Concept explainers

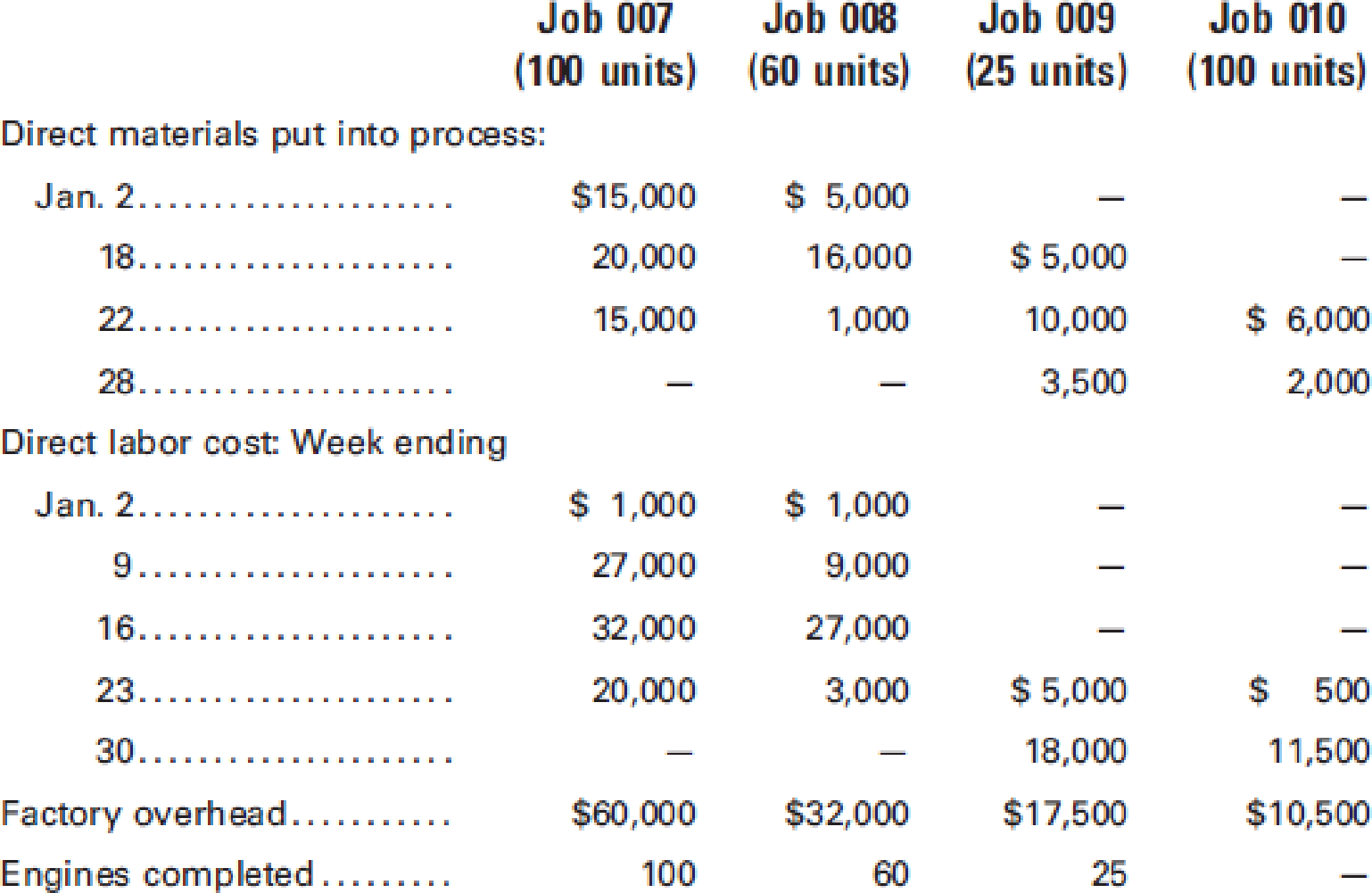

Potomac Automotive Co. manufactures engines that are made only on customers’ orders and to their specifications. During January, the company worked on Jobs 007, 008, 009, and 010. The following figures summarize the cost records for the month:

Jobs 007 and 008 have been completed and delivered to the customer at a total selling price of $426,000, on account. Job 009 is finished but has not yet been delivered. Job 010 is still in process. There were no materials or work in process inventories at the beginning of the month. Material purchases were $115,000, and there were no indirect materials used during the month.

Required:

- 1. Prepare a summary showing the total cost of each job completed during the month or in process at the end of the month.

- 2. Prepare the summary

journal entries for the month to record the distribution of materials, labor, andoverhead costs. - 3. Determine the cost of the inventories of completed engines and engines in process at the end of the month.

- 4. Prepare the journal entries to record the completion of the jobs and the sale of the jobs.

- 5. Prepare a statement of cost of goods manufactured.

1.

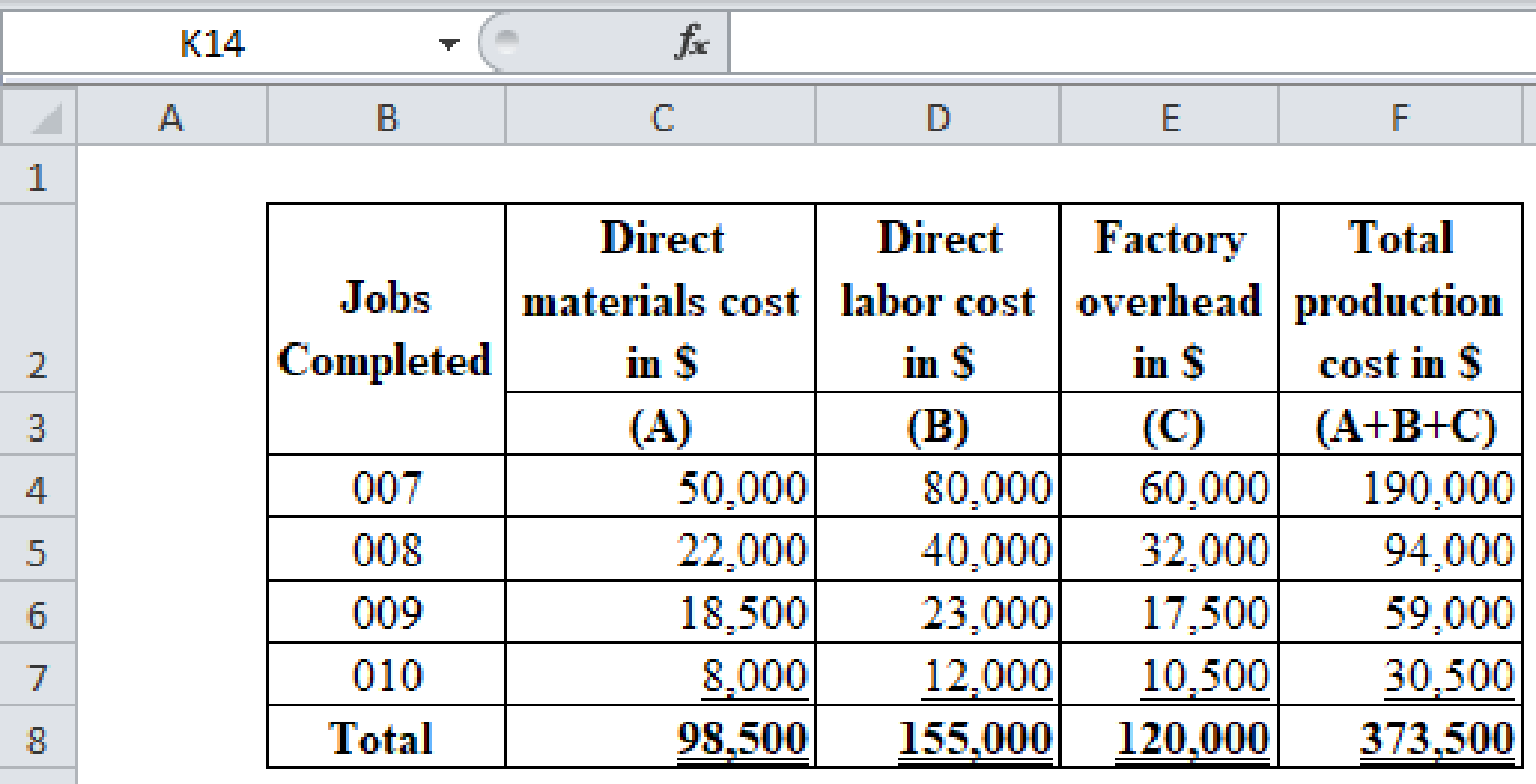

Determine the total production cost for each job.

Explanation of Solution

Production costs are those costs that are incurred for manufacturing a product or providing the service to the end user. The following are three basic elements of production costs.

Calculate the total production cost for each job.

(Figure 1)

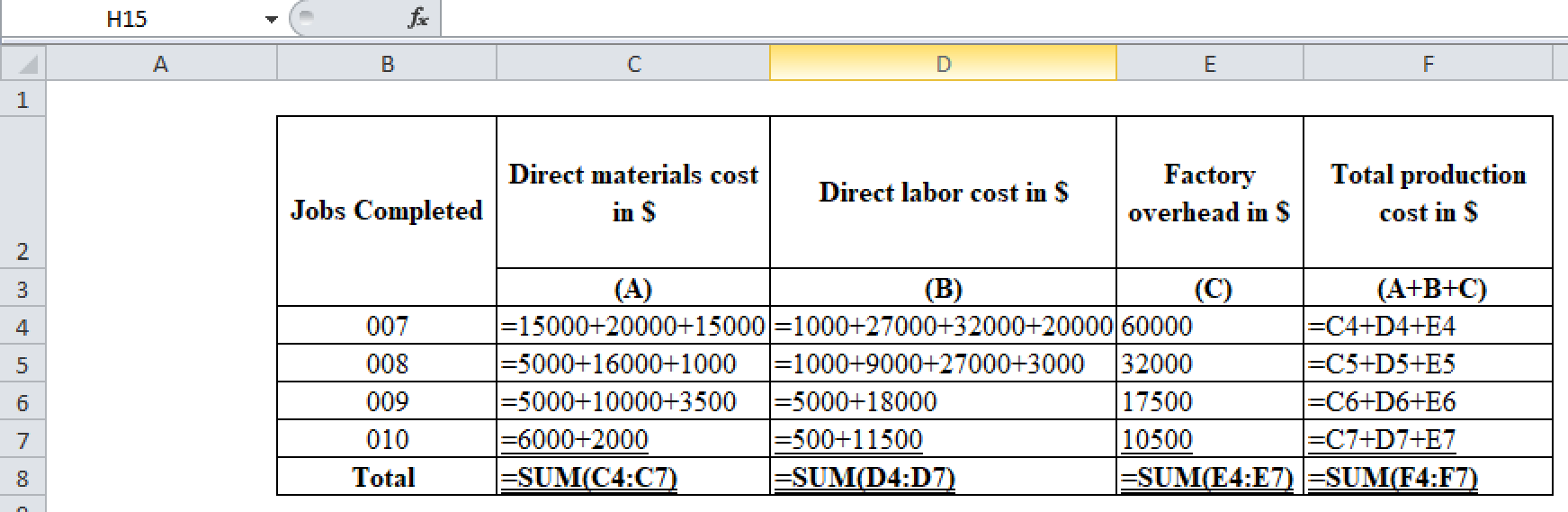

Excel workings:

(Figure 2)

2.

Prepare journal entry to record the distribution of materials, labor and overhead cost.

Explanation of Solution

Prepare journal entry to record the distribution of materials, labor and overhead cost.

| Date | Accounts title and explanation |

Debit ($) |

Credit ($) |

| Work in process inventory | 98,500 | ||

| Material inventory | 98,500 | ||

| (To record the issuance of materials to production) |

(Table 1)

| Date | Accounts title and explanation |

Debit ($) |

Credit ($) |

| Work in process inventory | 155,000 | ||

| Payroll | 155,000 | ||

| (To record the distribution of payroll) |

(Table 2)

| Date | Accounts title and explanation |

Debit ($) |

Credit ($) |

| Work in process inventory | 120,000 | ||

| Factory overhead | 120,000 | ||

| (To record the distribution of factory overhead) |

(Table 3)

3.

Identify the cost of the inventories for the engines completed and the engines that are in process during the end of the month.

Explanation of Solution

- Cost of the inventories for the completed and not yet delivered engines is $59,000 (Job 009).

- Cost of inventories that are in process during the end of the month is $30,500 (Job 010).

4.

Prepare journal entry to record the given transactions.

Explanation of Solution

Prepare journal entry to record the completion of jobs.

| Date | Accounts title and explanation |

Debit ($) |

Credit ($) |

| Finished goods | 343,000 | ||

| Work in process (1) | 343,000 | ||

| (To record jobs that were completed) |

(Table 4)

Prepare journal entry to record the sale of jobs.

| Date | Accounts title and explanation |

Debit ($) |

Credit ($) |

| Accounts receivable | 426,000 | ||

| Sales | 426,000 | ||

| (To record the sale on account during June) |

(Table 5)

| Date | Accounts title and explanation |

Debit ($) |

Credit ($) |

| Cost of goods sold (2) | 284,000 | ||

| Finished goods inventory | 284,000 | ||

| (To record cost of goods sold) |

(Table 6)

Working note 1: Calculate the value of jobs completed.

Working note 2: Calculate the value of cost of goods sold.

5.

Compute the Company P’s statement of cost of goods manufactured for the month ended January 31.

Explanation of Solution

Compute the Company P’s statement of cost of goods manufactured for the month ended January 31.

| Company P | ||

| Statement of cost of goods manufactured | ||

| For the month ended January 31 | ||

| Particulars | Amount in $ | Amount in $ |

| Direct materials: | ||

| Inventory, January 1 | 0 | |

| Add: Purchase | 115,000 | |

| Total cost of available materials | 115,000 | |

| Less: Inventory, January 31 (3) | 16,500 | |

| Cost of materials used | 98,500 | |

| Less: Indirect materials used | 0 | |

| Cost of direct materials used in production | 98,500 | |

| Direct labor | 155,000 | |

| Factory Overhead | 120,000 | |

| Total manufacturing cost | 373,500 | |

| Add: work in process inventory, January 1 | 0 | |

| 373,500 | ||

| Less: Work in process inventory, January 31 | 30,500 | |

| Cost of goods sold manufactured | 343,000 | |

(Table 7)

Working note 3: Calculate the value of ending inventory.

Want to see more full solutions like this?

Chapter 1 Solutions

PRINCIPLES OF COST ACCOUNTING

- Franklin & Baker Consulting had a net income of $68,000 and net sales of $425,000. Compute the relationship of net income to net sales.arrow_forwardI need help with this general accounting question using standard accounting techniques.arrow_forwardPlease explain the solution to this financial accounting problem with accurate explanations.arrow_forward

- Please explain the solution to this general accounting problem with accurate explanations.arrow_forwardI am looking for help with this general accounting question using proper accounting standards.arrow_forwardEddie Woodworks manufactures custom shelving. During the most productive month of the year, 4,200 units were manufactured at a total cost of $73,500. In the month of lowest production, the company made 1,600units at a cost of $49,800. Using the high-low method of cost estimation, total fixed costs are__.arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,