Exercise 1-6 Effect of transactions on general ledger accounts

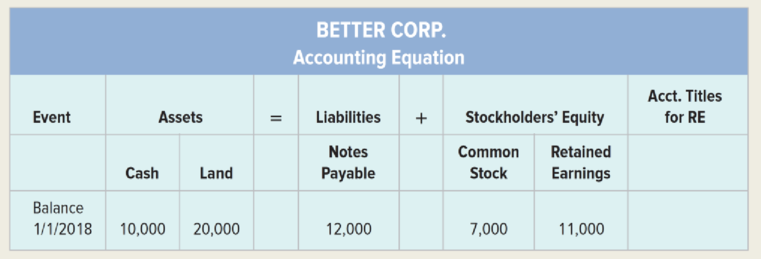

At the beginning of 2018, Better Corp.’s accounting records had the following general ledger accounts and balances:

Better Corp. completed the following transactions during 2018:

1. Purchased land for $5,000 cash.

2. Acquired $25,000 cash from the issue of common stock.

3. Received $75,000 cash for providing services to customers.

4. Paid cash operating expenses of $42,000.

5. Borrowed $10,000 cash from the bank.

6. Paid a $5,000 cash dividend to the stockholders.

7. Determined that the market value of the land purchased in event 1 is $35,000.

Required

a. Record the transactions in the appropriate general ledger accounts. Record the amounts of revenue, expense, and dividends in the

b. As of December 31, 2018, determine the total amount of assets, liabilities, and stockholders’ equity and present this information in the form of an

c. What is the amount of total assets, liabilities, and stockholders’ equity as of January 1, 2019?

Want to see the full answer?

Check out a sample textbook solution

Chapter 1 Solutions

SURVEY OF ACCOUNT.(LL)-W/ACCESS>CUSTOM<

- For the current year ended March 31, Carter Company expects fixed costs of $620,000, a unit variable cost of $72, and a unit selling price of $95. a. Compute the anticipated break-even sales (units). b. Compute the sales (units) required to realize an operating income of $145,000. (Round your answer to nearest units)arrow_forwardWhat is Bobby's 2019 net income using accrual accounting?arrow_forwardPension plan assets were $2,300 million at the beginning of the year and $2,560 million at the end of the year. At the end of the year, retiree benefits paid by the trustee were $60 million and cash invested in the pension fund was $65 million. What was the percentage rate of return on plan assets?arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning