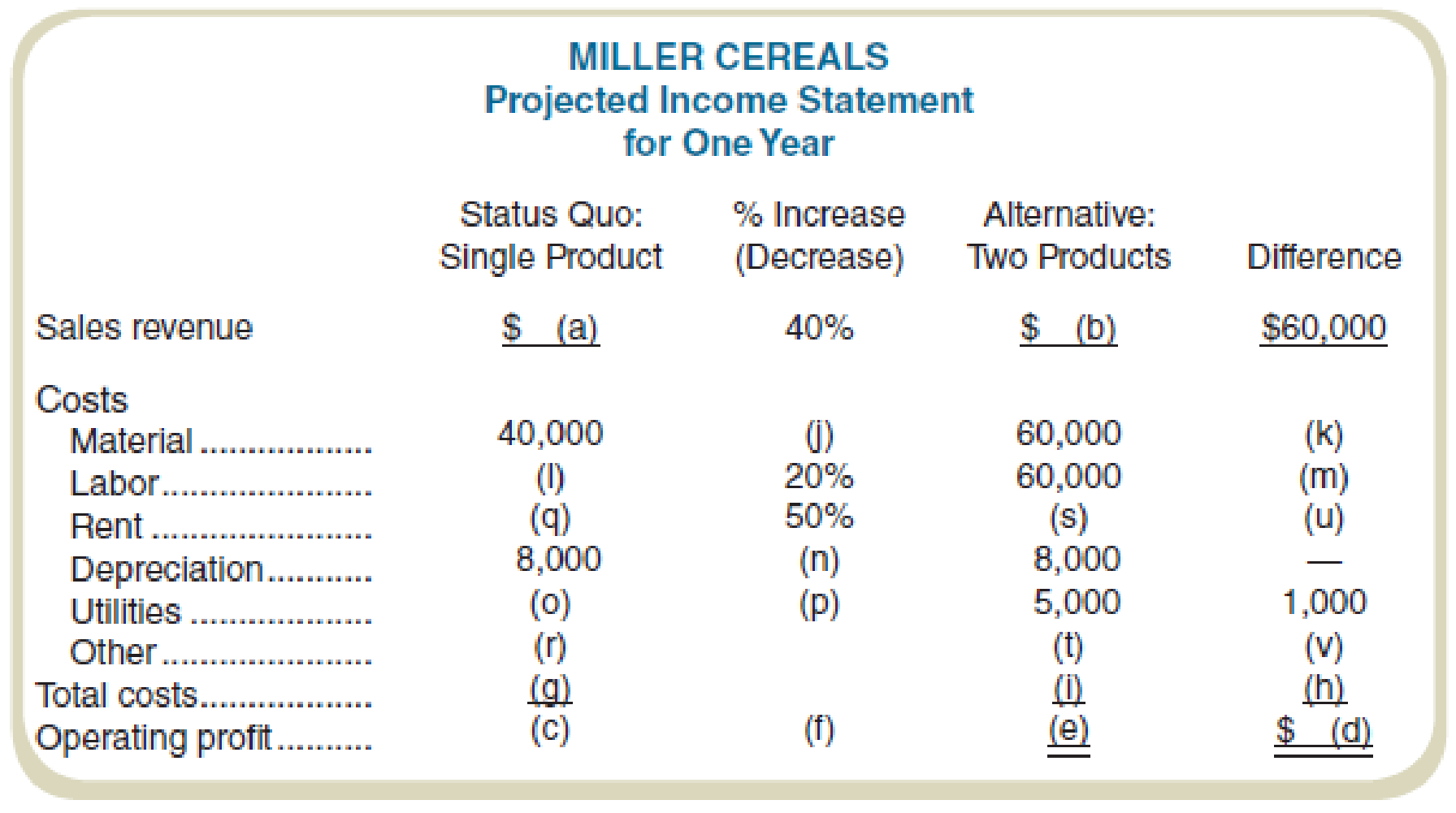

Miller Cereals is a small milling company that makes a single brand of cereal. Recently, a business school intern recommended that the company introduce a second cereal in order to “diversify the product portfolio.” Currently, the company shows an operating profit that is 20 percent of sales. With the single product, other costs were twice the cost of rent.

The intern estimated that the incremental profit of the new cereal would only be 2.5 percent of the incremental revenue, but it would still add to total profit. On his last day, the intern told Miller’s marketing manager that his analysis was on the company laptop in a spreadsheet with a file name, NewProduct.xlsx. The intern then left for a 12-month walkabout in the outback of Australia and cannot be reached.

When the marketing manager opened the file, it was corrupted and could not be opened. She then found an early (incomplete) copy on the company’s backup server. The incomplete spreadsheet is shown following. The marketing manager then called a cost

Required

As the management accountant, fill in the blank cells.

Fill in the blank cells of the projected income statement.

Explanation of Solution

Projected income statement: The projected income statement represents the future financial position of the entity. The projected income statement is prepared with an objective of showing the financial results for a future period of time.

Fill in the blank cells of the projected income statement:

| Company M | ||||

| Projected Income Statement | ||||

| For One Year | ||||

| Status Quo: | % Increase | Alternative | ||

| Single Product | Decrease | Two Products | Difference | |

| Sales revenue | $ 150,000 (a) | 40% | $ 210,000 (b) | $ 60,000 |

| Costs | ||||

| Material | $ 40,000 | 50% (j) | $ 60,000 | $ 20,000 (k) |

| Labor | $ 50,000 (l) | 20% | $ 60,000 | $ 10,000 (m) |

| Rent | $ 6,000 (q) | 50% | $ 9,000 (s) | $ 3,000 (u) |

| Depreciation | $ 8,000 | 0% (n) | $ 8,000 | $ - |

| Utilities | $ 4,000 (o) | 25% (p) | $ 5,000 | $ 1,000 |

| Other | $ 12,000 (r) | $ 36,500 (t) | $ 24,500 (v) | |

| Total costs | $ 120,000 (g) | $ 178,500 (i) | $ 58,500 (h) | |

| Operating profit | $ 30,000 (c) | 5% (f) | $ 31,500 (e) | $ 1,500 (d) |

Table (1)

Working note 1:

Compute the value of (a):

It is given that the profit has increased by 40%. (a) represents the amount of sales revenue.

Working note 2:

Compute the value of (b):

Working note 3:

Compute the value of (c):

Working note 4:

Compute the value of (d):

Working note 5:

Compute the value of (e):

Working note 5:

Compute the value of (f):

Working note 6:

Compute the value of (g):

Working note 6:

Compute the value of (h):

Working note 7:

Compute the value of (i):

Working note 8:

Compute the value of (j):

Working note 9:

Compute the value of (k):

Working note 10:

Compute the value of (l):

Working note 11:

Compute the value of (m):

Working note 12:

Compute the value of (n):

The value of n is 0 as there was no change.

Working note 13:

Compute the value of (o):

Working note 14:

Compute the value of (p):

Working note 15:

Compute the value of (q):

Value of rent:

The value of rent is half of the other costs. Thus, the value of rent will be $6,000, and that of other costs will be $12,000.

Thus,

Working note 16:

Compute the value of (r):

Working note 17:

Compute the value of (s):

Working note 18:

Compute the value of (t):

Working note 19:

Compute the value of (u):

Working note 20:

Compute the value of (v):

Want to see more full solutions like this?

Chapter 1 Solutions

Gen Combo Fundamentals Of Cost Accounting; Connect Access Card

- Tracy Company, a manufacturer of air conditioners, sold 100 units to Thomas Company on November 17, 2024. The units have a list price of $750 each, but Thomas was given a 20% trade discount. The terms of the sale were 3/10 , n/30 . 3-a. Prepare the journal entries to record the sale on November 17 (ignore cost of goods) and collection on November 26, 2024, assuming that the net method of accounting for cash discounts is used. 3-b. Prepare the journal entries to record the sale on November 17 (ignore cost of goods) and collection on December 15, 2024, assuming that the net method of accounting for cash discounts is used.arrow_forwardBurlington manufacturing complete solution general accounting questionarrow_forwardDo fast answer of this general accounting questionarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education