Concept explainers

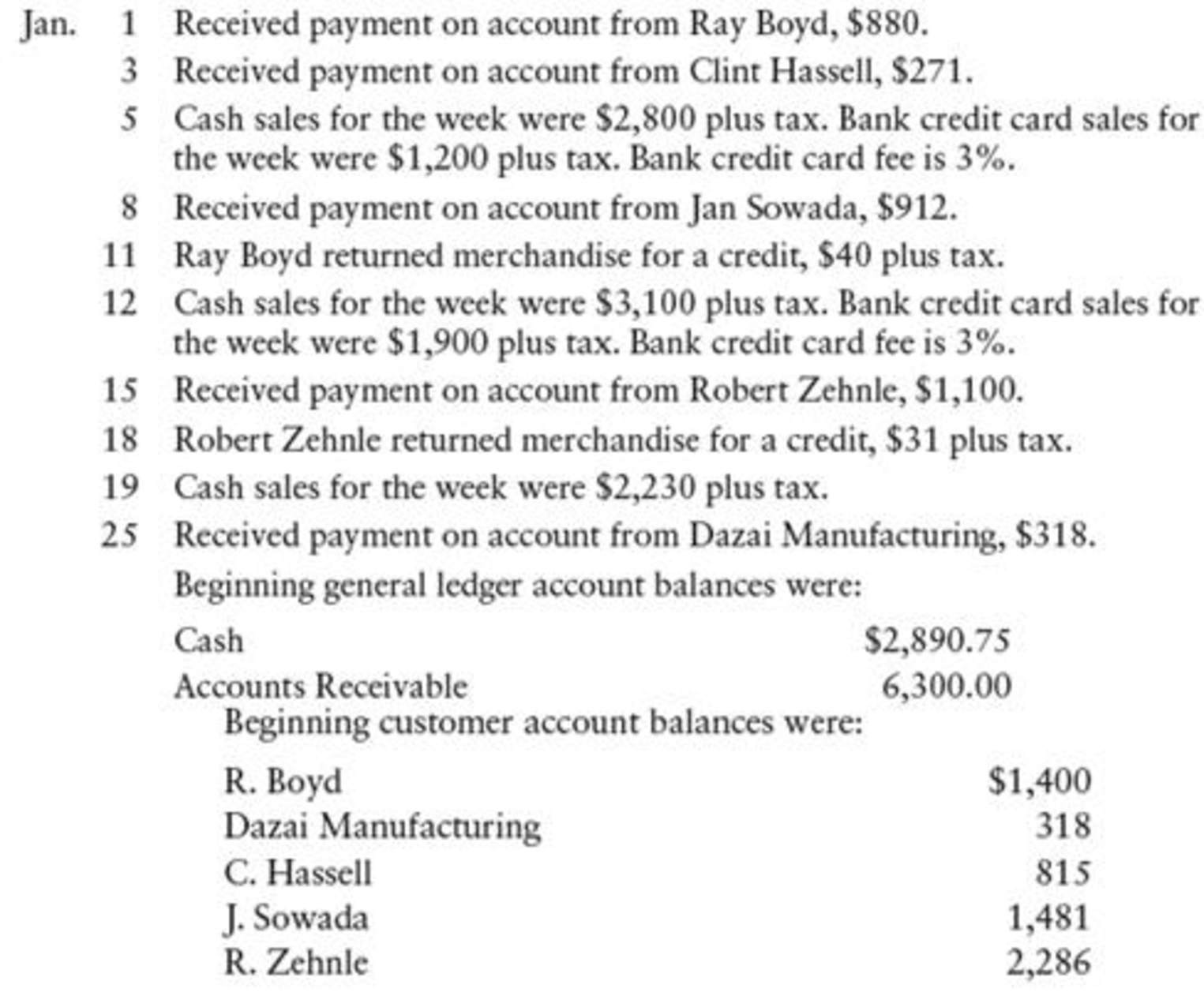

CASH RECEIPTS TRANSACTIONS Color Florists, a retail business, had the following cash receipts during January 20--. The sales tax is 5%.

REQUIRED

- 1. Record the transactions starting on page 20 of a general journal.

- 2. Post from the journal to the general ledger and

accounts receivable ledger accounts. Use account numbers as shown in the chapter.

1.

Journalize the transactions related to cash receipt transactions.

Explanation of Solution

Journal entry: Journal entry is a set of economic events which can be measured in monetary terms. These are recorded chronologically and systematically.

Debit and credit rules:

- Debit an increase in asset account, increase in expense account, decrease in liability account, and decrease in stockholders’ equity accounts.

