College Accounting (Book Only): A Career Approach

13th Edition

ISBN: 9781337280570

Author: Scott, Cathy J.

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 1, Problem 4PA

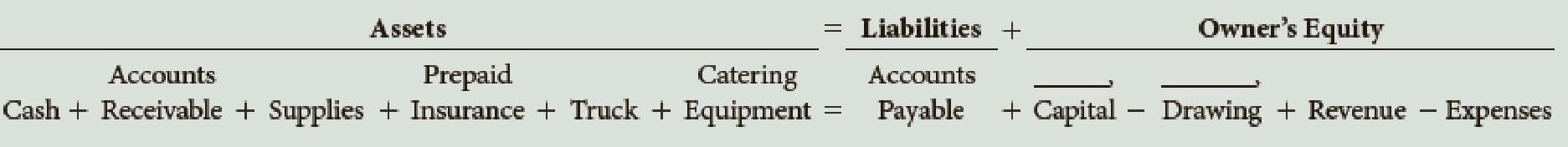

On March 1 of this year, B. Gervais established Gervais Catering Service. The account headings are presented below. Transactions completed during the month follow.

- a. Gervais deposited $25,000 in a bank account in the name of the business.

- b. Bought a truck from Kelly Motors for $26,329, paying $8,000 in cash and placing the balance on account, Ck. No. 500.

- c. Bought catering equipment on account from Luigi’s Equipment, $3,795.

- d. Paid the rent for the month, $1,255, Ck. No. 501.

- e. Bought insurance for the truck for one year, $400, Ck. No. 502.

- f. Sold catering services for cash for the first half of the month, $3,012.

- g. Bought supplies for cash, $185, Ck. No. 503.

- h. Sold catering services on account, $4,307.

- i. Received and paid the heating bill, $248, Ck. No. 504.

- j. Received a bill from GC Gas and Lube for gas and oil for the truck, $128.

- k. Sold catering services for cash for the remainder of the month, $2,649.

- l. Gervais withdrew cash for personal use, $1,550, Ck. No. 505.

- m. Paid the salary of the assistant, $1,150, Ck. No. 506.

Required

- 1. Record the transactions and the balance after each transaction.

- 2. Total the left side of the

accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

How much is Samuels disposable income?

Triton Manufacturing had a beginning finished goods inventory of $23,500 and an ending finished goods inventory of $21,000 during FY 2023. Beginning work-in-process was $19,500 and ending work-in-process was $18,000. Factory overhead was $28,600. The total manufacturing costs amounted to $298,000. Use this information to determine the FY 2023 Cost of Goods Sold. (Round enter as whole dollars only.) Provide answer

4 PTS

Chapter 1 Solutions

College Accounting (Book Only): A Career Approach

Ch. 1 - Prob. 1QYCh. 1 - Prob. 2QYCh. 1 - Which of the following accounts would increase...Ch. 1 - Which of the following statements is true? a....Ch. 1 - M. Parish purchased supplies on credit. What is...Ch. 1 - Define assets, liabilities, owners equity,...Ch. 1 - Prob. 2DQCh. 1 - How do Accounts Payable and Accounts Receivable...Ch. 1 - Describe two ways to increase owners equity and...Ch. 1 - What is the effect on the fundamental accounting...

Ch. 1 - When an owner withdraws cash or goods from the...Ch. 1 - Define chart of accounts and identify the...Ch. 1 - What account titles would you suggest for the...Ch. 1 - Prob. 1ECh. 1 - Determine the following amounts: a. The amount of...Ch. 1 - Dr. L. M. Patton is an ophthalmologist. As of...Ch. 1 - Describe a business transaction that will do the...Ch. 1 - Describe a transaction that resulted in each of...Ch. 1 - Label each of the following accounts as asset (A),...Ch. 1 - Describe a transaction that resulted in the...Ch. 1 - Describe the transactions that are recorded in the...Ch. 1 - On June 1 of this year, J. Larkin, Optometrist,...Ch. 1 - On July 1 of this year, R. Green established the...Ch. 1 - S. Davis, a graphic artist, opened a studio for...Ch. 1 - On March 1 of this year, B. Gervais established...Ch. 1 - In April, J. Rodriguez established an apartment...Ch. 1 - In July of this year, M. Wallace established a...Ch. 1 - In March, K. Haas, M.D., established the Haas...Ch. 1 - P. Schwartz, Attorney at Law, opened his office on...Ch. 1 - In March, T. Carter established Carter Delivery...Ch. 1 - In October, A. Nguyen established an apartment...Ch. 1 - Why Does It Matter? MACS CUSTOM CATERING, Eugene,...Ch. 1 - What Would You Say? A friend of yours wants to...Ch. 1 - Prob. 3A

Additional Business Textbook Solutions

Find more solutions based on key concepts

A typical discounted price of a AAA battery is 0.75. It is designed to provide 1.5 volts and 1.0 amps for about...

Engineering Economy (17th Edition)

1-1. Define marketing and outline the steps in the marketing process. (AASCB: Communication)

Marketing: An Introduction (13th Edition)

Whether callable bonds have a higher or lower yield than otherwise identical bonds without a call feature. Intr...

Corporate Finance (4th Edition) (Pearson Series in Finance) - Standalone book

Fundamental and Enhancing Characteristics. Identify whether the following items are fundamental characteristics...

Intermediate Accounting (2nd Edition)

E6-14 Using accounting vocabulary

Learning Objective 1, 2

Match the accounting terms with the corresponding d...

Horngren's Accounting (12th Edition)

How is activity-based costing useful for pricing decisions?

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Suppose PayPal (PYPL) has no debt and an equity cost of capital of 9.7 %. The average debt-to- value ratio for the credit services industry is 15.4 %. What would its cost of equity be if it took on the average amount of debt for its industry at the cost of debt of 6%?arrow_forwarddo fast answer of this accountingarrow_forwardCan you help me with accounting questionsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY