Concept explainers

1.

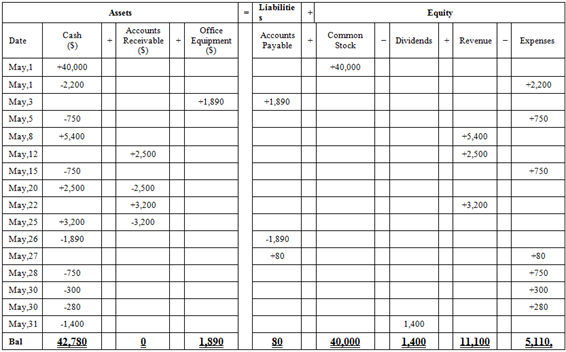

To identify: The effect of given transactions on the

1.

Explanation of Solution

Table (1)

Hence, the cash balance is $42,780, office equipment is $1,890, accounts payable is $80, common stock is $40,000, dividend is $1,400, revenue is $11,100 and expenses is $5,110.

2.

To prepare: The income statement, statement of

2.

Explanation of Solution

Prepare income statement.

| G. Company | ||

| Income Statement | ||

| For the month ended May 31,20XX | ||

| Particulars | Amount ($) | Amount ($) |

| Revenue: | ||

| Service Revenue | 11,100 | |

| Total Revenue | 11,100 | |

| Expenses: | ||

| Advertising Expenses | 80 | |

| Cleaning Expenses | 750 | |

| Rent Expenses | 2200 | |

| Salary Expenses | 1,500 | |

| Telephone Expenses | 300 | |

| Utilities Expenses | 280 | |

| Total Expense | 5,110 | |

| Net income | 5,990 | |

Table(2)

Hence, net income of .G Company as on May 31, 20XX is $5,990.

Prepare statement of retained earnings.

| G. Company | |

| Retained Earnings Statement | |

| For the month ended May 31,20XX | |

| Particulars | Amount ($) |

| Opening balance | 0 |

| Net income | 5,990 |

| Total | 5,990 |

| Dividends | (1,400) |

| Retained earnings | 4,590 |

Table(3)

Hence, the retained earnings of G Company as on May 31, 20XX are $4,590.

Prepare balance sheet.

| G. Company | ||

| Balance Sheet | ||

| As on May 31, 20XX | ||

| Particulars |

| Amount ($) |

| Assets | ||

| Cash | 42,780 | |

| Equipment | 1,890 | |

| Total assets |

| 44,670 |

| Liabilities and | ||

| Liabilities | ||

| Accounts payable | 80 | |

| Stockholder’s equity | ||

| Common stock | 40,000 | |

| Retained earnings | 4,590 | |

| Total stockholders’ equity |

| 44,590 |

| Total Liabilities and Stockholder’s equity |

| 44,670 |

Table(4)

Hence, the total of the balance sheet of the G Company as on May 31, 20XX is of $44,670.

3.

To prepare: The statement of

3.

Explanation of Solution

Prepare the cash flow statement.

| G. Company | ||

| Statement of Cash Flows | ||

| Month Ended May 31, 20XX | ||

| Particulars | Amount ($) | Amount ($) |

| Cash flow from operating activities | ||

| Receipts: | ||

| Collections from customers |

| 11,100 |

| Payments: |

| |

| Cleaning Expenses | (750) | |

| Rent Expenses | (2200) | |

| Salary Expenses | (1,500) | |

| Telephone Expenses | (300) | |

| Utilities | (280) | (5,030) |

| Net cash from operating activities |

| 6,070 |

| Cash flow from investing activities |

| |

| Purchase of equipment | (1,890) | |

| Net cash from investing activities |

| (1,890) |

| Cash flow from financing activities |

| |

| Issued common stock | 40,000 | |

| Less: Payment of cash dividends | (1,400) | |

| Net cash from financing activities |

| 38,600 |

| Net increase in cash |

| 42,780 |

| Cash balance, May 1,20XX |

| 0 |

| Cash balance, May 31,20XX |

| 42,780 |

Table(5)

Hence, the cash balance of the G Company as on May 31, 20XX is $42,780.

Want to see more full solutions like this?

Chapter 1 Solutions

CONNECT PLUS-FINANCIAL & MANAGERIAL AC

- 21 Hobbiton Tours Ltd. has the following details related to its defined benefit pension plan as at December 31, 2024: Pension fund assets of $1,900,000 and Actuarial obligation of $1,806,317. The actuarial obligation represents the present value of a single benefit payment of $3,200,000 that is due on December 31, 2030, discounted at an interest rate of 10%; i.e. $3,200,000 / 1.106 = $1,806,317. Funding during 2025 was $55,000. The actual value of pension fund assets at the end of 2025 was $2,171,000. As a result of the current services received from employees, the single payment due on December 31, 2030, had increased from $3,200,000 to $3,380,000. Required1. Compute the current service cost for 2025 and the amount of the accrued benefit obligation at December 31, 2025. Perform this computation for an interest rate of 10%.2. Derive the pension expense for 2025 under various assumptions about the expected return and discount rate. Complete the following table (with supporting…arrow_forwardNo ai Which entry is correct for recording revenue earned on account?A. Debit Cash, Credit RevenueB. Debit Revenue, Credit Accounts ReceivableC. Debit Accounts Receivable, Credit RevenueD. Debit Unearned Revenue, Credit Casharrow_forwardPlease provide the accurate answer to this general accounting problem using appropriate methods.arrow_forward

- Can you solve this general accounting question with accurate accounting calculations?arrow_forwardFor a $100,000 trade payable with terms of 2/10, net 45, how much would be reported as "purchase discount lost" under the gross method if a payment was made after 60 days? Question 1 options: $2,000 $4,50 $10,000 $0arrow_forwardI am looking for help with this general accounting question using proper accounting standards.arrow_forward

- Which entry is correct for recording revenue earned on account?A. Debit Cash, Credit RevenueB. Debit Revenue, Credit Accounts ReceivableC. Debit Accounts Receivable, Credit RevenueD. Debit Unearned Revenue, Credit Cash need helparrow_forward7 Which statement about "share buyback" is correct? Question 7 options: If the repurchase price is below the average issue price, the difference goes to "contributed surplus." If the repurchase price is below the average issue price, the difference goes to "common shares." If the repurchase price is below the average issue price, the difference goes to "loss on repurchase of shares," which will decrease the net income. If the repurchase price is below the average issue price, the difference goes to "gain on repurchase of shares," which will increase the net income.arrow_forwardI need help with accountingarrow_forward

- Which entry is correct for recording revenue earned on account?A. Debit Cash, Credit RevenueB. Debit Revenue, Credit Accounts ReceivableC. Debit Accounts Receivable, Credit RevenueD. Debit Unearned Revenue, Credit Cash Needarrow_forward8 Which statement about "common shares" is correct? Question 8 options: Common shares have the highest priority of all shares issued by a company. Common shares have the lowest priority of all shares issued by a company. Common shares have the lowest claim to residual ownership interest of all shares. Common shares have no claim to residual ownership interest of all shares.arrow_forward19 FAST Jetski Corp. has sold motorized watercraft for a number of years. FAST Jetski includes a three-year warranty on each watercraft they sell. Management estimates that the cost of providing the warranty coverage is 2% of sales in the first year and 3% of sales in each of years two and three. Other facts follow: • FAST Jetski reported a $270,000 provision for warranty payable on its December 31, 2025 balance sheet.• FAST Jetski's sales for 2026 totalled $6,000,000 spread evenly through the year.• The cost to FAST Jetski of meeting their warranty claims in 2026 was $480,000; $300,000 for parts and $180,000 for labour.• FAST Jetski's sales for 2027 totalled $6,200,000 spread evenly through the year.• The cost to FAST Jetski of meeting their warranty claims in 2027 was $468,000; $280,800 for parts and $187,200 for labour. Based on recent claims history, FAST Jetski revises their 2027 warranty provision to 9% of sales. Required1. Prepare summary journal entries to…arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education