- Credit decrease in asset account, increase in revenue account, increase in liability account, and increase in stockholders’ equity accounts.

Journalize the transactions related to cash receipts.

Transaction on January 1:

| Page: 20 | ||||||

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| January | 1 | Cash | 101 | 880 | ||

| Accounts Receivable, RB | 122/✓ | 880 | ||||

| (Record cash received for sales on account) | ||||||

Table (1)

Description:

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Accounts Receivable, RB is an asset account. Since amount to be received has decreased, asset account decreased, and a decrease in asset is credited.

Transaction on January 3:

| Page: 20 | ||||||

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| January | 3 | Cash | 101 | 271 | ||

| Accounts Receivable, CH | 122/✓ | 271 | ||||

| (Record cash received for sales on account) | ||||||

Table (2)

Description:

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Accounts Receivable, CH is an asset account. Since amount to be received has decreased, asset account decreased, and a decrease in asset is credited.

Transaction on January 5:

| Page: 20 | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| January | 5 | Cash | 101 | 2,940 | ||

| Sales | 401 | 2,800 | ||||

| Sales Tax Payable | 231 | 140 | ||||

| (Record cash sales) | ||||||

Table (3)

Description:

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Sales is a revenue account. Since revenues and gains increase equity, equity value is increased, and an increase in equity is credited.

- Sales Tax Payable is a liability account. Since the payable increased, the liability increased, and an increase in liability is credited.

Working Note 1:

Compute sales tax payable amount.

Working Note 2:

Compute cash amount (Refer to Working Note 1 for value of sales tax payable).

Transaction on January 5:

| Page: 20 | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| January | 5 | Cash | 101 | 1,222.20 | ||

| Bank Credit Card Expense | 513 | 37.80 | ||||

| Sales | 401 | 1,200.00 | ||||

| Sales Tax Payable | 231 | 60.00 | ||||

| (Record credit card sale) | ||||||

Table (4)

Description:

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Bank Credit Card Expense is an expense account. Since expenses and losses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Sales is a revenue account. Since revenues and gains increase equity, equity value is increased, and an increase in equity is credited.

- Sales Tax Payable is a liability account. Since the payable increased, the liability increased, and an increase in liability is credited.

Working Note 3:

Compute sales tax payable amount.

Working Note 4:

Compute bank credit card expense amount (Refer to Working Note 3 for value of sales tax payable).

Working Note 5:

Compute amount of cash received (Refer to Working Note 3 for value of sales tax payable and Working Note 4 for value of bank credit card expense).

Transaction on January 8:

| Page: 20 | ||||||

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| January | 8 | Cash | 101 | 912 | ||

| Accounts Receivable, JS | 122/✓ | 912 | ||||

| (Record cash received for sales on account) | ||||||

Table (5)

Description:

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Accounts Receivable, JS is an asset account. Since amount to be received has decreased, asset account decreased, and a decrease in asset is credited.

Transaction on January 11:

| Page: 20 | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| January | 11 | Sales Returns and Allowances | 401.1 | 40 | ||

| Sales Tax Payable | 231 | 2 | ||||

| Accounts Receivable, RB | 122/✓ | 42 | ||||

| (Record merchandise returned) | ||||||

Table (6)

Description:

- Sales Returns and Allowances is a contra-revenue account, and contra-revenue accounts decrease the equity value, and a decrease in equity is debited.

- Sales Tax Payable is a liability account. Since the payable decreased due to returns, the liability decreased, and a decrease in liability is debited.

- Accounts Receivable, RB is an asset account. Since inventory is returned, amount to be received has decreased, asset account is decreased, and a decrease in asset is credited.

Working Note 6:

Compute sales tax payable amount.

Working Note 7:

Compute accounts receivable amount (Refer to Working Note 7 for value of sales tax payable).

Transaction on January 12:

| Page: 20 | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| January | 12 | Cash | 101 | 3,255 | ||

| Sales | 401 | 3,100 | ||||

| Sales Tax Payable | 231 | 155 | ||||

| (Record cash sales) | ||||||

Table (7)

Description:

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Sales is a revenue account. Since revenues and gains increase equity, equity value is increased, and an increase in equity is credited.

- Sales Tax Payable is a liability account. Since the payable increased, the liability increased, and an increase in liability is credited.

Working Note 8:

Compute sales tax payable amount.

Working Note 9:

Compute cash amount (Refer to Working Note 8 for value of sales tax payable).

Transaction on January 12:

| Page: 20 | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| January | 12 | Cash | 101 | 1,935.15 | ||

| Bank Credit Card Expense | 513 | 59.85 | ||||

| Sales | 401 | 1,900.00 | ||||

| Sales Tax Payable | 231 | 95.00 | ||||

| (Record credit card sale) | ||||||

Table (8)

Description:

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Bank Credit Card Expense is an expense account. Since expenses and losses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Sales is a revenue account. Since revenues and gains increase equity, equity value is increased, and an increase in equity is credited.

- Sales Tax Payable is a liability account. Since the payable increased, the liability increased, and an increase in liability is credited.

Working Note 10:

Compute sales tax payable amount.

Working Note 11:

Compute bank credit card expense amount (Refer to Working Note 10 for value of sales tax payable).

Working Note 12:

Compute amount of cash received (Refer to Working Note 10 for value of sales tax payable and Working Note 11 for value of bank credit card expense).

Transaction on January 15:

| Page: 20 | ||||||

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| January | 15 | Cash | 101 | 1,100 | ||

| Accounts Receivable, RZ | 122/✓ | 1,100 | ||||

| (Record cash received for sales on account) | ||||||

Table (9)

Description:

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Accounts Receivable, RZ is an asset account. Since amount to be received has decreased, asset account decreased, and a decrease in asset is credited.

Transaction on January 18:

| Page: 20 | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| January | 18 | Sales Returns and Allowances | 401.1 | 31.00 | ||

| Sales Tax Payable | 231 | 1.55 | ||||

| Accounts Receivable, RZ | 122/✓ | 32.55 | ||||

| (Record merchandise returned) | ||||||

Table (10)

Description:

- Sales Returns and Allowances is a contra-revenue account, and contra-revenue accounts decrease the equity value, and a decrease in equity is debited.

- Sales Tax Payable is a liability account. Since the payable decreased due to returns, the liability decreased, and a decrease in liability is debited.

- Accounts Receivable, RZ is an asset account. Since inventory is returned, amount to be received has decreased, asset account is decreased, and a decrease in asset is credited.

Working Note 13:

Compute sales tax payable amount.

Working Note 14:

Compute accounts receivable amount (Refer to Working Note 13 for value of sales tax payable).

Transaction on January 19:

| Page: 20 | ||||||

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| January | 19 | Cash | 101 | 2,341.50 | ||

| Sales | 401 | 2,230.00 | ||||

| Sales Tax Payable | 231 | 111.50 | ||||

| (Record cash sales) | ||||||

Table (11)

Description:

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Sales is a revenue account. Since revenues and gains increase equity, equity value is increased, and an increase in equity is credited.

- Sales Tax Payable is a liability account. Since the payable increased, the liability increased, and an increase in liability is credited.

Working Note 15:

Compute sales tax payable amount.

Working Note 16:

Compute cash amount (Refer to Working Note 15 for value of sales tax payable).

Transaction on January 25:

| Page: 20 | ||||||

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | ||

| 20-- | ||||||

| January | 25 | Cash | 101 | 318 | ||

| Accounts Receivable, D Manufacturing | 122/✓ | 318 | ||||

| (Record cash received for sales on account) | ||||||

Table (12)

Description:

- Cash is an asset account. Since cash is received, asset account increased, and an increase in asset is debited.

- Accounts Receivable, D Manufacturing is an asset account. Since amount to be received has decreased, asset account decreased, and a decrease in asset is credited.

2.

Post the journalized entries into the accounts of the general ledger, and the customer accounts in accounts receivable ledger.

Explanation of Solution

Posting transactions: The process of transferring the journalized transactions into the accounts of the ledger is known as posting the transactions.

Post the journalized entries into the accounts of the general ledger.

| ACCOUNT Cash ACCOUNT NO. 101 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| January | 1 | Balance | ✓ | 2,890.75 | |||

| 1 | J20 | 880.00 | 3,770.75 | ||||

| 3 | J20 | 271.00 | 4,041.75 | ||||

| 5 | J20 | 2,940.00 | 6,981.75 | ||||

| 5 | J20 | 1,222.20 | 8,203.95 | ||||

| 8 | J20 | 912.00 | 9,115.95 | ||||

| 12 | J20 | 3,255.00 | 12,370.95 | ||||

| 12 | J20 | 1,935.15 | 14,306.10 | ||||

| 15 | J20 | 1,100.00 | 15,406.10 | ||||

| 19 | J20 | 2,341.50 | 17,747.60 | ||||

| 25 | J20 | 318.00 | 18,065.60 | ||||

Table (13)

| ACCOUNT Accounts Receivable ACCOUNT NO. 122 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| January | 1 | Balance | ✓ | 6,300.00 | |||

| 1 | J20 | 880.00 | 5,420.00 | ||||

| 3 | J20 | 271.00 | 5,149.00 | ||||

| 8 | J20 | 912.00 | 4,237.00 | ||||

| 11 | J20 | 42.00 | 4,195.00 | ||||

| 15 | J20 | 1,100.00 | 3,095.00 | ||||

| 18 | J20 | 32.55 | 3,062.45 | ||||

| 25 | J20 | 318.00 | 2,744.45 | ||||

Table (14)

| ACCOUNT Sales Tax Payable ACCOUNT NO. 231 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| January | 5 | J20 | 140.00 | 140.00 | |||

| 5 | J20 | 60.00 | 200.00 | ||||

| 11 | J20 | 2.00 | 198.00 | ||||

| 12 | J20 | 155.00 | 353.00 | ||||

| 12 | J20 | 95.00 | 448.00 | ||||

| 18 | J20 | 1.55 | 446.45 | ||||

| 19 | J20 | 111.50 | 557.95 | ||||

Table (15)

| ACCOUNT Sales ACCOUNT NO. 401 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| January | 5 | J20 | 2,800.00 | 2,800.00 | |||

| 5 | J20 | 1,200.00 | 4,000.00 | ||||

| 12 | J20 | 3,100.00 | 7,100.00 | ||||

| 12 | J20 | 1,900.00 | 9,000.00 | ||||

| 19 | J20 | 2,230.00 | 11,230.00 | ||||

Table (16)

| ACCOUNT Sales Returns and Allowances ACCOUNT NO. 401.1 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| January | 11 | J20 | 40.00 | 40.00 | |||

| 18 | J20 | 31.00 | 71.00 | ||||

Table (17)

| ACCOUNT Bank Credit Card Expense ACCOUNT NO. 513 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| January | 5 | J20 | 37.80 | 37.80 | |||

| 12 | J20 | 59.85 | 97.65 | ||||

Table (18)

Post the journalized entries into the customer accounts in accounts receivable ledger.

| NAME RB | ||||||

| ADDRESS | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20-- | ||||||

| January | 1 | Balance | ✓ | 1,400.00 | ||

| 1 | J20 | 880.00 | 520.00 | |||

| 11 | J20 | 42.00 | 478.00 | |||

Table (19)

| NAME D Manufacturing | ||||||

| ADDRESS | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20-- | ||||||

| January | 1 | Balance | ✓ | 318.00 | ||

| 25 | J20 | 318.00 | 0 | |||

Table (20)

| NAME CH | ||||||

| ADDRESS | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20-- | ||||||

| January | 1 | Balance | ✓ | 815.00 | ||

| 3 | J20 | 271.00 | 544.00 | |||

Table (21)

| NAME JS | ||||||

| ADDRESS | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20-- | ||||||

| January | 1 | Balance | ✓ | 1,481.00 | ||

| 8 | J20 | 912.00 | 569.00 | |||

Table (22)

| NAME RZ | ||||||

| ADDRESS | ||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance ($) | |

| 20-- | ||||||

| January | 1 | Balance | ✓ | 2,286.00 | ||

| 15 | J20 | 1,100.00 | 1,186.00 | |||

| 18 | J20 | 32.55 | 1,153.45 | |||

Table (23)

Want to see more full solutions like this?

Chapter 10 Solutions

Bundle: College Accounting, Chapters 1-27, Loose-leaf Version, 22nd + Cengagenowv2™, 2 Terms Printed Access Card For Heintz/parry's College ... Set For College Accounting, 22nd + Cenga

- REQUIRED Use the information provided below to answer the following questions: 4.1 Calculate the weighted average cost of capital (expressed to two decimal places). Your answer must include the calculations of the cost of equity, preference shares and the loan. 4.2 Calculate the cost of equity using the Capital Asset Pricing Model (expressed to two decimal places). (16 marks) (4 marks) INFORMATION Cadmore Limited intends raising finance for a proposed new project. The financial manager has provided the following information to determine the present cost of capital to the company: The capital structure consists of the following: ■3 million ordinary shares issued at R1.50 each but currently trading at R2 each. 1 200 000 12%, R2 preference shares with a market value of R2.50 per share. R1 000 000 18% Bank loan, due in March 2027. Additional information The company's beta coefficient is 1.3. The risk-free rate is 8%. The return on the market is 18%. The Gordon Growth Model is used to…arrow_forwardA dog training business began on December 1. The following transactions occurred during its first month. Use the drop-downs to select the accounts properly included on the income statement for the post-closing balancesarrow_forwardWhat is the expected return on a portfolio with a beta of 0.8 on these financial accounting question?arrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax CollegeCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning  College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning