Duncan Street Company (DSC), a British company, is considering establishing an operation in the United States to assemble and distribute smart speakers. The initial investment is estimated to be 25,000,000 British pounds (GBP), which is equivalent to 30,000,000 U.S. dollars (USD) at the current exchange rate. Given the current corporate income tax rate in the United States, DSC estimates that total after-tax annual cash flow in each of the three years of the investment’s life would be US$10,000,000, US$12,000,000, and US$15,000,000, respectively. However, the U.S. national legislature is considering a reduction in the corporate income tax rate that would go into effect in the second year of the investment’s life and would result in the following total annual

The U.S. operation will distribute 100 percent of its after-tax annual cash flow to DSC as a dividend at the end of each year. The terminal value of the investment at the end of three years is estimated to be US$25,000,000. The U.S. withholding tax on dividends is 5 percent; repatriation of the investment’s terminal value will not be subject to U.S. withholding tax. Neither the dividends nor the terminal value received from the U.S. investment will be subject to British income tax.

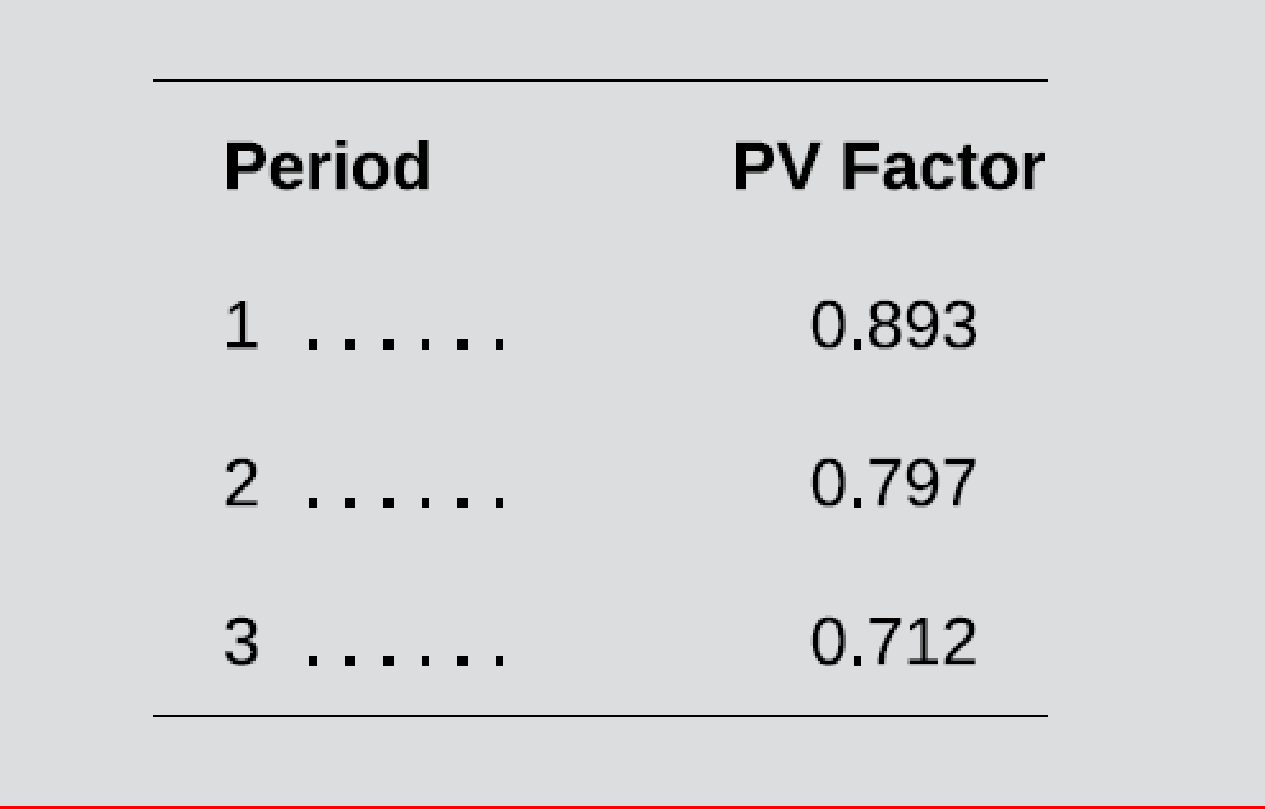

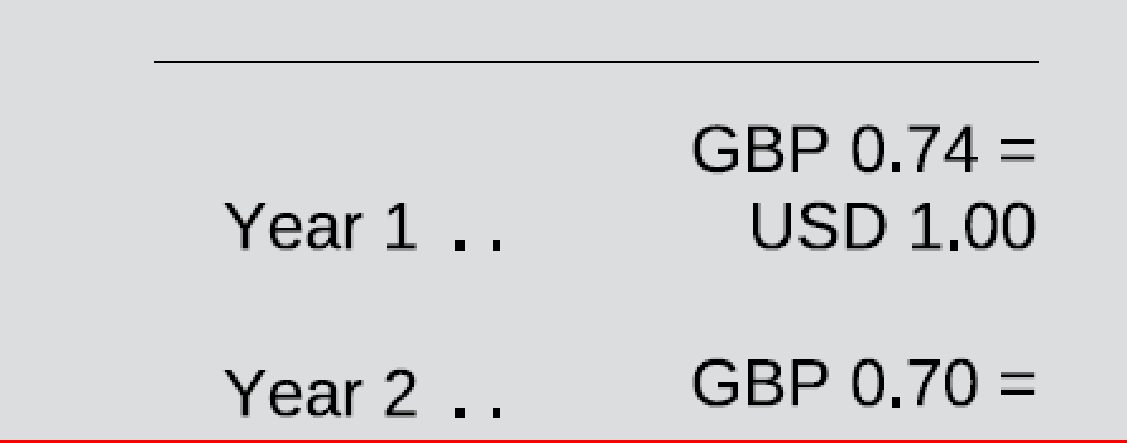

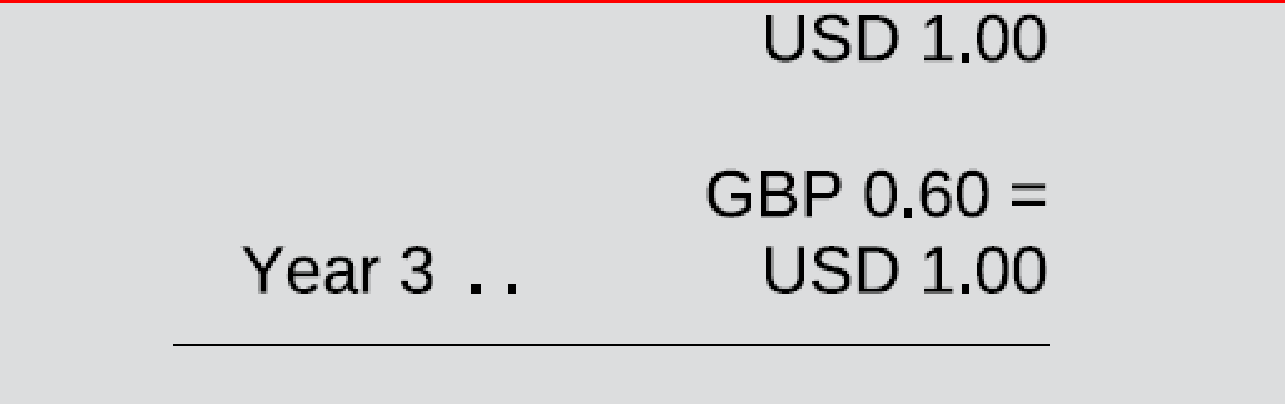

Exchange rates between the GBP and USD are

Required:

- a. Determine the expected

net present value of the potential U.S. investment from a project perspective. - b. Determine the expected net present value of the potential U.S. investment from a parent company perspective.

Want to see the full answer?

Check out a sample textbook solution

Chapter 10 Solutions

Connect Online Access for International Accounting

- Compute the total cost of work in process for the year on these general accounting questionarrow_forwardDetermine the cost per equivalent unit of conversion on these general accounting questionarrow_forwardCarla Vista Corporation had a projected benefit obligation of $2,890,000 and plan assets of $3,097,000 at January 1, 2025. Carla Vista also had a net actuarial loss of $437,680 in accumulated OCI at January 1, 2025. The average remaining service period of Carla Vista's employees is 7.9 years. Compute Carla Vista's minimum amortization of the actuarial loss. Minimum amortization of the actuarial lossarrow_forward

- Chapter 15 Homework i 10 0.83 points Saved Help Save & Exit Submit Check my work QS 15-8 (Algo) Computing predetermined overhead rates LO P3 A company estimates the following manufacturing costs at the beginning of the period: direct labor, $520,000; direct materials, $216,000; and factory overhead, $141,000. Required: eBook 1. Compute its predetermined overhead rate as a percent of direct labor. 2. Compute its predetermined overhead rate as a percent of direct materials. Ask Complete this question by entering your answers in the tabs below. Print Required 1 Required 2 References Mc Graw Hill Compute its predetermined overhead rate as a percent of direct labor. Overhead Rate Numerator: 1 Denominator: = Overhead Rate = Overhead Rate = 0arrow_forwardhello teacher please solve questions general accountingarrow_forwardCampbell Soup Company reported pension expense of $94 million and contributed $81.5 million to the pension fund. Prepare Campbell's journal entry to record pension expense and funding, assuming campbell has no OCI amounts.arrow_forward

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT