Concept explainers

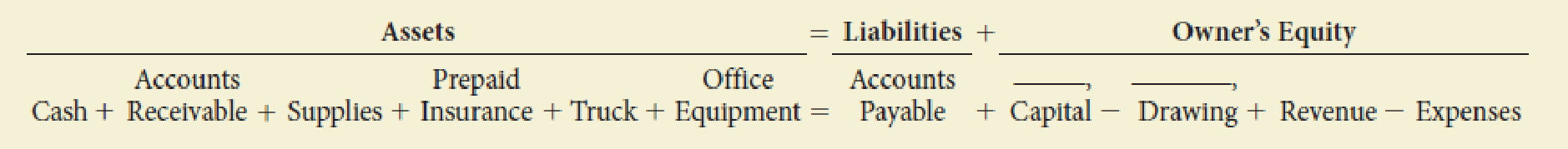

In April, J. Rodriguez established an apartment rental service. The account headings are presented below. Transactions completed during the month of April follow.

- a. Rodriguez deposited $70,000 in a bank account in the name of the business.

- b. Paid the rent for the month, $2,000, Ck. No. 101 (Rent Expense).

- c. Bought supplies on account, $150.

- d. Bought a truck for $23,500, paying $2,500 in cash and placing the remainder on account.

- e. Bought insurance for the truck for the year, $2,400, Ck. No. 102.

- f. Sold services on account, $4,700 (Service Income).

- g. Bought office equipment on account from Stern Office Supply, $1,250.

- h. Sold services for cash for the first half of the month, $8,250 (Service Income).

- i. Received and paid the bill for utilities, $280, Ck. No. 103 (Utilities Expense).

- j. Received a bill for gas and oil for the truck, $130 (Gas and Oil Expense).

- k. Paid wages to the employees, $2,680, Ck. Nos. 104–106 (Wages Expense).

- l. Sold services for cash for the remainder of the month, $3,500 (Service Income).

- m. Rodriguez withdrew cash for personal use, $4,000, Ck. No. 107.

Required

1. In the equation, write the owner’s name above the terms Capital and Drawing.

2. Record the transactions and the balance after each transaction. Identify the account affected when the transaction involves revenues or expenses.

3. Write the account totals from the left side of the equals sign and add them. Write the account totals from the right side of the equals sign and add them. If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.

Trending nowThis is a popular solution!

Chapter 1 Solutions

College Accounting (Book Only): A Career Approach

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT  College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,