

Publisher: DGTL BNCOM

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 10, Problem 18P

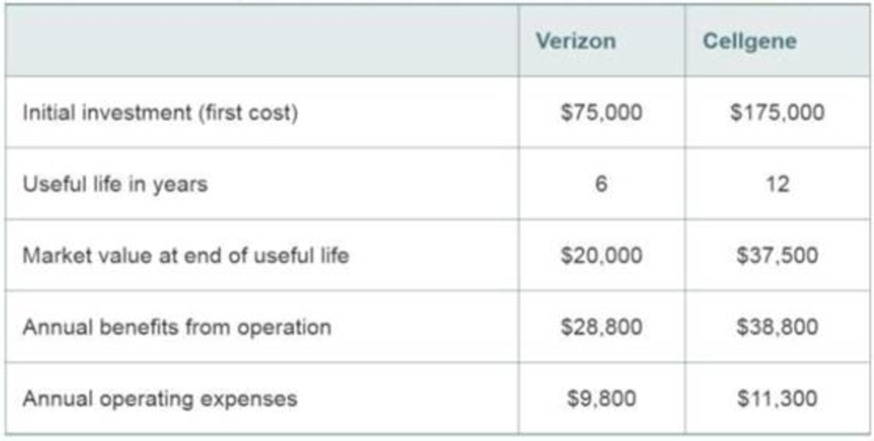

Two municipal cell tower designs are being considered by the city of Newton. If the city expects a modified benefit–cost ratio of 1.0 or better, which design would you recommend based on the data that follows? Assume repeatability. The city's cost of capital is 10% per year.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Ken Allen, capital budgeting analyst for Bally Gears, Inc., has been asked to evaluate a proposal. The manager of the automotive division believes that replacing therobotics used on the heavy truck gear line will produce total benefits of $516,000 (in today's dollars) over the next 5 years. The existing robotics would produce benefits of $387,000 (also in today's dollars) over that same timeperiod. An initial cash investment of $206,400 would be required to install the new equipment. The manager estimates that the existing robotics can be sold for $72,000. Show how Ken will apply marginal cost-benefit analysistechniques to determine the following:a. The marginal benefits of the proposed new robotics.b. The marginal cost of the proposed new roboticsc. The net benefit of the proposed new robotics.

Ken Allen, capital budgeting analyst for Bally Gears, Inc., has been asked to evaluate a proposal. The manager of the automotive division believes that replacing the robotics used on the heavy truck gear line will produce total benefits of $560,000 (in today's dollars) over the next 5 years. The existing robotics would produce benefits of $400,000 (also in today's dollars) over that same time period. An initial cash investment of $220,000 would be required to install the new equipment. The manager estimates that the existing robotics can be sold for $70,000.

Show how Ken will apply marginal cost-benefit analysis techniques to determine the following:

The marginal (added) benefits of the proposed new robotics is $______________

The marginal (added) cost of the proposed new robotics is $__________________

The net benefit of the proposed new robotics is

What is FW of Design A, Design B, and Design C. Which alternative should be chosen. Do not round off in the solution.

Chapter 10 Solutions

Engineering Economy

Ch. 10 - The Adams Construction Company is bidding on a...Ch. 10 - Prob. 2PCh. 10 - Prob. 3PCh. 10 - A retrofitted space-heating system is being...Ch. 10 - Prob. 5PCh. 10 - Prob. 6PCh. 10 - Prob. 7PCh. 10 - Prob. 8PCh. 10 - Prob. 9PCh. 10 - Prob. 10P

Ch. 10 - Prob. 11PCh. 10 - Prob. 12PCh. 10 - Prob. 13PCh. 10 - Prob. 14PCh. 10 - Prob. 15PCh. 10 - Prob. 16PCh. 10 - Four mutually exclusive projects are being...Ch. 10 - Two municipal cell tower designs are being...Ch. 10 - Prob. 19PCh. 10 - Prob. 20PCh. 10 - Prob. 21PCh. 10 - Prob. 22PCh. 10 - You have been requested to recommend one of the...Ch. 10 - Prob. 24PCh. 10 - Prob. 25PCh. 10 - Prob. 26FECh. 10 - Prob. 27FECh. 10 - Prob. 28FECh. 10 - A flood control project with a life of 16 years...Ch. 10 - Prob. 30FECh. 10 - Prob. 31FE

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Based on the incremental return shown and the company's MARR of 16% per year, the alternative that should be selected is _____ The project initial costs are such that A < C < B. Comparison Rate of Return, % (A-DN) (B-DN) (C-DN) (B-A) (C-A) (B-C) Alternative C Do nothing Alternative B Alternative A Cannot be determined. 17 25 19 14 18 12arrow_forwardEvaluate a combined cycle power plant on the basis of the PW method when the MARR is 18% per year. Pertinent cost data are as follows: Investment cost Useful life Market value (EOY 15) Annual operating expenses Annual expenses Overhaul cost-end of 5th year Overhaul cost-end of 10th year Power Plant (thousands of Php) Php 1,100,000 15 years Php 500,000 Php 50,000 Php 290,000 Php 12,500 Php 25,000arrow_forwardQ#1) Select the most economical among the following mutually exclusive alternatives using PW and AW methods of analysis at interest rate of 10% per year: First cost ($) Annual Operating Cost ($/year) Major repair ($) Life (years) Salvage ($) Machine A 20,000 5,000 for the first year and increases by 1,000 each year none 10 2,000 Machine B 50,000 2,000 per year up to year 10 and 5,000 per year thereafter 5,000 every 5 years including at year 40 40 5,000 Q#2) Find the Rate of Return for machines A and B in question #1 if the annual revenues for each machine is estimated at $20,000 per year.arrow_forward

- Evaluate a combined cycle power plant on the basis of the FW method when the MARR is 18% per year. Pertinent cost data are as follows:arrow_forwardFor the two alternatives, demonstrate that the sum of the incremental cash flow series (Z − X) over the LCM is equal to the difference in the sums of the individual cash flow series for X and Z. System X Z First cost, $ −40,000 −95,000 AOC, $ per year −12,000 −5,000 Salvage value, $ 6,000 14,000 Life, years 3 6arrow_forwardWHICH IS MORE ECONOMICAL? USE METHOD OF COMPARISON OF ALTERNATIVES! In a cold storage plant, it is desired to determine whether to use insulation two inches thick or three inches thick in insulating the walls of the cold storage ware house. Heat absorb through the walls without insulation would cost P96.00 per year per squaremeter. A two-inch insulation will cost P30.40 per square meter and will cut out 89% of the loss. A three-inch insulation will cut out 92% of the loss and will cost P65.00 per square meter. Using a life 15 years for the insulation with no salvage value and a minimum attractive return of 8%, what thickness of insulation should be used?arrow_forward

- Dexcon Technologies, Inc., is evaluating two alternatives to produce its new plastic filament with low friction properties for creating custom bearings for 3-D printers. The estimates associated with each alternative are shown below. Using a MARR of 16% per year, which alternative has the better present worth and what is that value (select the closest value)? Method First Cost AOC, per Year Salvage Value Life DDM $170,000 $65,000 $4,000 2 years LS $350,000 $40,000 $29,000 4 years DDM with a PW--$473,000 LS with a PW --$445,900 LS with a PW --$222,055 DDM with a PW--$109,300arrow_forwardTwo automatic systems for dispensing maps are being compared by the state highway department. The accompanying breakeven chart of the comparison of these systems (System I vs. System II) shows total yearly costs for the number of maps dispensed per year for both alternatives. Answer the following questions. (a) What is the fixed cost for System I? (b) What is the fixed cost for System II? (c) What is the variable cost per map dispensed for System I? (d) What is the variable cost per map dispensed for System II? (e) What is the breakeven point in terms of maps dispensed at which the two systems have equal annual costs? (f) For what range of annual number of maps dispensed is System I recommended? (g) For what range of annual number of maps dispensed is System II recommended? (h) At 3000 maps per year, what are the marginal and average map costs for each system?arrow_forwardDetermine the IROR and profitability index at 12% per year for an industrial smart-grid system that has a first cost of $400,000, an AOC of $75,000 per year, estimated annual savings of $192,000, and a salvage value of 20% of its first cost after a 5-year useful life.arrow_forward

- Preliminary plans are under way for the construction of a new stadium for a major league baseball team. City officials have questioned the number and profitability of the luxury corporate boxes planned for the upper deck of the stadium. Corporations and selected individuals may buy the boxes for $340,000 each. The fixed construction cost for the upper deck area is estimated to be $5,780,000, with a variable cost of $170,000 for each box constructed. (a) What is the break-even point for the number of luxury boxes in the new stadium? x = (b) Preliminary drawings for the stadium show that space is available for the construction of up to 52 luxury boxes. Promoters indicate that buyers are available and that all 52 could be sold if constructed. (ii) What profit is anticipated? (Enter a negative value if a predicted loss.) $arrow_forwardAnswer it correctly please. I will rate accordinglyarrow_forwardEvaluate a combined cycle power plant on the basis of the FW method when the MARR is 12% per year. Pertinent cost data are as follows : Power Plant (thousands of $) Investment cost $13,000 Useful life 15 years Market value (EOY 15) $3,000 Annual operating expenses $1,000 Overhaul cost—end of 5th year $200 Overhaul cost—end of 10th year $550 WITH DIAGRAM CASH FLOW THANK YOUarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education

Valuation Analysis in Project Finance Models - DCF & IRR; Author: Financial modeling;https://www.youtube.com/watch?v=xDlQPJaFtCw;License: Standard Youtube License