Effect of Convertible Bonds on Earnings per Share

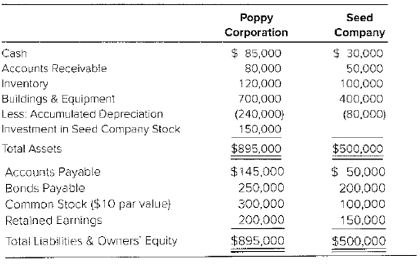

Poppy Corporation owns 60 percent of Seed Company’s common shares.

The bonds of Poppy Corporal ion and Seed Company pay annual interest of 8 percent and 10 percent, respectively. Poppy’s bonds are not convertible. Seeds bonds can be converted into 10,000 shares of its company stock any time after January 1, 20X1. An income tax rate of 40 percent is applicable to both companies. Seed reports net income of $30,000 for 20X2 and pays dividend of $15,000. Poppy reports income from its separate operations of $45,000 and pays dividends of $25,000.

Required

Compute basic and diluted EPS for the consolidated entity for 20X2.

Want to see the full answer?

Check out a sample textbook solution

Chapter 10 Solutions

ADV.FIN.ACCT. CONNECT+PROCTORIO PLUS

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning