Cost Data for Managerial Purposes—Finding Unknowns

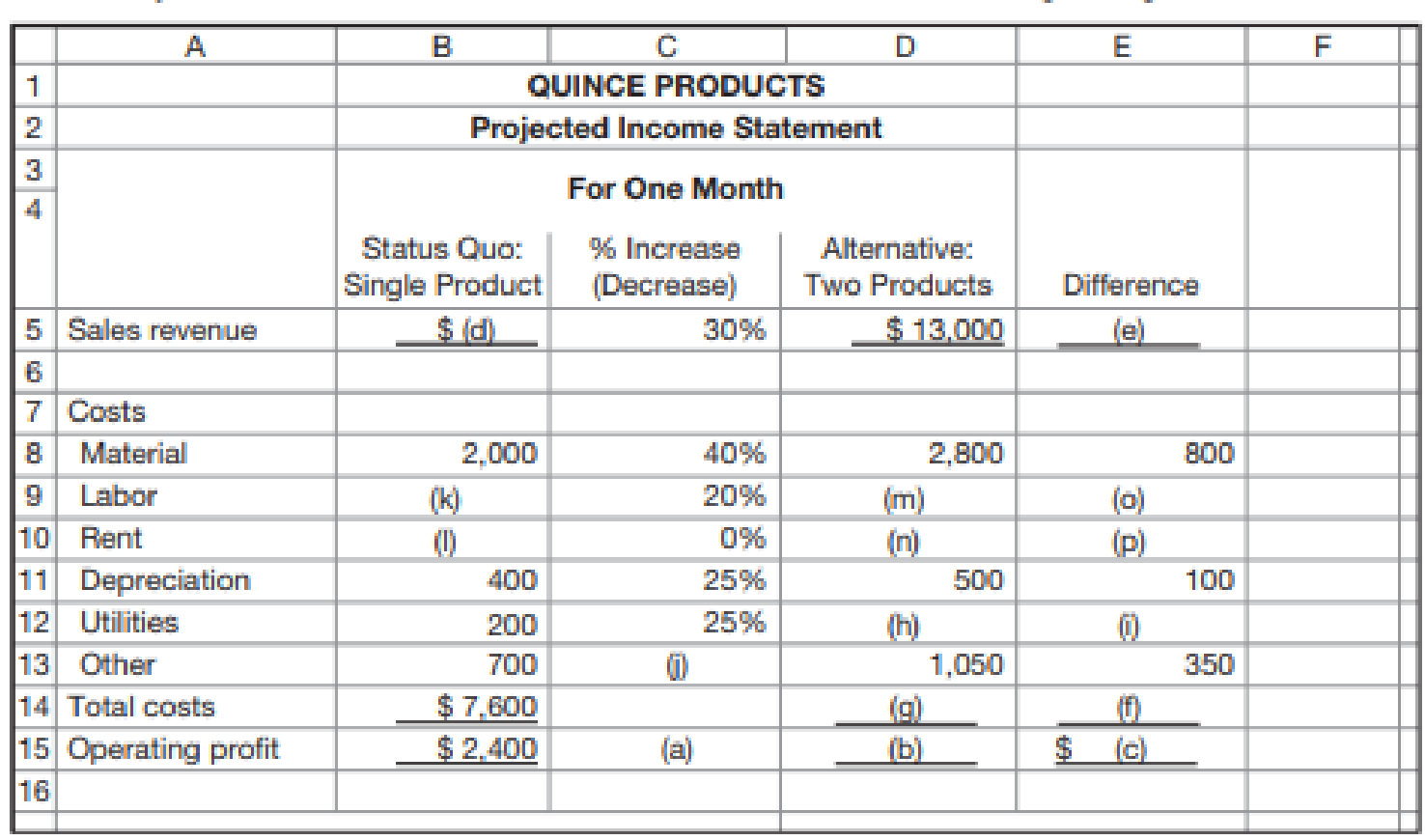

Quince Products is a small company in southern California that makes jams and preserves. Recently, a sales rep from one of the company’s suppliers suggested that Quince could increase its profitability by 50 percent if it introduced a second line of products, packaged fruit. She offered to do the analysis and show the company her assumptions.

When Quince’s management opened the spreadsheet sent by the sales rep, they noticed that there were several blank cells. In the meantime, the sales rep had taken a job with a competitor and told the managers at Quince that she could no longer advise them. Although they were not sure they should rely on the analysis, they asked you to see if you could reconstruct the sales rep’s analysis. They had been considering this new business already and wanted to see if their analysis was close to that of an outside observer. The incomplete spreadsheet follows.

Required

Fill in the blank cells.

Fill in the blank cells of the projected income statement.

Explanation of Solution

Projected income statement: The projected income statement represents the future financial position of the entity. The projected income statement is prepared with an objective of showing the financial results for a future period of time.

Fill in the blank cells of the projected income statement:

| Company Q | ||||

| Projected Income Statement | ||||

| For One Month | ||||

| Status Quo: | % Increase | Alternative | ||

| Single Product | Decrease | Two Products | Difference | |

| Sales revenue | $ 10,000 (d) | 30% | $ 13,000 | $ 3,000 (e) |

| Costs | ||||

| Material | $ 2,000 | 40% | $ 2,800 | $ 800 |

| Labor | $ 2,500 (k) | 20% | $ 3,000 (m) | $ 500 (o) |

| Rent | $ 1,800 (l) | 0% | $ 1,800 (n) |

|

| Depreciation | $ 400 | 25% | $ 500 | $ 100 |

| Utilities | $ 200 | 25% | $ 250 (h) | $ 50 (i) |

| Other | $ 700 | 50% (j) | $ 1,050 | $ 350 |

| Total costs | $ 7,600 | $ 9,400 (g) | $ 1,800 (f) | |

| Operating profit | $ 2,400 (a) | $ 3,600 (b) | $ 1,200 (c) | |

Working note 1:

Compute value of (a):

It is given that the profit has increased by 50%, (a) represent the % increase or decrease in profit.

Working note 2:

Compute value of (b):

Working note 3:

Compute value of (c):

Working note 4:

Compute value of (d):

Working note 5:

Compute value of (e):

Working note 5:

Compute value of (f):

Working note 6:

Compute value of (g):

Working note 6:

Compute value of (h):

Working note 7:

Compute value of (i):

Working note 8:

Compute value of (j):

Working note 8:

Compute value of (k):

Labor plus rent (single product):

Labor plus rent (two products):

Increase in labor:

Thus,

Working note 8:

Compute value of (l):

Working note 8:

Compute value of (m):

Working note 9:

Compute value of (n):

Working note 10:

Compute value of (o):

Working note 11:

Compute value of (p):

Want to see more full solutions like this?

Chapter 1 Solutions

GEN COMBO FUNDAMENTALS OF COST ACCOUNTING; CONNECT 1S ACCESS CARD

- Please explain the solution to this financial accounting problem with accurate principles.arrow_forwardHello tutor please given General accounting question answer do fast and properly explain all answerarrow_forwardI need help solving this general accounting question with the proper methodology.arrow_forward

- Based on the results of the Accounts Receivable Aging as of December 31, 2022 visualization, what conclusion can be made regarding the outstanding accounts receivables? a. The count of unpaid invoices was the highest for invoices within the 90+ days aging group and the lowest for invoices in the 31-60 days aging group. b. The count of unpaid invoices was the highest for invoices within the 31-60 days aging group and the lowest for invoices in the 90+ days aging group. c. The outstanding accounts receivable value for the 90+ days aging group is approximately the value of the other aging groups combined. d. The outstanding accounts receivable value for the 90+ days aging group is approximately twice the value of the other aging groups combined.arrow_forwardPlease given correct answer for General accounting question I need step by step explanationarrow_forwardBased on the results of the Sales Total vs Sales Order Counts by Channel in 2022 visualization, how do the sales channels compare with each other? a. Website sales had the lowest number of sales orders, and the average value of the sales orders was lower compared to the other sales channels. b. B2B sales had the highest number of sales orders, and the average value of the sales orders was lower compared to the other sales channels. c. Storefront sales had the highest number of sales orders, and the average value of the sales orders was lower compared to the other sales channels. d. Storefront sales had the highest number of sales orders, and the average value of the sales orders was higher compared to the other sales channels.arrow_forward

- Please explain this financial accounting problem by applying valid financial principles.arrow_forwardI want to this question answer for Financial accounting question not need ai solutionarrow_forwardI need help with this financial accounting question using accurate methods and procedures.arrow_forward

- Using the Sales Total vs Sales Order Counts by Channel in 2022 visualization, what trends are shown for the B2B sales channel? What recommendations do you have for management for the B2B strategy? What are some considerations when pursuing a B2B strategy?arrow_forwardCan you provide a detailed solution to this financial accounting problem using proper principles?arrow_forwardUsing the results of the Top 5 Customers by Accounts Receivable Amount Due and the Top 5 Customers by Outstanding Sales Order Amount visualization, what conclusion can be made regarding the outstanding sales orders? a. The high value of outstanding accounts receivable for Sanders Corp may be directly related to their high value of outstanding sales orders. b. The high value of outstanding accounts receivable for Williams Corp may be directly related to their high value of outstanding sales orders. c. The high value of outstanding sales orders for Roberts Corp has caused them not to pay a large value of invoices. d. Evans Corp has a high value of outstanding accounts receivable and outstanding sales orders.arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning