Concept explainers

a.

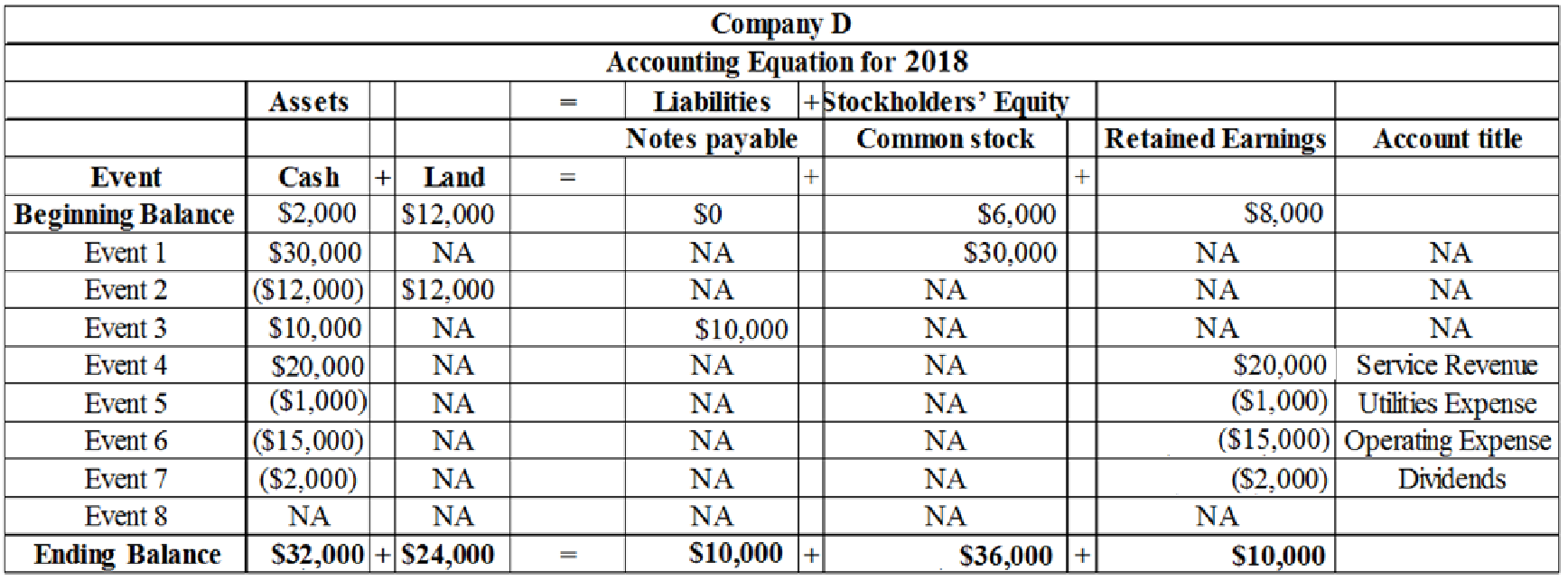

Record the eight events in the

a.

Explanation of Solution

The eight events are recorded using

Table (1)

b.

Prepare an income statement, statement of changes in equity, year-end

b.

Explanation of Solution

Income statement: Income statement is the financial statement of a company which shows all the revenues earned and expenses incurred by the company over a period of time.

Income statement for the Year 2018 is prepared as follows:

| Company D | |

| Income Statement | |

| For the Year Ended December 31, 2018 | |

| Particulars | Amount ($) |

| Service Revenue | $20,000 |

| Utilities Expense | (1,000) |

| Operating Expense | ($15,000) |

| Net Income | 4,000 |

Table (2)

Statement of changes in stockholders' equity: Statement of changes in stockholders' equity records the changes in the

Statement of changes in equity for the Year 2018 is prepared is as follows:

| Company D | ||

| Statement of Changes in Stockholders’ Equity | ||

| For the Year Ended December 31, 2018 | ||

| Particulars | Amount ($) | Amount ($) |

| Beginning Common Stock | 6,000 | |

| Add: Common Stock Issued | 30,000 | |

| Ending Common Stock | 36,000 | |

| Beginning | 8,000 | |

| Add: Net Income | 4,000 | |

| Less: Dividends | (2,000) | |

| Ending Retained Earnings | 10,000 | |

| Total Stockholders’ Equity | $46,000 | |

Table (3)

Balance sheet: Balance Sheet is one of the financial statements that summarize the assets, the liabilities, and the Shareholder’s equity of a company at a given date. It is also known as the statement of financial status of the business.

Balance sheet for the Year 2018 is prepared as follows:

| Company D | ||

| Balance Sheet | ||

| As of December 31, 2018 | ||

| Particulars | Amount ($) | Amount ($) |

| Assets: | ||

| Cash | 32,000 | |

| Land | 24,000 | |

| Total Assets | $56,000 | |

| Liabilities: | ||

| Notes Payable | 10,000 | |

| Total Liabilities | 10,000 | |

| Stockholders’ Equity: | ||

| Common Stock | 36,000 | |

| Retained Earnings | 10,000 | |

| Total Stockholders’ Equity | 46,000 | |

| Total Liabilities and Stockholders’ Equity | $56,000 | |

Table (4)

Statement of cash flows: Statement of cash flows is one among the financial statement of a Company statement that shows aggregate data of all

Statement of cash flows for the Year 2018 is prepared as follows:

| Company D | ||

| Statement of Cash Flows | ||

| For the Year Ended December 31, 2018 | ||

| Particulars | Amount ($) | Amount ($) |

| Cash Flows From Operating Activities: | ||

| Cash Receipts from Customers | 20,000 | |

| Cash Payment for Utilities Expense | (1,000) | |

| Cash Payments for Other Operating Expense | (15,000) | |

| Net Cash Flow from Operating Activities | 4,000 | |

| Cash Flows From Investing Activities: | ||

| Cash Paid to Purchase Land | (12,000) | |

| Net Cash Flow from Investing Activities | (12,000) | |

| Cash Flows From Financing Activities: | ||

| Cash Receipts from Stock Issue | 30,000 | |

| Cash Receipts from Loan | 10,000 | |

| Cash Payments for Dividends | (2,000) | |

| Net Cash Flow from Financing Activities | 38,000 | |

| Net Increase in Cash | 30,000 | |

| Add: Beginning Cash Balance | 2,000 | |

| Ending Cash Balance | $32,000 | |

Table (5)

c.

Ascertain the percentage of assets provided by the retained earnings and find out the amount of cash in the retained earnings account.

c.

Explanation of Solution

Retained earnings: Retained earnings are the portion of earnings kept by the business for the purpose of reinvestments, payment of debts, or for future growth.

Calculate the percentage of assets provided by retained earnings:

Retained earnings are used to purchase assets or to pay liabilities and therefore, the amount of cash in the retained earnings accounts cannot be determined.

Therefore, the percentage of assets provided by retained earnings is 17.9%.

Want to see more full solutions like this?

Chapter 1 Solutions

SURVEY OF ACCOUNT.(LL)-W/ACCESS>CUSTOM<

- Please help me solve this financial accounting problem with the correct financial process.arrow_forwardDear expDon't solve if you solve with incorrect values then i will give unhelpful .arrow_forwardCan you show me the correct approach to solve this financial accounting problem using suitable standards?arrow_forward

- Honda Corporation had beginning raw materials inventory of $34,500. During the period, the company purchased $128,000 of raw materials on account. If the ending balance in raw materials was $22,700, the amount of raw materials transferred to work in process inventory is?arrow_forwardMistral Inc. reported $85,000 in net profit for the year using absorption costing.arrow_forwardTransactions: Dec. 3 Wrote off Langston Corporation’s past-due account as uncollectible, $645.75. M203. 9 Accepted a 90-day, 8% note from Farris Company for an extension of time on its account, $2,400.00. NR23. 18 Received cash from Storage Solutions for the maturity value of NR19, a 90-day, 9% note for $2,000.00. R455. 21 Coastal Supply dishonored NR21, a 90-day, 8% note, for $3,000.00. M245. 30 Received cash in full payment of Langston Corporation’s account, previously written off as uncollectible, $645.75. M232 and R463. Task 1 Journalize the transactions for Miller Corporation in Questions Assets that were completed during December of the current year. Use page 12 of the general journal and page 12 of the cash receipts journal. Task 2 Post each entry to the general ledger and to the customer accounts in the accounts receivable ledger. You will not need to make entries to the Item columns of the ledgers. Task 3 Continue to…arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning