Horngren's Accounting: The Managerial Chapters, Student Value Edition (12th Edition)

12th Edition

ISBN: 9780134491509

Author: MILLER-NOBLES, Tracie L., Mattison, Brenda L., Matsumura, Ella Mae

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 1, Problem E1.29E

Using the

Ashley Stamper opened a medical practice During July, the first month of operation, the business, titled Ashley Stamper, MD, experienced the following events:

Learning Objective 4

| Jul. 6 | Stamper contributed $68,000 in the business by opening a bank account in the name of A. Stamper, MD. The business gave capital to Stamper. |

| 9 | Paid $56,000 cash for land. |

| 12 | Purchased medical supplies for $1,500 on account. |

| 15 | Officially opened for business. |

| 20 | Paid cash expenses: employees' salaries, $1,300; office rent, $1,500; utilities, $100. |

| 31 | Earned service revenue for the month, $13,000, receiving cash. |

| 31 | Paid $1,050 on account. |

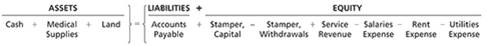

Analyze the effects of these events on the accounting equation of the medical practice of Ashley Stamper, MD, using the following format:

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Explain the concept of materiality in accounting. Need

What is the difference between a contra asset account and a liability? No ai

What is the difference between a contra asset account and a liability?

Chapter 1 Solutions

Horngren's Accounting: The Managerial Chapters, Student Value Edition (12th Edition)

Ch. 1 - Prob. 1QCCh. 1 - Which of the following is not an external user of...Ch. 1 - Prob. 3QCCh. 1 - Prob. 4QCCh. 1 - Prob. 5QCCh. 1 - Which of the following requires accounting...Ch. 1 - At the end of a recent year, Global Cleaning...Ch. 1 - Consider the overall effects on Global Cleaning...Ch. 1 - Assume that Global Cleaning Service performed...Ch. 1 - The balance sheet reports the Learning Objective 5...

Ch. 1 - Assume Global Cleaning Service had net income of...Ch. 1 - What is accounting?Ch. 1 - Prob. 2RQCh. 1 - Prob. 3RQCh. 1 - Prob. 4RQCh. 1 - Prob. 5RQCh. 1 - Prob. 6RQCh. 1 - Prob. 7RQCh. 1 - A business purchases an acre of land for $5,000....Ch. 1 - What does the going concern assumption mean for a...Ch. 1 - Which concept states that accounting information...Ch. 1 - Financial statements in the United States are...Ch. 1 - Prob. 12RQCh. 1 - What is the accounting equation? Briefly explain...Ch. 1 - What are two ways that equity increases? What are...Ch. 1 - How is net income calculated? Define revenues and...Ch. 1 - What are the steps used when analyzing a business...Ch. 1 - List the four financial statements. Briefly...Ch. 1 - What is the calculation for ROA? Explain what ROA...Ch. 1 - Prob. S1.1SECh. 1 - Determining organizations that govern accounting...Ch. 1 - Identifying types of business organizations...Ch. 1 - Prob. S1.4SECh. 1 - Applying accounting assumptions and principles...Ch. 1 - Prob. S1.6SECh. 1 - Using the accounting equation Learning Objective 3...Ch. 1 - Identifying accounts Learning Objective 3 Consider...Ch. 1 - Prob. S1.9SECh. 1 - Using the accounting equation to analyze...Ch. 1 - Identifying accounts on the financial statements...Ch. 1 - Preparing the income statement Learning Objective...Ch. 1 - Preparing the statement of owner’s equity Learning...Ch. 1 - Prob. S1.14SECh. 1 - Preparing the statement of cash flows Learning...Ch. 1 - Calculating ROA Learning Objective 6 Matured Water...Ch. 1 - Prob. E1.17ECh. 1 - Prob. E1.18ECh. 1 - 1. Accounting equation a. An economic resource...Ch. 1 - Using the accounting equation Learning Objective 3...Ch. 1 - E1-21 Using the accounting equation Learning...Ch. 1 - Using the accounting equation Learning Objective 3...Ch. 1 - Using the accounting equation Learning Objective 3...Ch. 1 - E1-24 Using the accounting equation Learning...Ch. 1 - Using the accounting equation to analyze...Ch. 1 - Using the accounting equation to analyze business...Ch. 1 - Using the accounting equation to analyze business...Ch. 1 - Using the accounting equation to analyze business...Ch. 1 - Using the accounting equation to analyze business...Ch. 1 - Preparing the financial statements Learning...Ch. 1 - Preparing the income statement Learning Objective...Ch. 1 - Prob. E1.32ECh. 1 - Prob. E1.33ECh. 1 - Prob. E1.34ECh. 1 - Preparing the statement of owner’s equity Learning...Ch. 1 - Prob. E1.36ECh. 1 - Prob. E1.37ECh. 1 - Jan. 1 The owner contributed an additional $5,000...Ch. 1 - Calculating Return on Assets Learning Objective 6...Ch. 1 - Using the accounting equation for transaction...Ch. 1 - Prob. P1.41APGACh. 1 - P1-42A Preparing financial statements Learning...Ch. 1 - Preparing financial statements Learning Objective...Ch. 1 - Prob. P1.44APGACh. 1 - Using the accounting equation for transaction...Ch. 1 - Using the accounting equation for transaction...Ch. 1 - Using the accounting equation for transaction...Ch. 1 - Using the accounting equation for transaction...Ch. 1 - Preparing financial statements Presented here are...Ch. 1 - Prob. P1.50BPGBCh. 1 - Prob. P1.51BPGBCh. 1 - Using the accounting equation for transaction...Ch. 1 - Using the accounting equation for transaction...Ch. 1 - Prob. P1.54CTCh. 1 - P1-55 is the first problem in a continuing problem...Ch. 1 - Prob. 1.1TIATCCh. 1 - Decision Case 1-1 Let’s examine a case using...Ch. 1 - The tobacco companies have paid billions because...Ch. 1 - Prob. 1.1FCCh. 1 - Prob. 1.1FSC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Joe transferred land worth $200,000, with a tax basis of $40,000, to JH Corporation, an existing entity, for 100 shares of its stock. JH Corporation has two other shareholders, Ethan and Young, each of whom holds 100 shares. With respect to the transfer:a. Joe has no recognized gain. b. JH Corporation has a basis of $160,000 in the land.c. Joe has a basis of $200,000 in his 100 shares in JH Corporation. d. Joe has a basis of $40,000 in his 100 shares in JH Corporation. e. None of the above.arrow_forwardI need help with this general accounting problem using proper accounting guidelines.arrow_forwardI am looking for the correct answer to this general accounting problem using valid accounting standards.arrow_forward

- accounting question?arrow_forwardThree individuals form JEY Corporation with the following contributions: Joe, cash of $50,000 for 50 shares; Ethan, land worth $20,000 (basis of $11,000) for 20 shares; and Young, cattle worth $9,000 (basis of $6,000) for 9 shares and services worth $21,000 for 21 shares. a. These transfers are fully taxable and not subject to § 351. b. Young’s basis in her stock is $27,000. c. Young’s basis in her stock is $6,000. d. Ethan’s basis in his stock is $20,000. e. None of the above.arrow_forwardNonearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax CollegeCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY