Flow of costs and income statement

R-Tunes Inc. is in the business of developing, promoting, and selling musical talent online and with compact discs (CDs). The company signed a new group, called Cyclone Panic, on January 1, 20Y8. For the first six months of 20Y8, the company spent $1,000,000 on a media campaign for Cyclone Panic and $175,000 in legal costs. The CD production began on April 1, 20Y8. R-Tunes uses a

The production process is straightforward. First, the blank CDs are brought to a production area where the digital soundtrack is copied onto the CD. The copying machine can copy 3,600 CDs per hour.

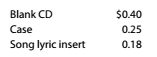

After the CDs are copied, they are brought to an assembly area where an employee packs the CD with a case and song lyric insert. The direct labor cost is $0.37 per CD.

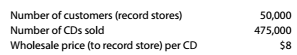

The CDs are sold to record stores. Each record store is given promotional materials, such as posters and aisle displays. Promotional materials cost $30 per record store. In addition, shipping costs average $0.28 per CD.

Total completed production was 500,000 CDs during the year. Other information is as follows:

Instructions

Prepare an annual income statement for the Cyclone Panic CD, including supporting calculations, from the information above.

Trending nowThis is a popular solution!

Chapter 10 Solutions

Survey of Accounting (Accounting I)

- Sin Carter's start-up business is growing rapidly, but he needs $300,000 in additional funding to support continued expansion. Sin and an angel investor agree that the business is currently worth $1,200,000, and the angel investor is willing to invest the $300,000 needed. Sin currently owns all 60,000 shares in his business. What is a fair price per share, and how many additional shares must Sin sell to the angel investor?arrow_forwardNonearrow_forwardOn March 1, 2024, Eastlake Corporation, which uses the straight-line method, purchases equipment for $95,000. The company expects the equipment to last for 10 years and expects the equipment to have a residual value of $15,000. What is the annual depreciation rate? a. 8.42% b. 8.95% c. 10.00% d. 12.67%arrow_forward

- Required: Management has requested that you do the following: a. Prepare a traditional income statement. b. Prepare an activity-based income statement. Complete this question by entering your answers in the tabs below. Required A Required B Prepare a traditional income statement. Traditional Income Statement Required A Required B Prepare an activity-based income statement. Costs Unit Batch Activity-Based Income Statement Resources Used Unused Resource Capacity Resources Supplied $ 0 $ 0 $ 0 0 $ 0 $ 0 Product and customer sustaining $ 0 $ 0 $ 0 Capacity sustaining $ 0 $ 0 $ 0 Total costs 0 0 0 $ Total costsarrow_forwardProvide answerarrow_forwardi need help making a T-accountarrow_forward

- What was the variable overhead rate variance?arrow_forwardSubject:-- general accounting questionsarrow_forwardNozama.com Inc. sells consumer electronics online. For the upcoming period, the budgeted cost of the sales order processing activity is $600,000, and 75,000 sales orders are estimated to be processed. a. Determine the activity rate of the sales order processing activity (cost per order). b. Determine the total sales order processing cost if Nozama.com processes 50,000 sales orders.arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning