Concept explainers

Sanyu Sony started a new business and completed these transactions during December.

Dec. 1 Sanyu Sony transferred $65,000 cash from a personal savings account to a checking account in the name of Sony Electric in exchange for its common stock.

2 The company rented office space and paid $1,000 cash for the December rent.

3 The company purchased $13,000 of electrical equipment by paying $4,800 cash and agreeing to pay the $8,200 balance in 30 days.

5 The company purchased office supplies by paying $800 cash.

6 The company completed electrical work and immediately collected $1,200 cash for these services.

15 The company completed electrical work on credit in the amount of $5,000.

18 The company purchased $350 of office supplies on credit0

20 The company paid $2,530 cash for the office equipment purchased on December 8.

24 The company billed a client $900 for electrical work completed; the balance is due in 30 days.

28 The company received $5,000 cash for the work completed on December 15.

29 The company paid the assistant’s salary of $1,400 cash for this month.

30 The company paid $540 cash for this month’s utility bill.

31 The company paid $950 cash in dividends to the owner (sole shareholder).

Required

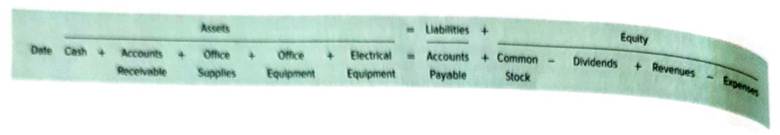

1. Create the following table similar to the one in Exhibit 1.9.

Use additional and subtractions within the table to show the dollar effects of each transaction on individual items of the

2. Prepare the income statement and the statement of

3. Prepare the statement of

Analysis Component

4. Assume that the owner investment transaction on December 1 was $49,000 cash instead of $65,000 and that Sony Electric obtained another $16,000 in cash by borrowing it from a bank. Compute the dollar effect of this change on the month-end amounts for (a) total assets, (b) total liabilities, and (c) total equity.

Introduction: Cash Flow Analysis is a technique used by the company to know the overall worth of the company as well as its subsidiary or branches. Cash flow analysis helps in analyzing the company’s cash outflow and inflow through different activities like financing activities, investing activities, operating activities. This analysis shows how the company generates money or revenue for its working.

To determine: To create asset liability and equity table.

Answer to Problem 9PSA

Balance of account receivable is $900, Office Supplies $1150, electrical equipment $13000, Office Equipment $2530, Account payable $8550, common stock $65000, drawing account $950, revenue $7100 and expense account for $2940

Explanation of Solution

| Dated(July) | Assets | Liabilities | Owner’s capital | |||||||

| Date(July) | Cash | Account Receivable | Office Supplies | Office equipment | Electrical Equipment | Account payable | Capital | Div | Revenue | Expenses |

| 1 | 65,000 | 6,5000 | ||||||||

| 2 | -1,000 | 1,000 | ||||||||

| 3 | -4,800 | 13000 | 8,200 | |||||||

| 5 | -800 | 800 | ||||||||

| 6 | 1,200 | 1,200 | ||||||||

| 8 | 2530 | 2,530 | ||||||||

| 15 | 5,000 | 5,000 | ||||||||

| 18 | 350 | 350 | ||||||||

| 20 | -2,530 | -2,530 | ||||||||

| 24 | 900 | 900 | ||||||||

| 28 | 5,000 | -5,000 | ||||||||

| 29 | -1,400 | 1,400 | ||||||||

| 30 | -540 | 540 | ||||||||

| 31 | -950 | 950 | ||||||||

| 59180 | 900 | 1,150 | 2,530 | 13,000 | 8,550 | 65,000 | 950 | 7,100 | 2,940 | |

Introduction: Cash Flow Analysis is a technique used by the company to know the overall worth of the company as well as its subsidiary or branches. Cash flow analysis helps in analyzing the company’s cash outflow and inflow through different activities like financing activities, investing activities, operating activities. This analysis shows how the company generates money or revenue for its working.

To prepare: Income statement and statement of retain earning.

Answer to Problem 9PSA

Net income account for $4,160, retain earning account for $3,210 and assets and liabilities account for $76760.

Explanation of Solution

Income statement for the month of May

| Particular | Amount $ |

| Revenue | 7,100 |

| Less: Expense | 1,000 |

| Expense of salary | 1,400 |

| Expense for utilities | 540 |

| Net income | 4,160 |

Statement of retain earning

| Particular | Amount $ |

| Retain earning as on Dec 1 | 0 |

| Add: net income | 4,160 |

| Less: Dividend | 950 |

| Retained earnings as on Dec 31 | 3,210 |

Balance sheet

| S companyBalance sheetFor the month ended dec 31 | |||

| Assets | Liability | ||

| Particular | Amount | Particular | Amount |

| Cash | 59180 | Accounts payable | 8550 |

| Office equipment | 2530 | ||

| Office supplies | 1150 | Equity | |

| Receivable | 900 | Owner’s capital | 68210 |

| Electrics equipment | 13000 | ||

| Total assets | 76760 | Total Liabilities | 76760 |

Introduction: Cash Flow Analysis is a technique used by the company to know the overall worth of the company as well as its subsidiary or branches. Cash flow analysis helps in analyzing the company’s cash outflow and inflow through different activities like financing activities, investing activities, operating activities. This analysis shows how the company generates money or revenue for its working.

To construct: The cash flow statement.

Answer to Problem 9PSA

Balance of cash as on Dec 31st 59180

Explanation of Solution

Company’s cash flow statement

| Particular | Particular | Dr. |

| Receipt of cash | 6200 | |

| Rent payment | (1000) | |

| Supplies payment | (800) | |

| Utilities | (540) | |

| Payment to employee | (1400) | |

| Net utilization of cash by activities | (25460) | |

| Cash flow from investing activities | ||

| Purchase of equipment | (2530) | |

| Purchase of electrical equipment | 04800) | |

| Net utilization from investing | (7330) | |

| Cash flow from financing activities | ||

| Investment | 65000 | |

| Dividend | (950) | |

| Net cash by act | 64050 | |

| Net increase in cash | 59180 | |

| Balance of cash as on July 1st | 0 | |

| Balance of cash as on July 31st | 59180 |

Introduction: Cash Flow Analysis is a technique used by the company to know the overall worth of the company as well as its subsidiary or branches. Cash flow analysis helps in analyzing the company’s cash outflow and inflow through different activities like financing activities, investing activities, operating activities. This analysis shows how the company generates money or revenue for its working.

To create: Assets, liabilities and equity statement.

Answer to Problem 9PSA

There will be no effect on the assets of the company.

Explanation of Solution

If the investment on Dec 1 for cash amounting to $49000 in comparison to $65000 then the difference amounting to $16000($65000-$49000) would be borrowed. The effect of the assets and liabilities will be:

- The liabilities would increase by $16000

- The total investment by the owner would be lower by $16000

- There would be no effect on the assets of the company.

Want to see more full solutions like this?

Chapter 1 Solutions

Financial Accounting: Information for Decisions

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning