Concept explainers

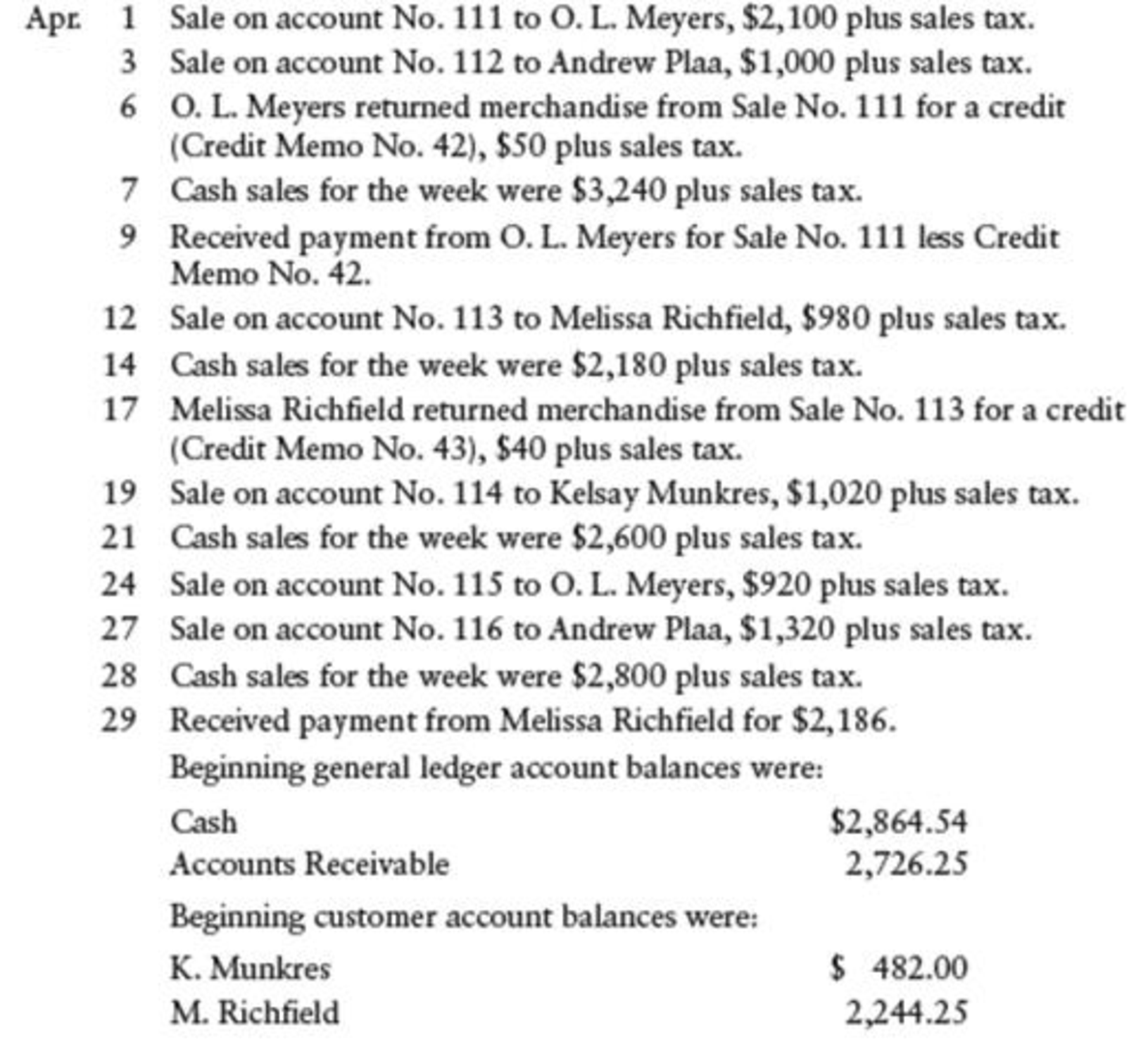

SALES AND CASH RECEIPTS TRANSACTIONS Paul Jackson owns a retail business. The following sales, returns, and cash receipts are for April 20--. There is a 7% sales tax.

REQUIRED

- 1. Record the transactions starring on page 7 of a general journal.

- 2. Post from the journal to the general ledger and

accounts receivable ledger accounts. Use account numbers as shown in the chapter.

1.

Journalize the transactions related to sales and cash receipt transactions.

Explanation of Solution

Journal entry: Journal entry is a set of economic events which can be measured in monetary terms. These are recorded chronologically and systematically.

Debit and credit rules:

- Debit an increase in asset account, increase in expense account, decrease in liability account, and decrease in stockholders’ equity accounts.

- Credit decrease in asset account, increase in revenue account, increase in liability account, and increase in stockholders’ equity accounts.

Journalize the transactions related to sales and cash receipt transactions.

Transaction on April 1:

| Page: 7 | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| April | 1 | Accounts Receivable, OLM | 122/✓ | 2,247 | ||

| Sales | 401 | 2,100 | ||||

| Sales Tax Payable | 231 | 147 | ||||

| (Record credit sale) | ||||||

Table (1)

Description:

- Accounts Receivable, OLM is an asset account. Since sales is made on account, the receivables increased, and an increase in asset is debited.

- Sales is a revenue account. Since revenues and gains increase equity, equity value is increased, and an increase in equity is credited.

- Sales Tax Payable is a liability account. Since the payable increased, the liability increased, and an increase in liability is credited.

Working Note 1:

Compute sales tax payable amount.

Working Note 2:

Compute accounts receivable amount (Refer to Working Note 1 for value of sales tax payable).

Transaction on April 3:

| Page: 7 | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| April | 3 | Accounts Receivable, AP | 122/✓ | 1,070.00 | ||

| Sales | 401 | 1,000.00 | ||||

| Sales Tax Payable | 231 | 70.00 | ||||

| (Record credit sale) | ||||||

Table (2)

Description:

- Accounts Receivable, AP is an asset account. Since sales is made on account, the receivables increased, and an increase in asset is debited.

- Sales is a revenue account. Since revenues and gains increase equity, equity value is increased, and an increase in equity is credited.

- Sales Tax Payable is a liability account. Since the payable increased, the liability increased, and an increase in liability is credited.

Working Note 3:

Compute sales tax payable amount.

Working Note 4:

Compute accounts receivable amount (Refer to Working Note 3 for value of sales tax payable).

Transaction on April 6:

| Page: 7 | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| April | 6 | Sales Returns and Allowances | 401.1 | 50.00 | ||

| Sales Tax Payable | 231 | 3.50 | ||||

| Accounts Receivable, OLM | 122/✓ | 53.50 | ||||

| (Record merchandise returned) | ||||||

Table (3)

Description:

- Sales Returns and Allowances is a contra-revenue account, and contra-revenue accounts decrease the equity value, and a decrease in equity is debited.

- Sales Tax Payable is a liability account. Since the payable decreased due to returns, the liability decreased, and a decrease in liability is debited.

- Accounts Receivable, OLM is an asset account. Since inventory is returned, amount to be received has decreased, asset account is decreased, and a decrease in asset is credited.

Working Note 5:

Compute sales tax payable amount.

Working Note 6:

Compute accounts receivable amount (Refer to Working Note 5 for value of sales tax payable).

Transaction on April 7:

| Page: 7 | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| April | 7 | Cash | 101 | 3,466.80 | ||

| Sales | 401 | 3,240.00 | ||||

| Sales Tax Payable | 231 | 226.80 | ||||

| (Record cash sales) | ||||||

Table (4)

Description:

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Sales is a revenue account. Since revenues and gains increase equity, equity value is increased, and an increase in equity is credited.

- Sales Tax Payable is a liability account. Since the payable increased, the liability increased, and an increase in liability is credited.

Working Note 7:

Compute sales tax payable amount.

Working Note 8:

Compute cash amount (Refer to Working Note 7 for value of sales tax payable).

Transaction on April 9:

| Page: 7 | ||||||

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | ||

| April | 9 | Cash | 101 | 2,193.50 | ||

| Accounts Receivable, OLM | 122/✓ | 2,193.50 | ||||

| (Record cash received for sales on account) | ||||||

Table (5)

Description:

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Accounts Receivable, OLM is an asset account. Since amount to be received has decreased, asset account decreased, and a decrease in asset is credited.

Working Note 9:

Compute accounts receivable value (Refer to Working Notes 2 and 6 for both the values).

Transaction on April 12:

| Page: 7 | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| April | 12 | Accounts Receivable, MR | 122/✓ | 1,048.60 | ||

| Sales | 401 | 980.00 | ||||

| Sales Tax Payable | 231 | 68.60 | ||||

| (Record credit sale) | ||||||

Table (6)

Description:

- Accounts Receivable, MR is an asset account. Since sales is made on account, the receivables increased, and an increase in asset is debited.

- Sales is a revenue account. Since revenues and gains increase equity, equity value is increased, and an increase in equity is credited.

- Sales Tax Payable is a liability account. Since the payable increased, the liability increased, and an increase in liability is credited.

Working Note 10:

Compute sales tax payable amount.

Working Note 11:

Compute accounts receivable amount (Refer to Working Note 10 for value of sales tax payable).

Transaction on April 14:

| Page: 7 | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| April | 14 | Cash | 101 | 2,332.60 | ||

| Sales | 401 | 2,180.00 | ||||

| Sales Tax Payable | 231 | 152.60 | ||||

| (Record cash sales) | ||||||

Table (7)

Description:

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Sales is a revenue account. Since revenues and gains increase equity, equity value is increased, and an increase in equity is credited.

- Sales Tax Payable is a liability account. Since the payable increased, the liability increased, and an increase in liability is credited.

Working Note 12:

Compute sales tax payable amount.

Working Note 13:

Compute cash amount (Refer to Working Note 12 for value of sales tax payable).

Transaction on April 17:

| Page: 7 | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| April | 17 | Sales Returns and Allowances | 401.1 | 40.00 | ||

| Sales Tax Payable | 231 | 2.80 | ||||

| Accounts Receivable, MR | 122/✓ | 42.80 | ||||

| (Record merchandise returned) | ||||||

Table (8)

Description:

- Sales Returns and Allowances is a contra-revenue account, and contra-revenue accounts decrease the equity value, and a decrease in equity is debited.

- Sales Tax Payable is a liability account. Since the payable decreased due to returns, the liability decreased, and a decrease in liability is debited.

- Accounts Receivable, MR is an asset account. Since inventory is returned, amount to be received has decreased, asset account is decreased, and a decrease in asset is credited.

Working Note 14:

Compute sales tax payable amount.

Working Note 15:

Compute accounts receivable amount (Refer to Working Note 14 for value of sales tax payable).

Transaction on April 19:

| Page: 7 | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| April | 19 | Accounts Receivable, KM | 122/✓ | 1,091.40 | ||

| Sales | 401 | 1,020.00 | ||||

| Sales Tax Payable | 231 | 71.40 | ||||

| (Record credit sale) | ||||||

Table (9)

Description:

- Accounts Receivable, KM is an asset account. Since sales is made on account, the receivables increased, and an increase in asset is debited.

- Sales is a revenue account. Since revenues and gains increase equity, equity value is increased, and an increase in equity is credited.

- Sales Tax Payable is a liability account. Since the payable increased, the liability increased, and an increase in liability is credited.

Working Note 16:

Compute sales tax payable amount.

Working Note 17:

Compute accounts receivable amount (Refer to Working Note 16 for value of sales tax payable).

Transaction on April 21:

| Page: 7 | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| April | 21 | Cash | 101 | 2,782 | ||

| Sales | 401 | 2,600 | ||||

| Sales Tax Payable | 231 | 182 | ||||

| (Record cash sales) | ||||||

Table (10)

Description:

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Sales is a revenue account. Since revenues and gains increase equity, equity value is increased, and an increase in equity is credited.

- Sales Tax Payable is a liability account. Since the payable increased, the liability increased, and an increase in liability is credited.

Working Note 18:

Compute sales tax payable amount.

Working Note 19:

Compute cash amount (Refer to Working Note 18 for value of sales tax payable).

Transaction on April 24:

| Page: 7 | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| April | 24 | Accounts Receivable, OLM | 122/✓ | 984.40 | ||

| Sales | 401 | 920.00 | ||||

| Sales Tax Payable | 231 | 64.40 | ||||

| (Record credit sale) | ||||||

Table (11)

Description:

- Accounts Receivable, OLM is an asset account. Since sales is made on account, the receivables increased, and an increase in asset is debited.

- Sales is a revenue account. Since revenues and gains increase equity, equity value is increased, and an increase in equity is credited.

- Sales Tax Payable is a liability account. Since the payable increased, the liability increased, and an increase in liability is credited.

Working Note 20:

Compute sales tax payable amount.

Working Note 21:

Compute accounts receivable amount (Refer to Working Note 20 for value of sales tax payable).

Transaction on April 27:

| Page: 7 | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| April | 27 | Accounts Receivable, AP | 122/✓ | 1,412.40 | ||

| Sales | 401 | 1,320.00 | ||||

| Sales Tax Payable | 231 | 92.40 | ||||

| (Record credit sale) | ||||||

Table (12)

Description:

- Accounts Receivable, AP is an asset account. Since sales is made on account, the receivables increased, and an increase in asset is debited.

- Sales is a revenue account. Since revenues and gains increase equity, equity value is increased, and an increase in equity is credited.

- Sales Tax Payable is a liability account. Since the payable increased, the liability increased, and an increase in liability is credited.

Working Note 22:

Compute sales tax payable amount.

Working Note 23:

Compute accounts receivable amount (Refer to Working Note 22 for value of sales tax payable).

Transaction on April 28:

| Page: 7 | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| April | 28 | Cash | 101 | 2,996 | ||

| Sales | 401 | 2,800 | ||||

| Sales Tax Payable | 231 | 196 | ||||

| (Record cash sales) | ||||||

Table (13)

Description:

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Sales is a revenue account. Since revenues and gains increase equity, equity value is increased, and an increase in equity is credited.

- Sales Tax Payable is a liability account. Since the payable increased, the liability increased, and an increase in liability is credited.

Working Note 24:

Compute sales tax payable amount.

Working Note 25:

Compute cash amount (Refer to Working Note 24 for value of sales tax payable).

Transaction on April 29:

| Page: 7 | ||||||

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | ||

| April | 29 | Cash | 101 | 2,186 | ||

| Accounts Receivable, MR | 122/✓ | 2,186 | ||||

| (Record cash received for sales on account) | ||||||

Table (14)

Description:

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Accounts Receivable, MR is an asset account. Since amount to be received has decreased, asset account decreased, and a decrease in asset is credited.

2.

Post the journalized entries into the accounts of the general ledger, and the customer accounts in accounts receivable ledger.

Explanation of Solution

Posting transactions: The process of transferring the journalized transactions into the accounts of the ledger is known as posting the transactions.

Post the journalized entries into the accounts of the general ledger.

| ACCOUNT Cash ACCOUNT NO. 101 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| April | 1 | Balance | ✓ | 2,864.54 | |||

| 7 | J7 | 3,466.80 | 6,331.34 | ||||

| 9 | J7 | 2,193.50 | 8,524.84 | ||||

| 14 | J7 | 2,332.60 | 10,857.44 | ||||

| 21 | J7 | 2,782.00 | 13,639.44 | ||||

| 28 | J7 | 2,996.00 | 16,635.44 | ||||

| 29 | J7 | 2,186.00 | 18,821.44 | ||||

Table (15)

| ACCOUNT Accounts Receivable ACCOUNT NO. 122 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| April | 1 | Balance | ✓ | 2,726.25 | |||

| 1 | J7 | 2,247.00 | 4,973.25 | ||||

| 3 | J7 | 1,070.00 | 6,043.25 | ||||

| 6 | J7 | 53.50 | 5,989.75 | ||||

| 9 | J7 | 2,193.50 | 3,796.25 | ||||

| 12 | J7 | 1,048.60 | 4,844.85 | ||||

| 17 | J7 | 42.80 | 4,802.05 | ||||

| 19 | J7 | 1,091.40 | 5,893.45 | ||||

| 24 | J7 | 984.40 | 6,877.85 | ||||

| 27 | J7 | 1,412.40 | 8,290.25 | ||||

| 29 | J7 | 2,186.00 | 6,104.25 | ||||

Table (16)

| ACCOUNT Sales Tax Payable ACCOUNT NO. 231 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| April | 1 | J7 | 147.00 | 147.00 | |||

| 3 | J7 | 70.00 | 217.00 | ||||

| 6 | J7 | 3.50 | 213.50 | ||||

| 7 | J7 | 226.80 | 440.30 | ||||

| 12 | J7 | 68.60 | 508.90 | ||||

| 14 | J7 | 152.60 | 661.50 | ||||

| 17 | J7 | 2.80 | 658.70 | ||||

| 19 | J7 | 71.40 | 730.10 | ||||

| 21 | J7 | 182.00 | 912.10 | ||||

| 24 | J7 | 64.40 | 976.50 | ||||

| 27 | J7 | 92.40 | 1,068.90 | ||||

| 28 | J7 | 196.00 | 1,264.90 | ||||

Table (17)

| ACCOUNT Sales ACCOUNT NO. 401 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| April | 1 | J7 | 2,100 | 2,100 | |||

| 3 | J7 | 1,000 | 3,100 | ||||

| 7 | J7 | 3,240 | 6,340 | ||||

| 12 | J7 | 980 | 7,320 | ||||

| 14 | J7 | 2,180 | 9,500 | ||||

| 19 | J7 | 1,020 | 10,520 | ||||

| 21 | J7 | 2,600 | 13,120 | ||||

| 24 | J7 | 920 | 14,040 | ||||

| 27 | J7 | 1,320 | 15,360 | ||||

| 28 | J7 | 2,800 | 18,160 | ||||

Table (18)

| ACCOUNT Sales Returns and Allowances ACCOUNT NO. 401.1 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| April | 6 | J7 | 50.00 | 50.00 | |||

| 17 | J7 | 40.00 | 90.00 | ||||

Table (19)

Post the journalized entries into the customer accounts in accounts receivable ledger.

| NAME OLM | ||||||

| ADDRESS | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20-- | ||||||

| April | 1 | J7 | 2,247.00 | 2,247.00 | ||

| 6 | J7 | 53.50 | 2,193.50 | |||

| 9 | J7 | 2,193.50 | 0 | |||

| 24 | J7 | 984.40 | 984.40 | |||

Table (20)

| NAME KM | ||||||

| ADDRESS | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20-- | ||||||

| April | 1 | Balance | ✓ | 482.00 | ||

| 19 | J7 | 1,091.40 | 1,573.40 | |||

Table (21)

| NAME AP | ||||||

| ADDRESS | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20-- | ||||||

| April | 3 | J7 | 1,070.00 | 1,070.00 | ||

| 27 | J7 | 1,412.40 | 2,482.40 | |||

Table (22)

| NAME MR | ||||||

| ADDRESS | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20-- | ||||||

| April | 1 | Balance | ✓ | 2,244.25 | ||

| 12 | J7 | 1,048.60 | 3,292.85 | |||

| 17 | J7 | 42.80 | 3,250.05 | |||

| 29 | J7 | 2,186.00 | 1,064.05 | |||

Table (23)

Want to see more full solutions like this?

Chapter 10 Solutions

Bundle: College Accounting, Chapters 1-27, Loose-Leaf Version, 22nd + CengageNOWv2, 2 terms Printed Access Card

- Summit Beverages purchased a delivery truck for $90,000. The company estimates a 5-year useful life with a residual value of $10,000. Using the double-declining balance depreciation method, what is the depreciation expense for the first year?arrow_forwardNorthern Lights Inc. had net credit sales of $600,000 and accounts receivable of $75,000 at the beginning of the year and $85,000 at the end of the year. What is the accounts receivable turnover ratio for the company?arrow_forwardcorrect answer pleasearrow_forward

- Provide solutionarrow_forwardEvergreen Systems started the year with $980,000 in total assets and $450,000 in total liabilities. During the year, the company generated $160,000 in net income, paid $35,000 in dividends, and issued common stock worth $55,000. What is the company's total equity at the end of the year?arrow_forwardAnswer please but not use aiarrow_forward

- Express Delivery Company (EDC) is considering outsourcing its Payroll Department to a payroll processing company for an annual fee of $220,800. An internally prepared report summarizes the Payroll Department’s annual operating costs as follows: Supplies $ 30,800 Payroll clerks’ salaries 120,800 Payroll supervisor’s salary 58,800 Payroll employee training expenses 10,800 Depreciation of equipment 20,800 Allocated share of common building operating costs 15,800 Allocated share of common administrative overhead 28,800 Total annual operating cost $ 286,600 EDC currently rents overflow office space for $36,800 per year. If the company closes its Payroll Department, the employees occupying the rented office space could be brought in-house and the lease agreement on the rented space could be terminated with no penalty. If the Payroll Department is outsourced the payroll clerks will not be retained; however, the supervisor would be transferred to the company’s Human…arrow_forwardThalassines Kataskeves, S.A., of Greece makes marine equipment. The company has been experiencing losses on its bilge pump product line for several years. The most recent quarterly contribution format income statement for the bilge pump follows: Thalassines Kataskeves, S.A. Income Statement—Bilge Pump For the Quarter Ended March 31 Sales $ 410,000 Variable expenses: Variable manufacturing expenses $ 123,000 Sales commissions 50,000 Shipping 21,000 Total variable expenses 194,000 Contribution margin 216,000 Fixed expenses: Advertising (for the bilge pump product line) 27,000 Depreciation of equipment (no resale value) 120,000 General factory overhead 38,000* Salary of product-line manager 113,000 Insurance on inventories 5,000 Purchasing department 49,000† Total fixed expenses 352,000 Net operating loss $ (136,000) *Common costs allocated on the basis of machine-hours. †Common costs allocated on the basis of…arrow_forwardDo companies maintain two sets of depreciation schedules, one for financial reporting and the other one for tax purposes?arrow_forward

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:CengagePrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:CengagePrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,