Concept explainers

Cost Data for Managerial Purposes—Budgeting

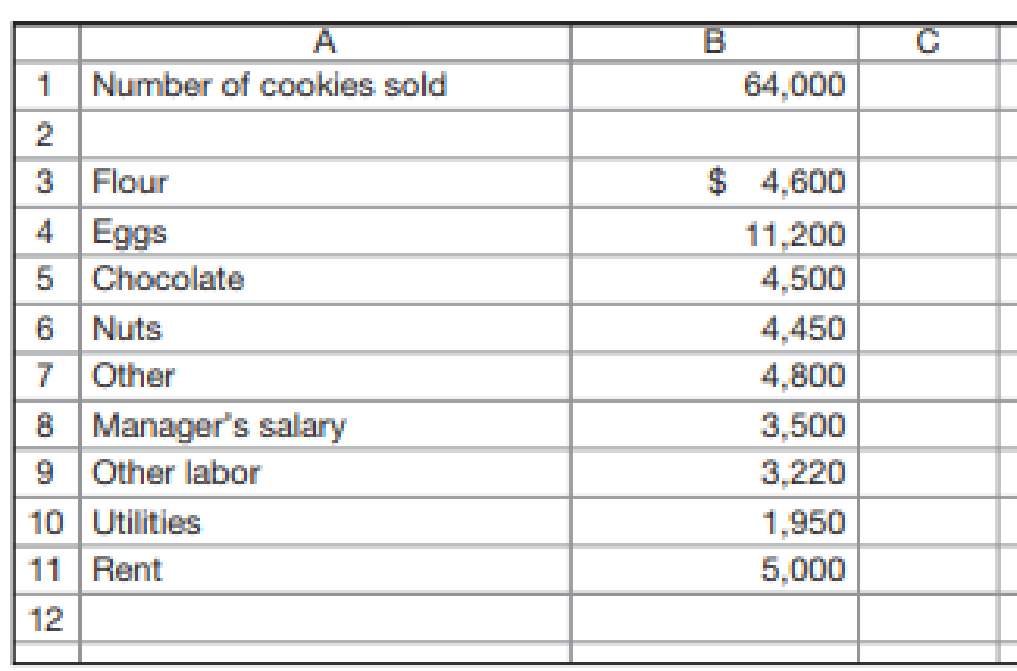

Refer to Exhibit 1.5, which shows budgeted versus actual costs. Assume that Carmen’s Cookies is preparing a budget for the month ending November 30. Management prepares the budget for the month ending November 30 by starting with the actual results for April that appear in Exhibit 1.5. Then, management considers what the differences in costs will be between April and November.

Management expects cookie sales to be 100 percent greater in November than in April because of the holiday season. Management expects that all food costs (e.g., flour, eggs) will be 120 percent higher in November than in April because of the increase in cookie sales and because prices for ingredients are generally higher in the high demand holiday months. Management expects “other” labor costs to be 120 percent higher in November than in April, partly because more labor will be required in November and partly because employees will get a pay raise. (120 percent higher means that the amount in November will be 220 percent of the amount in April.) The manager will get a pay raise that will increase the salary from $3,000 in April to $3,500 in November. Utilities will be 5 percent higher in November than in April. Rent will be the same in November as in April.

Now, move ahead to December and assume the following actual results occurred in November:

Required

- a. Prepare a statement like the one in Exhibit 1.5 that compares the budgeted and actual costs.

- b. Suppose that you have limited time to determine why actual costs are not the same as budgeted costs. Which three cost items would you investigate to see why actual and budgeted costs are different? Why would you choose those three costs?

Want to see the full answer?

Check out a sample textbook solution

Chapter 1 Solutions

GEN COMBO FUNDAMENTALS OF COST ACCOUNTING; CONNECT 1S ACCESS CARD

- Which of the following accounts is increased by a debit? A) RevenueB) Accounts PayableC) SuppliesD) Capitalcorrectarrow_forwardAccounting solutionarrow_forwardWhat does the matching principle require? A) Expenses should be recorded when paidB) Revenues should match cash inflowsC) Expenses should be recorded in the same period as related revenuesD) Only cash expenses should be recordedNeedarrow_forward

- What does the matching principle require? A) Expenses should be recorded when paidB) Revenues should match cash inflowsC) Expenses should be recorded in the same period as related revenuesD) Only cash expenses should be recordedno aiarrow_forwardWhat does the matching principle require? A) Expenses should be recorded when paidB) Revenues should match cash inflowsC) Expenses should be recorded in the same period as related revenuesD) Only cash expenses should be recordedarrow_forwardCan you solve with general accounting questionarrow_forward

- What does the matching principle require? A) Expenses should be recorded when paidB) Revenues should match cash inflowsC) Expenses should be recorded in the same period as related revenuesD) Only cash expenses should be recorded Correct solutionarrow_forwardWhat is recorded in a bank reconciliation? A) The difference between assets and liabilitiesB) Outstanding checks and deposits in transitC) Revenue and expensesD) Inventory levelscorrectarrow_forwardWhat is recorded in a bank reconciliation? A) The difference between assets and liabilitiesB) Outstanding checks and deposits in transitC) Revenue and expensesD) Inventory levelsneedarrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,