Concept explainers

Payroll accounts and year-end entries

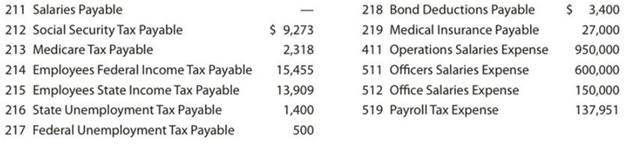

The following accounts, with the balances indicated, appear in the ledger of Garcon Co. on December 1 of the current year:

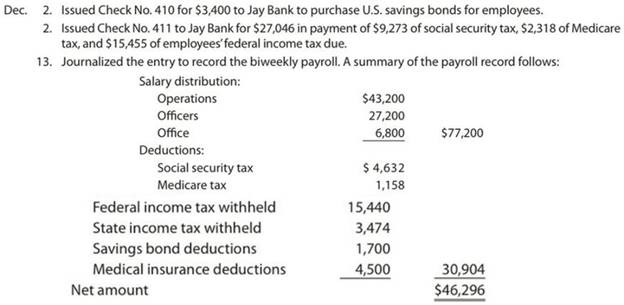

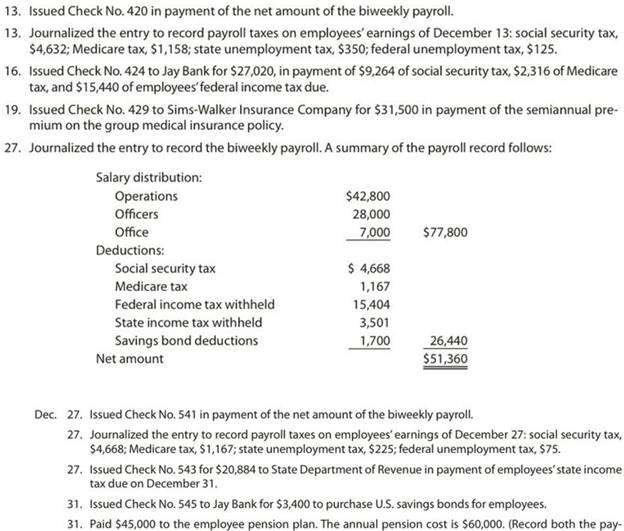

The following transactions relating to payroll, payroll deductions, and payroll taxes occurred during December:

Instructions

1. Journalize the transactions.

2. Journalize the following

A. Salaries accrued: operations salaries, $8,560; officers salaries, $5,600; office salaries, $1,400. The payroll taxes are immaterial and are not accrued.

B. Vacation pay, $15,000.

Want to see the full answer?

Check out a sample textbook solution

Chapter 10 Solutions

FINANCIAL AND MANAGERIAL ACCOUNTING

Additional Business Textbook Solutions

Intermediate Accounting (2nd Edition)

Horngren's Accounting (12th Edition)

Financial Accounting, Student Value Edition (5th Edition)

Understanding Business

Principles of Operations Management: Sustainability and Supply Chain Management (10th Edition)

Essentials of MIS (13th Edition)

- What is the tax liability that appears on the balance sheet for this year of this financial accounting question?arrow_forwardA company can sell all the units it can produce of either Product X or Product Y but not both. Product X has a unit contribution margin of $18 and takes four machine hours to make, while Product Y has a unit contribution margin of $25 and takes five machine hours to make. If there are 6,000 machine hours available to manufacture a product, income will be: A. $6,000 more if Product X is made B. $6,000 less if Product Y is made C. $6,000 less if Product X is made D. the same if either product is made. Need answerarrow_forwardWhat is the yield to maturity of the bond on these financial accounting question?arrow_forward

- Financial Accounting 5.2arrow_forwardMorgan & Co. is currently an all-equity firm with 100,000 shares of stock outstanding at a market price of $30 per share. The company's earnings before interest and taxes are $120,000. Morgan & Co. has decided to add leverage to its financial operations by issuing $750,000 of debt at an 8% interest rate. This $750,000 will be used to repurchase shares of stock. You own 2,500 shares of Morgan & Co. stock. You also loan out funds at an 8% interest rate. How many of your shares of stock in Morgan & Co. must you sell to offset the leverage that the firm is assuming? Assume that you loan out all of the funds you receive from the sale of your stock.arrow_forwardSolve this financial accounting problemarrow_forward

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning