Concept explainers

Payroll accounts and year-end entries

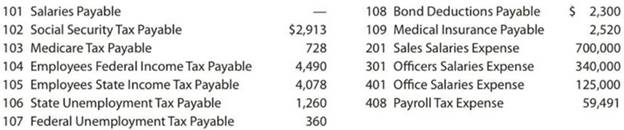

The following accounts, with the balances indicated, appear in the ledger of Garcon Co. on December 1 of the current year:

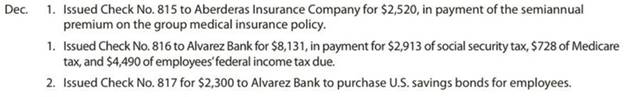

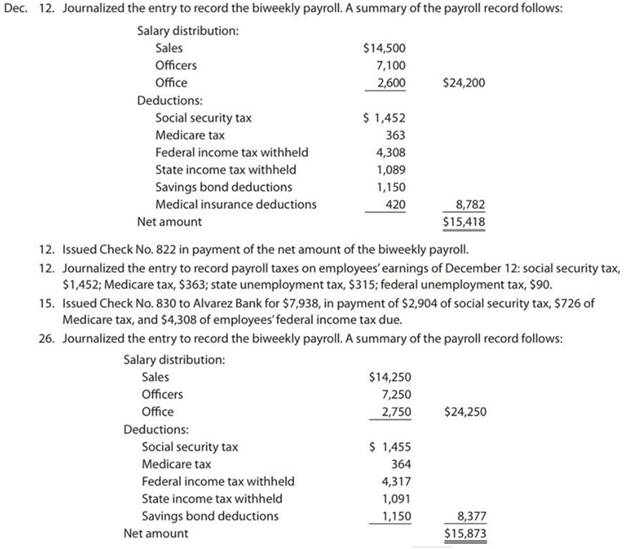

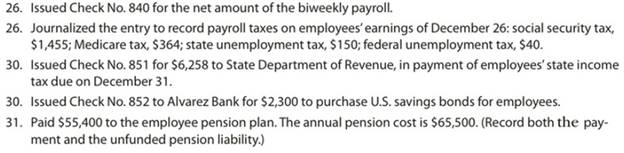

The following transactions relating to payroll, payroll deductions, and payroll taxes occurred during December:

Instructions

1. Journalize the transactions.

2. Journalize the following

A. Salaries accrued: sales salaries, $4,275; officers salaries, $2,175; office salaries, $825. The payroll taxes are immaterial and are not accrued.

B. Vacation pay, $13,350.

Trending nowThis is a popular solution!

Chapter 10 Solutions

Financial & Managerial Accounting

Additional Business Textbook Solutions

Marketing: An Introduction (13th Edition)

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

Engineering Economy (17th Edition)

Operations Management

Financial Accounting, Student Value Edition (5th Edition)

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

- Headland Company pays its office employee payroll weekly. Below is a partial list of employees and their payroll data for August. Because August is their vacation period, vacation pay is also listed. Earnings to Weekly Vacation Pay to Be Employee July 31 Pay Received in August Mark Hamill $5,180 $280 Karen Robbins 4,480 230 $460 Brent Kirk 3,680 190 380 Alec Guinness 8,380 330 Ken Sprouse 8,980 410 820 Assume that the federal income tax withheld is 10% of wages. Union dues withheld are 2% of wages. Vacations are taken the second and third weeks of August by Robbins, Kirk, and Sprouse. The state unemployment tax rate is 2.5% and the federal is 0.8%, both on a $7,000 maximum. The FICA rate is 7.65% on employee and employer on a maximum of $142,800 per employee. In addition, a 1.45% rate is charged both employer and employee for an employee's wages in excess of $142,800. Make the journal entries necessary for each of the four August payrolls. The entries for the payroll and for the…arrow_forwardThe direct materials variance is computed when the materials are purchasedarrow_forwardAction to increase net incomearrow_forward

- Exercise 5-18 (Algo) Calculate receivables ratios (LO5-8) Below are amounts (in millions) from three companies' annual reports. WalCo TarMart Costbet Beginning Accounts Receivable $1,795 6,066 609 Ending Accounts Receivable $2,742 6,594 645 Net Sales $320,427 65,878 66,963 Required: 1. Calculate the receivables turnover ratio and the average collection period for WalCo, TarMart and CostGet 2. Which company appears most efficient in collecting cash from sales? Complete this question by entering your answers in the tabs below. Required 1 Required C Calculate the receivables turnover ratio and the average collection period for WalCo, TarMart and CostGet. (Enter your answers in millions rounded to 1 decimal place.) Receivables Turnover Ratio: WalCo S TarMart. S CostGet S Choose Numerator Choose Numerator "ValCo FarMart CostGet 320,427 $ 65.878 66,963 Choose Denominator Receivables turnover ratio 2,742.0 116.9 times 0 times 0 times Average Collection Period Choose Denominator Average…arrow_forwardWhat is the Whistleblower Protection Act of 1989 (amended in 2011)?arrow_forwardWhat are the differences between IFRS and GAAP? What are the smiliarities between IFRS and GAAP?arrow_forward

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub