Concept explainers

Using the

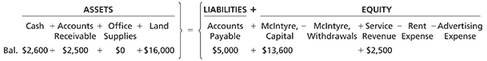

Meg McIntyre opened a public relations firm called Pop Chart on August 1, 2018. The following amounts summanze her business on August 31,2018:

Learning Objective 4

Cash $12,650

During September 2018, the business completed the following transactions:

a. Meg McIntyre contributed $14,000 cash in exchange for capital.

b. Performed service for a client and received cash of $1,600.

c. Paid off the beginning balance of accounts payable.

d. Purchased office supplies from OfficeMax on account, $1,200.

e. Collected cash from a customer on account, $2,300.

f. McIntyre withdrew $1,500.

g. Consulted for a new band and billed the client for services rendered, $4,000.

h. Recorded the following business expenses for the month:

Paid office rent: $900.

Paid advertising: $450.

Analyze the effects of the transactions on the accounting equation of Pop Chart using the format presented above.

Want to see the full answer?

Check out a sample textbook solution

Chapter 1 Solutions

Horngren's Accounting Plus Mylab Accounting With Pearson Etext -- Access Card Package (12th Edition)

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax CollegeCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,