Concept explainers

Analyzing transactions and preparing financial statements C4 P1 P2

Rivera Roofing Company, owned by Reyna Rivera, began operations in July and completed these transactions during that first month of operations.

July 1 Reyna Rivera invested $80,000 cash in the company in exchange for its common stock.

2 The company rented office space and paid $700 cash for the July rent.

3 The company purchased roofing equipment for $5,000 by paying $1,000 cash and agreeing to pay the $4,000 balance in 30 days.

6 The company purchased office supplies for $600 cash.

8 The company completed work for a customer and immediately collected $7,600 cash for the work.

10 The company purchased $2,300 of office equipment on credit.

15 The company completed work for a customer on credit in the amount of $8,200.

17 The company purchased $3,100 of office supplies on credit.

23 The company paid $2,300 cash for the office equipment purchased on July 10.

25 The company billed a customer $5,000 for work completed; the balance is due in 30 days.

28 The company received $8,200 cash for the work completed on July 15.

30 The company paid an assistant's salary of $1,560 cash for this month.

31 The company paid $295 cash for this month's utility bill.

31 The company paid $1,800 cash in dividends to the owner (sole shareholder).

Required

Create the following table similar to the one in Exhibit 1.9.

Use additions and subtractions within the table to show the dollar effects of each transaction on individual items of theaccounting equation. Show new balances after each transaction.

Check (1) Ending balances: Cash, $87,545; Accounts Payable, $7,100- Prepare the income statement and the statement of

retained earnings for the month of July, and thebalance sheet as of July 31.

(2) Net income, $18,245;Total assets, $103,545 - Prepare the statement of

cash flows for the month of July. - Assume that the $5,000 purchase of roofing equipment on July 3 was financed from an owner investment of another $5,000 cash in the business in exchange for more common stock (instead of the purchase conditions described in the transaction above). Compute the dollar effect of this change on the month-end amounts for(a) total assets,(b) total liabilities, and(c) total equity.

Analysis Component

Accounting Equation:

The assets, liabilities and equity relation, are known as the accounting equation. Assets are the resources of company and that increase as business expand whereas liabilities are the burden on company that has to pay in future; Equity means the owner claim on assets. An accounting equation represent the assets of the company are equal to the liabilities and equity of the company.

In can be represented as follow,

Income statement:

It includes the information of net income earn or net loss suffered by the company. The expenses deducting from revenue and the resultant is net income or loss to the company. This is informative report that helps the user of financial information to take decision.

Statement of Retained Earnings:

It is the part of financial statement of the company, that contained information related to retained earnings. Retained earnings are the amount that a company wants to keep aside for internal usage of the company. That will not pay in the form of dividends to the shareholders and kept by the company aside, to pay debts or further investment.

Balance Sheet:

It is a part of the Financial Statement of a company, which shows the financial position of the company as from where the company receive the money (assets) and to whom the company has to pay. (liabilities and shareholders').While purchase a share in the company the investor will firstly see the balance sheet of the respective company than only decide whether he purchase the share or not.

Statement of Cash Flows:

This statement records the inflows and outflows of cash and funds of the Company during the accounting period.

It has following three parts:

- Cash flow from operating activities

- Cash flow from investing activities

- Cash flow from financing activities

1.

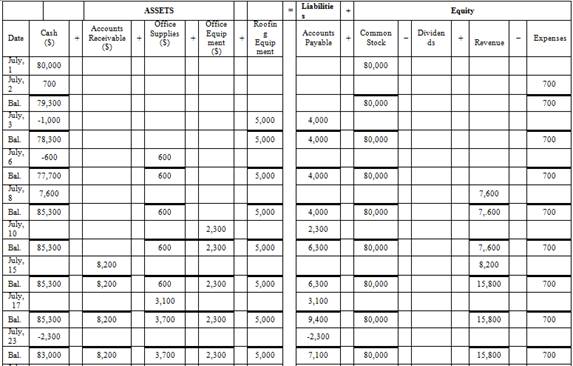

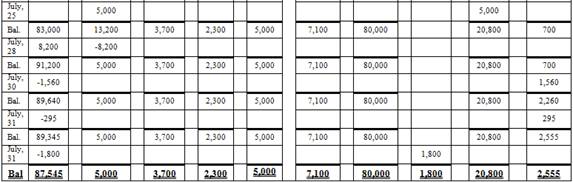

To identify: The effect of transactions on the accounting equation.

Explanation of Solution

Table (1)

Hence, the cash balance is $87,545,accounts receivables is $5,000, office supplies is $3,700 office equipment is $2,300,roofing equipment is$5,000 accounts payable is $7,100, common stock is $80,000, dividend is $1,800, revenue is $20,800 and expenses is $2,555.

2.

To prepare: The income statement, statement of retained earnings and balance sheet for the month of July 31,20XX.

Explanation of Solution

Prepare income statement.

| R. Company | ||

| Income Statement | ||

| For the month ended July 31,20XX | ||

| Particulars | Amount($) | Amount($) |

| Revenue: | ||

| Service Revenue | 20,800 | |

| Total Revenue | 20,800 | |

| Expenses: | ||

| Rent Expenses | 700 | |

| Salary Expenses | 1,560 | |

| Utilities Expenses | 295 | |

| Total Expense | 2,555 | |

| Net income | 18,245 | |

Table (2)

Hence, net income of .R Company as on July 31, 20XX is $18,245

Prepare statement of retained earnings

| R. Company | ||

| Retained Earnings Statement | ||

| For the month ended July 31,20XX | ||

| Particulars | Amount($) | |

| Opening balance | 0 | |

| Net income | 18,245 | |

| Total | 18,245 | |

| Dividends | (1,800) | |

| Retained earnings | 16,445 | |

Table (3)

Hence, the retained earnings of .R Company as on July 31, 20XX are $16,445.

Prepare balance sheet

| R. Company | ||

| Balance sheet | ||

| As on July 31, 20XX | ||

| Particulars | Amount($) | |

| Assets | ||

| Cash | 87,545 | |

| Accounts Receivables | 5,000 | |

| Office Supplies | 3,700 | |

| Office Equipment | 2,300 | |

| Roofing Equipment | 5,000 | |

| Total Assets | 103,545 | |

| Liabilities and Stockholder’s Equity | ||

| Liabilities | ||

| Accounts Payable | 7,100 | |

| Stockholder’s Equity | ||

| Common Stock | 80,000 | |

| Retained earnings | 16,445 | |

| Total stockholders’ equity | 96,445 | |

| Total Liabilities and Stockholder’s equity | 103,545 | |

Table (4)

Hence, the total of the balance sheet of the R Company as on July 31, 20XX is of $103,545.

3.

To prepare: The statement of cash flows of the S Electric.

Explanation of Solution

Prepare the cash flow statement.

| R. Company | ||

| Statement of Cash Flows | ||

| Month Ended July 31, 20XX | ||

| Particulars | Amount($) | Amount($) |

| Cash flow from operating activities | ||

| Receipts: | ||

| Collections from customers | 15,800 | |

| Payments: | ||

| Supplies | (600) | |

| Rent Expenses | (700) | |

| Salary Expenses | (1,560) | |

| Utilities | (295) | (3,155) |

| Net cash from operating activities | 12,645 | |

| Cash flow from investing activities | ||

| Purchase of office equipment | (2,300) | |

| Purchase of Roofing equipment | (1,000) | |

| Net cash from investing activities | (3,300) | |

| Cash flow from financing activities | ||

| Issued common stock | 80,000 | |

| Less: Payment of cash dividends | (1,800) | |

| Net cash from financing activities | 78,200 | |

| Net increase in cash | 87,545 | |

| Cash balance, July 1,20XX | 0 | |

| Cash balance, July 31,20XX | 87,545 | |

Table (5)

Hence, the cash balance of the R Company as on July 31, 20XX is $87,545.

4.

To identify: The changes on (a) total assets, (b) total liabilities, and (c) total equity.

Explanation of Solution

If the company purchase roofing equipment by owner investment instead of cash as mention in question.

- On assets- The asset of the company increases by $1,000.

- On liabilities- The liability of the company decreases by $4,000.

- On equity- The common stock is increased by $5,000 and common stock is the part of equity so equity increases by $5,000.

Thus, assets and equity will increase and liability will decrease.

Want to see more full solutions like this?

Chapter 1 Solutions

Gen Combo Ll Financial Accounting Fundamentals; Connect Access Card

- Can you explain this financial accounting question using accurate calculation methods?arrow_forwardCan you help me solve this financial accounting question using valid financial accounting techniques?arrow_forwardPlease provide the accurate answer to this financial accounting problem using appropriate methods.arrow_forward

- Please provide the solution to this general accounting question using proper accounting principles.arrow_forwardI need help finding the accurate solution to this general accounting problem with valid methods.arrow_forwardDetermine the price of a $1.3 million bond issue under each of the following independent assumptions: Maturity 10 years, interest paid annually, stated rate 8%, effective (market) rate 10%. Maturity 10 years, interest paid semiannually, stated rate 8%, effective (market) rate 10%. Maturity 10 years, interest paid semiannually, stated rate 10%, effective (market) rate 8%. Maturity 20 years, interest paid semiannually, stated rate 10%, effective (market) rate 8%. Maturity 20 years, interest paid semiannually, stated rate 10%, effective (market) rate 10%.arrow_forward

- If total assets increase while liabilities remain unchanged, equity must: A) IncreaseB) DecreaseC) Remain the sameD) Be negativearrow_forwardNo chatgpt!! Which of the following is an intangible asset? A) InventoryB) CopyrightC) EquipmentD) Accounts Receivablearrow_forwardWhich of the following is an intangible asset? A) InventoryB) CopyrightC) EquipmentD) Accounts Receivableno aiarrow_forward

- Which of the following is an intangible asset? A) InventoryB) CopyrightC) EquipmentD) Accounts Receivablearrow_forwardWhat does a ledger account represent? A) A detailed record of all business transactionsB) A summary of trial balancesC) An individual record for each accountD) The final balance of a financial statement Need help!arrow_forwardWhat is the primary purpose of accounting? A) To generate tax revenueB) To record, summarize, and report financial transactionsC) To determine the market value of assetsD) To manage payrollarrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage