Connect 1 Semester Access Card for Fundamentals of Financial Accounting

5th Edition

ISBN: 9781259128547

Author: Fred Phillips Associate Professor, Robert Libby, Patricia Libby

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 10, Problem 10.9CP

(Supplement 10A) Completing an Amortization Schedule (Straight-Line Amortization)

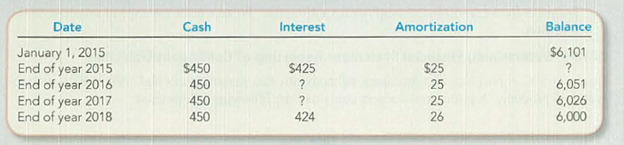

The Peg Corporation (TPC) issued bonds and received cash in full for the issue price. The bonds were dated and issued on January 1, 2015. The stated interest rate was payable at the end of each year. The bonds mature at the end of four years. The following schedule has been prepared (amounts in thousands):

Required:

- 1. Complete the amortization schedule.

TIP: The switch in amortization from $25 to $26 in the final year is caused by rounding.

- 2. What was the maturity amount (face

value) of the bonds ? - 3. How much cash was received at date of issuance of the bonds?

- 4. Was there a premium or a discount? If so, which and how much was it?

- 5. How much cash is paid for interest each period and will be paid in total for the full life of the bond issue?

- 6. What is the stated interest rate?

- 7. What is the market interest rate?

- 8. What amount of interest expense should be reported on the income statement each year?

- 9. Show how the bonds should be reported on the

balance sheet at the end of 2016 and 2017.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Can you solve this general accounting question with accurate accounting calculations?

Please explain the correct approach for solving this general accounting question.

Accounting Question

Chapter 10 Solutions

Connect 1 Semester Access Card for Fundamentals of Financial Accounting

Ch. 10 - Prob. 1QCh. 10 - Prob. 2QCh. 10 - What three factors influence the dollar amount...Ch. 10 - Prob. 4QCh. 10 - Prob. 5QCh. 10 - Prob. 6QCh. 10 - Prob. 7QCh. 10 - If a company has a long-term loan that has only...Ch. 10 - What are the reasons that some bonds are issued at...Ch. 10 - Prob. 10Q

Ch. 10 - Will the stated interest rate be higher than the...Ch. 10 - What is the carrying value of a bond payable?Ch. 10 - What is the difference between a secured bond and...Ch. 10 - Prob. 14QCh. 10 - Prob. 15QCh. 10 - Prob. 16QCh. 10 - Prob. 17QCh. 10 - Which of the following best describes Accrued...Ch. 10 - Prob. 2MCCh. 10 - Prob. 3MCCh. 10 - Prob. 4MCCh. 10 - Which of the following does not impact the...Ch. 10 - Which of the following is false when a bond is...Ch. 10 - To determine if a bond will be issued at a...Ch. 10 - A bond is issued at a price of 103 and retired...Ch. 10 - In a recent year. Land O Lakes, Inc., reported (in...Ch. 10 - Prob. 10MCCh. 10 - Recording Unearned Revenues A local theater...Ch. 10 - Prob. 10.2MECh. 10 - Prob. 10.3MECh. 10 - Reporting Payroll Tax Liabilities Refer to M10-3....Ch. 10 - Prob. 10.5MECh. 10 - Prob. 10.6MECh. 10 - Prob. 10.7MECh. 10 - Prob. 10.8MECh. 10 - Prob. 10.9MECh. 10 - Prob. 10.10MECh. 10 - Recording Bonds Issued at Face Value Schlitterbahn...Ch. 10 - Prob. 10.12MECh. 10 - Computing the Debt-to-Assets Ratio and the Times...Ch. 10 - Analyzing the Impact of Transactions on the...Ch. 10 - Prob. 10.15MECh. 10 - Prob. 10.16MECh. 10 - Prob. 10.17MECh. 10 - Prob. 10.1ECh. 10 - Recording a Note Payable through Its Time to...Ch. 10 - Recording Payroll Costs McLoyd Company completed...Ch. 10 - Recording Payroll Costs with and without...Ch. 10 - Prob. 10.5ECh. 10 - Determining and Recording the Financial Statement...Ch. 10 - Preparing Journal Entries to Record Issuance of...Ch. 10 - Preparing Journal Entries to Record Issuance of...Ch. 10 - Prob. 10.9ECh. 10 - Prob. 10.10ECh. 10 - (Supplement 10A) Recording the Effects of a...Ch. 10 - Prob. 10.12ECh. 10 - Prob. 10.13ECh. 10 - Prob. 10.14ECh. 10 - (Supplement 10B) Recording the Effects of a...Ch. 10 - Prob. 10.16ECh. 10 - Determining Financial Effects of Transactions...Ch. 10 - Recording and Reporting Current Liabilities with...Ch. 10 - Recording and Reporting Current Liabilities...Ch. 10 - Prob. 10.4CPCh. 10 - Determining Financial Statement Reporting of...Ch. 10 - Prob. 10.6CPCh. 10 - (Supplement 10B) Recording Bond Issuance and...Ch. 10 - Prob. 10.8CPCh. 10 - (Supplement 10A) Completing an Amortization...Ch. 10 - (Supplements 10B or 10C) Completing an...Ch. 10 - Prob. 10.1PACh. 10 - Prob. 10.2PACh. 10 - Recording and Reporting Current Liabilities...Ch. 10 - Prob. 10.4PACh. 10 - Prob. 10.5PACh. 10 - Prob. 10.6PACh. 10 - Prob. 10.7PACh. 10 - Prob. 10.8PACh. 10 - Prob. 10.1PBCh. 10 - Recording and Reporting Current Liabilities with...Ch. 10 - Prob. 10.3PBCh. 10 - Prob. 10.4PBCh. 10 - Recording and Explaining the Early Retirement of...Ch. 10 - Prob. 10.6PBCh. 10 - (Supplement 10B) Recording Bond Issue, Interest...Ch. 10 - (Supplement 10C) Recording Bond Issue, Interest...Ch. 10 - Prob. 10.1COPCh. 10 - Prob. 10.1SDCCh. 10 - Prob. 10.2SDCCh. 10 - Prob. 10.4SDCCh. 10 - Prob. 10.5SDCCh. 10 - Prob. 10.6SDCCh. 10 - Prob. 10.7SDCCh. 10 - Prob. 10.8SDCCh. 10 - (Supplement 10C) Preparing a Bond Amortization...Ch. 10 - Prob. 10.1CC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I need assistance with this general accounting question using appropriate principles.arrow_forwardCan you explain this financial accounting question using accurate calculation methods?arrow_forwardCan you help me solve this financial accounting question using valid financial accounting techniques?arrow_forward

- Please provide the accurate answer to this financial accounting problem using appropriate methods.arrow_forwardPlease provide the solution to this general accounting question using proper accounting principles.arrow_forwardI need help finding the accurate solution to this general accounting problem with valid methods.arrow_forward

- Determine the price of a $1.3 million bond issue under each of the following independent assumptions: Maturity 10 years, interest paid annually, stated rate 8%, effective (market) rate 10%. Maturity 10 years, interest paid semiannually, stated rate 8%, effective (market) rate 10%. Maturity 10 years, interest paid semiannually, stated rate 10%, effective (market) rate 8%. Maturity 20 years, interest paid semiannually, stated rate 10%, effective (market) rate 8%. Maturity 20 years, interest paid semiannually, stated rate 10%, effective (market) rate 10%.arrow_forwardIf total assets increase while liabilities remain unchanged, equity must: A) IncreaseB) DecreaseC) Remain the sameD) Be negativearrow_forwardNo chatgpt!! Which of the following is an intangible asset? A) InventoryB) CopyrightC) EquipmentD) Accounts Receivablearrow_forward

- Which of the following is an intangible asset? A) InventoryB) CopyrightC) EquipmentD) Accounts Receivableno aiarrow_forwardWhich of the following is an intangible asset? A) InventoryB) CopyrightC) EquipmentD) Accounts Receivablearrow_forwardWhat does a ledger account represent? A) A detailed record of all business transactionsB) A summary of trial balancesC) An individual record for each accountD) The final balance of a financial statement Need help!arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Accounting - Long-term Liabilities - Bonds; Author: Finance & Accounting Videos by Prof Coram;https://www.youtube.com/watch?v=_1fwsJIGMos;License: Standard Youtube License