Concept explainers

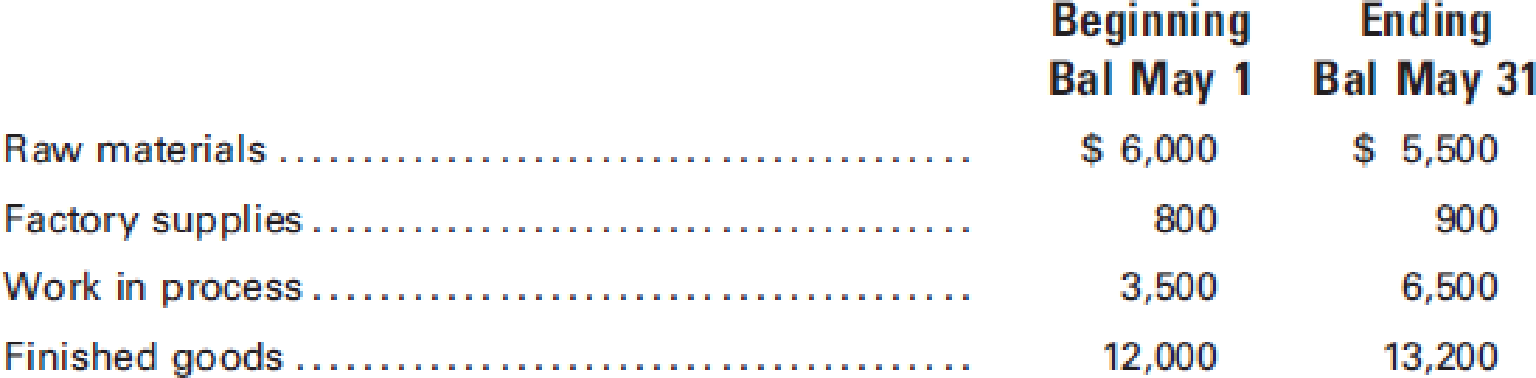

Selected account balances and transactions of Titan Foundry Inc. follow:

May Transactions:

- a. Purchased raw materials and factory supplies on account at costs of $45,000 and $10,000, respectively. (One inventory account is maintained.)

- b. Incurred wages during the month of $65,000 ($15,000 was for indirect labor).

- c. Incurred

factory overhead costs in the amount of $42,000 on account. - d. Made

adjusting entries to record $10,000 of factory overhead for items such asdepreciation (credit Various Credits). Factory overhead was closed to Work in Process. Completed jobs were transferred to Finished Goods, and the cost of jobs sold was charged to Cost of Goods Sold.

Required:

Prepare

- 1. The purchase of raw materials and factory supplies.

- 2. The issuance of raw materials and supplies into production. (Hint: Be certain to consider the beginning and ending balances of raw materials and supplies as well as the amount of the purchases.)

- 3. The recording of the payroll.

- 4. The distribution of the payroll.

- 5. The payment of the payroll.

- 6. The recording of factory overhead incurred.

- 7. The adjusting entry for factory overhead.

- 8. The entry to transfer factory overhead costs to Work in Process.

- 9. The entry to transfer the cost of completed work to Finished Goods. (Hint: Be sure to consider the beginning and ending balances of Work in Process as well as the manufacturing costs added to Work in Process this period.)

- 10. The entry to record the cost of goods sold. (Hint: Be sure to consider the beginning and ending balances of Finished Goods as well as the cost of the goods finished during the month.)

Prepare journal entry to record the given transactions.

Explanation of Solution

Cost accounting system of an organization consists of procedures and techniques used by an enterprise. This system helps the enterprise to track their resources that are used in creating and delivering products and services.

Prepare journal entry to record the given transactions.

| Date | Accounts title and explanation |

Debit ($) |

Credit ($) |

| 1. | Material inventory | 55,000 | |

| Accounts payable | 55,000 | ||

| (To record the purchase of materials and office supplies on account) | |||

| 2. | Work in process inventory (Materials) (1) | 45,500 | |

| Factory overhead (Indirect materials) (2) | 9,900 | ||

| Materials inventory | 55,400 | ||

| (To record issuance of raw materials and supply for production) | |||

| 3. | Payroll | 65,000 | |

| Wages payable | 65,000 | ||

| (To record the payroll) | |||

| 4. | Work in process inventory (Labor) | 50,000 | |

| Factory overhead (Indirect labor) | 15,000 | ||

| Payroll | 65,000 | ||

| (To record the distribution of payroll) | |||

| 5. | Wages payable | 65,000 | |

| Cash | 65,000 | ||

| (To record the payment of payroll) | |||

| 6. | Factory overhead | 42,000 | |

| Accounts payable | 42,000 | ||

| (To record the factory overhead incurred) | |||

| 7. | Factory overhead | 10,000 | |

| Various credits (Prepaid insurance, Accumulated Depreciation) | 10,000 | ||

| (Adjusting entry for the factory overhead expense) | |||

| 8. | Work in process (3) | 76,900 | |

| Factory overhead | 76,900 | ||

| (To record transfer of factory overhead costs to work in process) | |||

| 9. | Finished goods (4) | 169,400 | |

| Work in process | 169,400 | ||

| (To record transfer of cost of completed work to finished goods) | |||

| 10 | Cost of goods sold (5) | 168,200 | |

| Finished goods | 168,200 | ||

| (To record the cost of goods sold) |

(Table 1)

Working note 1: Calculate the work in process of raw materials.

Working note 2: Calculate the factory overhead of indirect materials.

Working note 3: Calculate the amount of goods transferred from factory overhead to work in process.

Working note 4: Calculate the amount goods transferred from completed work to finished goods.

Working note 5: Calculate the cost of goods sold.

Want to see more full solutions like this?

Chapter 1 Solutions

PRINCIPLES OF COST ACCOUNTING

- Accounting?arrow_forwardFallon Manufacturing Company measures its activity in terms of machine hours. Last month, the budgeted level of activity was 2,300 machine hours and the actual level of activity was 2,450 machine hours. The cost formula for maintenance expenses is $4.25 per machine hour plus $18,500 per month. The actual maintenance expense was $29,600. Last month, the spending variance for maintenance expenses was _.arrow_forwardCan you solve this financial accounting problem with appropriate steps and explanations?arrow_forward

- I need help with this financial accounting question using standard accounting techniques.arrow_forwardRBI company issues $500,000 face value bonds with a 6% stated interest rate, payable semiannually. The bonds sell for $532,000 (at a premium) and have 10 years until maturity. Using the straight-line method, what is the amount of premium amortization for each semiannual interest payment?arrow_forwardA company sells a product for $75 per unit. Variable costs are $45 per unit, and fixed costs total $180,000 per year. How many units must be sold to achieve a target profit of $120,000?arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub