Concept explainers

The assets, liabilities and equity relation, are known as the accounting equation. Assets are the resources of company and that increase as business expand whereas liabilities are the burden on company that has to pay in future; Equity means the owner claim on assets. An accounting equation represent the assets of the company are equal to the liabilities and equity of the company.

In can be represented as follow,

Income statement:

It includes the information of net income earn or net loss suffered by the company. The expenses deducting from revenue and the resultant is net income or loss to the company. This is informative report that helps the user of financial information to take decision.

Statement of

It is the part of financial statement of the company, that contained information related to retained earnings. Retained earnings are the amount that a company wants to keep aside for internal usage of the company. That will not pay in the form of dividends to the shareholders and kept by the company aside, to pay debts or further investment.

It is a part of the Financial Statement of a company, which shows the financial position of the company as from where the company receive the money (assets) and to whom the company has to pay. (liabilities and shareholders').While purchase a share in the company the investor will firstly see the balance sheet of the respective company than only decide whether he purchase the share or not.

Statement of

This statement records the inflows and outflows of cash and funds of the Company during the accounting period.

It has following three components,

- Cash flow from operating activities.

- Cash flow from investing activities.

- Cash flow from financing activities.

1.

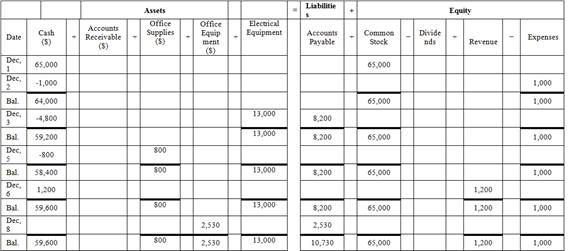

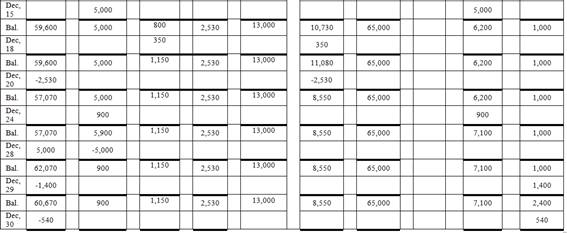

To identify: The effect of transactions on the accounting equation.

Explanation of Solution

Table (1)

Hence, the cash balance is $59,180,accounts receivables is $900, office supplies is $1,150 office equipment is $2,530,electrical equipment is$13,000 accounts payable is $8,550, common stock is $65,000, dividend is $950, revenue is $7,100 and expenses is $2,940.

2.

To prepare: The income statement, statement of retained earnings and balance sheet for the month of December 31,20XX.

2.

Explanation of Solution

Prepare income statement.

| S. Electric | ||

| Income Statement | ||

| For the month ended December 31,20XX | ||

| Particulars | Amount($) | Amount($) |

| Revenue: | ||

| Service Revenue | 7,100 | |

| Total Revenue | 7,100 | |

| Expenses: | ||

| Rent Expenses | 1000 | |

| Salary Expenses | 1,400 | |

| Utilities Expenses | 540 | |

| Total Expense | 2,940 | |

| Net income | 4,160 | |

Table (2)

Hence, net income of .S Electric as on December 31, 20XX is $4,160.

Prepare statement of retained earnings.

| S. Electric | ||

| Retained Earnings Statement | ||

| For the month ended December 31,20XX | ||

| Particulars | Amount($) | |

| Opening balance | 0 | |

| Net income | 4,160 | |

| Total | 4,160 | |

| Dividends | (950) | |

| Retained earnings | 3,210 | |

Table (3)

Hence, the retained earnings of S Electric as on December 31, 20XX are $3,210.

Prepare balance sheet.

| S. Electric | ||

| Balance sheet | ||

| As on December 31, 20XX | ||

| Particulars | Amount($) | |

| Assets | ||

| Cash | 59,180 | |

| Accounts Receivables | 900 | |

| Office Supplies | 1,150 | |

| Office Equipment | 2,530 | |

| Electric Equipment | 13,000 | |

| Total Assets | 76,760 | |

| Liabilities and | ||

| Liabilities | ||

| Accounts Payable | 8,550 | |

| Stockholder’s Equity | ||

| Common Stock | 65,000 | |

| Retained earnings | 3,210 | |

| Total stockholders’ equity | 68,210 | |

| Total Liabilities and Stockholder’s equity | 76,760 | |

Table (4)

Hence, the total of the balance sheet of the S Electric as on December 31, 20XX is of $76,760.

3.

To prepare: The statement of cash flows of the S Electric.

3.

Explanation of Solution

Prepare the cash flow statement.

| S. Electric | ||

| Statement of Cash Flows | ||

| Month Ended December 31, 20XX | ||

| Particulars | Amount($) | Amount($) |

| Cash flow from operating activities | ||

| Receipts: | ||

| Collections from customers | 6,200 | |

| Payments: | ||

| Supplies | (800) | |

| Rent Expenses | (1,000) | |

| Salary Expenses | (1,400) | |

| Utilities | (540) | (3,740) |

| Net cash from operating activities | 2,460 | |

| Cash flow from investing activities | ||

| Purchase of office equipment | (2,530) | |

| Purchase of electric equipment | (4,800) | |

| Net cash from investing activities | (7,330) | |

| Cash flow from financing activities | ||

| Issued common stock | 65,000 | |

| Less: Payment of cash dividends | (950) | |

| Net cash from financing activities | 64,050 | |

| Net increase in cash | 59,180 | |

| Cash balance, December 1,20XX | 0 | |

| Cash balance, December 31,20XX | 59,180 | |

Table (5)

Hence, the cash balance of the S Electric as on December 31, 20XX is $59,180.

4.

To identify: The changes in (a) total assets, (b) total liabilities, and (c) total equity.

4.

Explanation of Solution

If the owner of the company invests $49,000 cash instead of $65,000 for common stock and borrows $16,000 from the bank, then the effect on assets, liabilities and equity is,

- On assets- There is no change in assets, as in both the cases cash balance increases.

- On liabilities- There is an increase of $16,000 in accounts payable account and liability of S electric will increase.

- On equity- The common stock is decreased by $16,000 and common stock are the part of equity so equity decreases by $16,000.

Want to see more full solutions like this?

Chapter 1 Solutions

Gen Combo Ll Financial Accounting Fundamentals; Connect Access Card

- Nonearrow_forwardIndira Products has provided the following data for the month of August: a. The balance in the Finished Goods inventory account at the beginning of the month was $65,000 and at the end of the month was $29,500. b. The cost of goods manufactured for the month was $210,000. c. The actual manufacturing overhead cost incurred was $71,800 and the manufacturing overhead cost applied to Work in Process was $75,200. d. The company closes out any underapplied or overapplied manufacturing overhead to the cost of goods sold. What is the adjusted cost of goods sold that would appear on the income statement for August?arrow_forwardLand should be capitalized at what amountarrow_forward

- Delta Tools estimated its manufacturing overhead for the year to be $875,500. At the end of the year, actual direct labor hours were 49,600 hours, and the actual manufacturing overhead was $948,000. Manufacturing overhead for the year was overapplied by $81,400. If the predetermined overhead rate is based on direct labor hours, then the estimated direct labor hours at the beginning of the year used in the predetermined overhead rate must have been _.arrow_forwardWhat is the depreciation expense for 2022arrow_forwardCan you solve this financial accounting question with the appropriate financial analysis techniques?arrow_forward

- Julius provided consulting services amounting to P420, 000. His total expenses were 25%. His net income is: A. P105,000 B. P300,000 C. P315,000 D. P120,000arrow_forwardWhat is the cost of goods soldarrow_forwardSnapGallery Inc. sells one digital poster frame. The sales price per unit is $12. The variable cost per unit is $7. Fixed costs per annum are $13,500 and having a sales volume of 5,000 digital poster frames would result in: 1. a profit of $11,500 2. a loss of $2,500 3. breaking even 4. a profit of $8,000arrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning