Concept explainers

Classifying costs

The following is a list of costs that were incurred in the production and sale of all-terrain vehicles (ATVs).

a.Attorney fees for drafting a new lease for headquarters offices.

b.Cash paid to outside firm for janitorial services for factory.

c. Commissions paid to sales representatives, based on the number of ATVs sold.

d.Cost of advertising in a national magazine.

e.Cost of boxes used in packaging ATVs.

f. Electricity used to run the robotic machinery.

g.Engine oil used in engines prior to shipment. h. Factory cafeteria cashier's wages.

i. Filler for spray gun used to paint the ATVs.

j. Gasoline engines used for ATVs.

k.Hourly wages of operators of robotic machinery used in production.

I. License fees for use of patent for transmission assembly, based on the number of ATVs produced.

m. Maintenance costs for new robotic factory equipment, based on hours of usage.

n. Paint used to coat the ATVs.

o.Payroll taxes on hourly assembly line employees.

p.Plastic for outside housing of ATVs.

q.Premiums on insurance policy for factory buildings.

r. Properly taxes on the factory building and equipment.

s.Salary of factory supervisor.

t. Salary of quality control supervisor who inspects each ATV before it is shipped.

u.Salary of vice president of marketing.

v. Steering wheels for ATVs.

w. Straight-line

x.Steel used in producing the ATVs.

y.Telephone charges for company controller's office.

z.Tires for ATVs.

Instructions

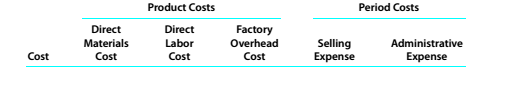

Classify each cost as either a product cost or a period cost. Indicate whether each product cost is a direct materials cost, a direct labor cost, or a

Want to see the full answer?

Check out a sample textbook solution

Chapter 10 Solutions

Survey of Accounting (Accounting I)

- What was his capital gains yield?arrow_forwardOn January 1, Trump Financial Services lends a corporate client $180,000 at an 8% interest rate. The amount of interest revenue that should be recorded for the quarter ending March 31 equals:arrow_forwardAt the beginning of the current fiscal year, the balance sheet of Wilson Corp. showed liabilities of $250,000. During the year, liabilities decreased by $40,000, assets increased by $90,000, and paid-in capital increased by $15,000 to $210,000. Dividends declared and paid during the year were $75,000. At the end of the year, owners' equity totaled $415,000. Calculate net income or loss for the year.arrow_forward

- Nonearrow_forwardFor its inspection cost pool, Henderson Precision Tools expected an overhead cost of $180,000 and an estimated 3,600 inspections. The actual overhead cost for that cost pool was $210,000 for 4,200 actual inspections. The activity-based overhead rate (ABOR) used to assign the costs of the inspecting cost pool to products is: A. $45 per inspection B. $50 per inspection C. $55 per inspection D. $60 per inspectionarrow_forwardFinancial accountingarrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College