Concept explainers

Gabi Gram started The Gram Co., a new business that began operations on May 1. The Gram Co. Completed the following transactions during its first month of operations.

May 1 G. Gram invested $40,000 cash in the company in exchange for its common stock.

1 The company rented a furnished office and paid $2,200 cash for May's rent.

3 The company purchased $1,890 of office equipment on credit.

5 The company paid $750 cash for this month's cleaning services.

8 The company provided consulting services for a client and immediately collected $5,400 cash

12 The company provided $2,500 of consulting services for a client on credit.

15 The company paid $750 cash for an assistant's salary for the first half of this month.

20 The company received $2,500 cash payment for the services provided on May 12.

22 The company provided $3,200 of consulting services on credit.

25 The company received $3,200 cash payment for the services provided on May 22.

26 The company paid $1,890 cash for the office equipment purchased on May 3.

27 The company purchased $80 of office equipment on credit.

28 The company paid $750 cash for an assistant’s salary for the second half of the this month.

30 The company paid $300 cash for this month’s telephone bill.

30 The company paid $280 cash for this month’s utilities.

31 The company paid $1,400 cash in dividends to the owner (sole shareholder).

Required

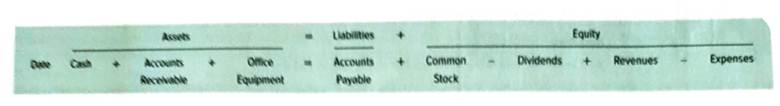

1. Create the following table similar to the one in Exhibit 1.9. Enter the effects of each transaction on the accounts of the

Enter the effects of each transaction on the accounts of the

2. Prepare the income statement and the statement of

3. Prepare the statement of

Introduction: Cash Flow Analysis is a technique used by the company to know the overall worth of the company as well as its subsidiary or branches. Cash flow analysis helps in analyzing the company’s cash outflow and inflow through different activities like financing activities, investing activities, operating activities. This analysis shows how the company generates money or revenue for its working.

To determine: To create asset liability and equity table.

Answer to Problem 7PSA

Explanation of Solution

| Assets | Liabilities | Equity | ||||||

| Date(May) | Cash | Account Receivable | Office Equipment | Account Payable | Common Stock | Dividends | Revenue | Expenses |

| 1 | 4000 | 4000 | ||||||

| 1 | -2200 | 2200 | ||||||

| 3 | 1890 | 1890 | ||||||

| 5 | -750 | 750 | ||||||

| 8 | 5400 | 5400 | ||||||

| 12 | 2500 | 2500 | ||||||

| 15 | -750 | 750 | ||||||

| 20 | 2500 | -2500 | ||||||

| 22 | 3200 | |||||||

| 25 | 3200 | -3200 | ||||||

| 26 | -1890 | 1890 | ||||||

| 27 | 80 | 80 | ||||||

| 28 | -750 | 750 | ||||||

| 30 | -300 | 300 | ||||||

| 30 | -280 | 280 | ||||||

| 31 | -1400 | 1400 | ||||||

| 42780 | 0 | 1890 | 80 | 40000 | 1400 | 11100 | 5110 | |

Introduction: Cash Flow Analysis is a technique used by the company to know the overall worth of the company as well as its subsidiary or branches. Cash flow analysis helps in analyzing the company’s cash outflow and inflow through different activities like financing activities, investing activities, operating activities. This analysis shows how the company generates money or revenue for its working.

To prepare: Income statement and statement of retain earning.

Answer to Problem 7PSA

Net income is $5990, retain earnings of May $4590, total assets and liability is 44,670.

Explanation of Solution

Income statement for the month of May

| G companyIncome statement for the month ended May 31 | ||

| Particular | Amount $ | Amount $ |

| Revenue: | ||

| Consulting service revenue | 11100 | |

| Less Expenses | ||

| Advertisement Expense | 80 | |

| Rent Expense | 2200 | |

| Cleaning Expense | 750 | |

| Salaries Expense | 1500 | |

| Telephones Expense | 300 | |

| Utility Expense | 280 | |

| Total Expenses | 5110 | |

| Net Income | 5990 | |

Statement of retain earning

| G companyIncome statement for the month ended May 31 | ||

| Particular | Amount $ | Amount $ |

| Retain earning May 1 | 0 | |

| Add: Net income | 5990 | |

| Less Dividend | 1400 | |

| Retain earning May 31 | 4590 | |

Balance sheet

| G companyBalance sheetFor the month ended may 31 | |||

| Assets | Liability | ||

| Particular | Amount | Particular | Amount |

| Current Assets | Current liabilities | ||

| Cash | 42,780 | Advertisement expense payable | 80 |

| Total Current Liabilities | 80 | ||

| Total Current assets | 42,780 | Shareholder’s equity | |

| Fixed Assets | Common stock | 40,000 | |

| Office equipment | 1,890 | Retain Earning | 4,590 |

| Total fixed Assets | 1,890 | Total shareholder’s equity | 44,590 |

| Total Assets | 44,670 | Total liabilities | 44,670 |

Introduction: Cash Flow Analysis is a technique used by the company to know the overall worth of the company as well as its subsidiary or branches. Cash flow analysis helps in analyzing the company’s cash outflow and inflow through different activities like financing activities, investing activities, operating activities. This analysis shows how the company generates money or revenue for its working.

To determine: the cash flow statement.

Answer to Problem 7PSA

Total of cash flow statement is 51,100

Explanation of Solution

Company’s cash flow statement

| G companyCash flow statement for the month ended May 31 | |||

| Dr | Cr | ||

| Beginning Bal | 40000 | Rent expense | 2200 |

| Revenue | 5400 | Cleaning expense | 750 |

| Account Receivable | 2500 | Salaries Experience | 750 |

| Account Receivable | 3200 | Account | 1890 |

| Salaries Expense | 750 | ||

| Telephone expense | 300 | ||

| Utilities expense | 280 | ||

| Dividends | 1400 | ||

| Ending Bal | 42780 | ||

| 51,100 | 51,100 | ||

Want to see more full solutions like this?

Chapter 1 Solutions

Loose Leaf for Financial Accounting: Information for Decisions

- Helparrow_forwardGeneral accountingarrow_forwardTower Company owned a service truck that was purchased at the beginning of Year 1 for $48,000. It had an estimated life of three years and an estimated salvage value of $3,000. Tower company uses straight-line depreciation. Its financial condition as of January 1, Year 3, is shown on the first line of the horizontal statements model. In Year 3, Tower Company spent the following amounts on the truck: January 4 Overhauled the engine for $7,600. The estimated life was extended one additional year, and the salvage value was revised to $2,000. July 6 Obtained oil change and transmission service, $410. August 7 Replaced the fan belt and battery, $510. December 31 Purchased gasoline for the year, $9,100. December 31 Recognized Year 3 depreciation expense. Required Record the Year 3 transactions in a statements model. Note: In the Statement of Cash Flows column, use the initials OA for operating activities, FA for financing activities, or IA for investing activity. Enter any decreases to…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education