Cost Data for Managerial Purposes—Finding Unknowns

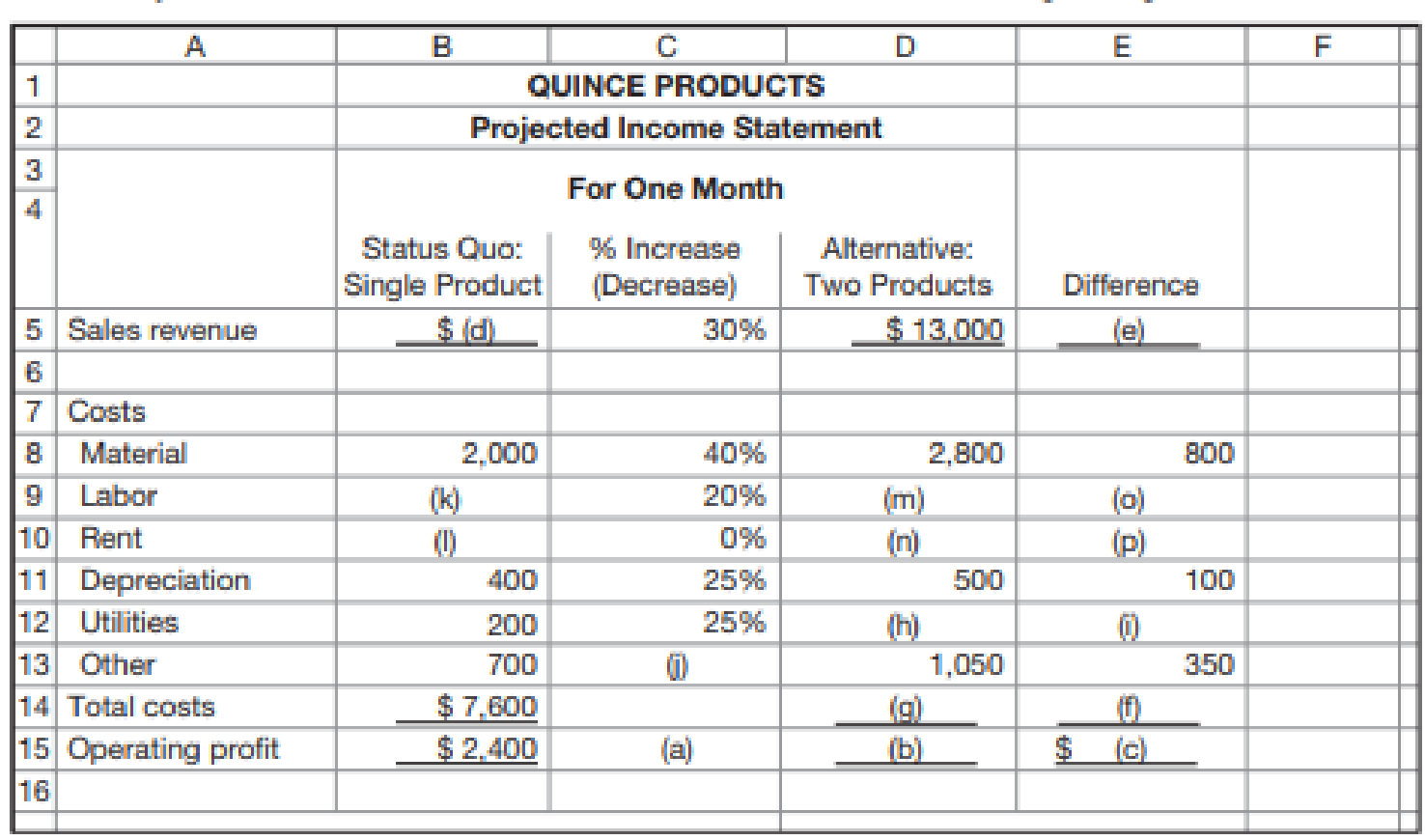

Quince Products is a small company in southern California that makes jams and preserves. Recently, a sales rep from one of the company’s suppliers suggested that Quince could increase its profitability by 50 percent if it introduced a second line of products, packaged fruit. She offered to do the analysis and show the company her assumptions.

When Quince’s management opened the spreadsheet sent by the sales rep, they noticed that there were several blank cells. In the meantime, the sales rep had taken a job with a competitor and told the managers at Quince that she could no longer advise them. Although they were not sure they should rely on the analysis, they asked you to see if you could reconstruct the sales rep’s analysis. They had been considering this new business already and wanted to see if their analysis was close to that of an outside observer. The incomplete spreadsheet follows.

Required

Fill in the blank cells.

Fill in the blank cells of the projected income statement.

Explanation of Solution

Projected income statement: The projected income statement represents the future financial position of the entity. The projected income statement is prepared with an objective of showing the financial results for a future period of time.

Fill in the blank cells of the projected income statement:

| Company Q | ||||

| Projected Income Statement | ||||

| For One Month | ||||

| Status Quo: | % Increase | Alternative | ||

| Single Product | Decrease | Two Products | Difference | |

| Sales revenue | $ 10,000 (d) | 30% | $ 13,000 | $ 3,000 (e) |

| Costs | ||||

| Material | $ 2,000 | 40% | $ 2,800 | $ 800 |

| Labor | $ 2,500 (k) | 20% | $ 3,000 (m) | $ 500 (o) |

| Rent | $ 1,800 (l) | 0% | $ 1,800 (n) |

|

| Depreciation | $ 400 | 25% | $ 500 | $ 100 |

| Utilities | $ 200 | 25% | $ 250 (h) | $ 50 (i) |

| Other | $ 700 | 50% (j) | $ 1,050 | $ 350 |

| Total costs | $ 7,600 | $ 9,400 (g) | $ 1,800 (f) | |

| Operating profit | $ 2,400 (a) | $ 3,600 (b) | $ 1,200 (c) | |

Working note 1:

Compute value of (a):

It is given that the profit has increased by 50%, (a) represent the % increase or decrease in profit.

Working note 2:

Compute value of (b):

Working note 3:

Compute value of (c):

Working note 4:

Compute value of (d):

Working note 5:

Compute value of (e):

Working note 5:

Compute value of (f):

Working note 6:

Compute value of (g):

Working note 6:

Compute value of (h):

Working note 7:

Compute value of (i):

Working note 8:

Compute value of (j):

Working note 8:

Compute value of (k):

Labor plus rent (single product):

Labor plus rent (two products):

Increase in labor:

Thus,

Working note 8:

Compute value of (l):

Working note 8:

Compute value of (m):

Working note 9:

Compute value of (n):

Working note 10:

Compute value of (o):

Working note 11:

Compute value of (p):

Want to see more full solutions like this?

Chapter 1 Solutions

Fundamentals of Cost Accounting

- Cullumber Company uses a job order cost system and applies overhead to production on the basis of direct labor costs. On January 1, 2025, Job 50 was the only job in process. The costs incurred prior to January 1 on this job were as follows: direct materials $16,800, direct labor $10,080, and manufacturing overhead $13,440. As of January 1, Job 49 had been completed at a cost of $75,600 and was part of finished goods inventory. There was a $12,600 balance in the Raw Materials Inventory account on January 1. During the month of January, Cullumber Company began production on Jobs 51 and 52, and completed Jobs 50 and 51. Jobs 49 and 50 were sold on account during the month for $102,480 and $132,720, respectively. The following additional events occurred during the month. 1. Purchased additional raw materials of $75,600 on account. 2. Incurred factory labor costs of $58,800. 3. Incurred manufacturing overhead costs as follows: depreciation expense on equipment $10,080; and various other…arrow_forwardCullumber Company uses a job order cost system and applies overhead to production on the basis of direct labor costs. On January 1, 2025, Job 50 was the only job in process. The costs incurred prior to January 1 on this job were as follows: direct materials $16,800, direct labor $10,080, and manufacturing overhead $13,440. As of January 1, Job 49 had been completed at a cost of $75,600 and was part of finished goods inventory. There was a $12,600 balance in the Raw Materials Inventory account on January 1. During the month of January, Cullumber Company began production on Jobs 51 and 52, and completed Jobs 50 and 51. Jobs 49 and 50 were sold on account during the month for $102,480 and $132,720, respectively. The following additional events occurred during the month. 1. Purchased additional raw materials of $75,600 on account. 2. Incurred factory labor costs of $58,800. 3. Incurred manufacturing overhead costs as follows: depreciation expense on equipment $10,080; and various other…arrow_forwardGeneral Accounting questionarrow_forward

- What Is the correct answer A B ?? General Accounting questionarrow_forwardCullumber Company uses a job order cost system and applies overhead to production on the basis of direct labor costs. On January 1, 2025, Job 50 was the only job in process. The costs incurred prior to January 1 on this job were as follows: direct materials $16,800, direct labor $10,080, and manufacturing overhead $13,440. As of January 1, Job 49 had been completed at a cost of $75,600 and was part of finished goods inventory. There was a $12,600 balance in the Raw Materials Inventory account on January 1. During the month of January, Cullumber Company began production on Jobs 51 and 52, and completed Jobs 50 and 51. Jobs 49 and 50 were sold on account during the month for $102,480 and $132,720, respectively. The following additional events occurred during the month. 1. Purchased additional raw materials of $75,600 on account. 2. Incurred factory labor costs of $58,800. 3. Incurred manufacturing overhead costs as follows: depreciation expense on equipment $10,080; and various other…arrow_forwardAccounting questionarrow_forward

- Determine the cost of the patent.arrow_forwardAccounting questionarrow_forwardMs. Sharon Washton was born 26 years ago in Bahn, Germany. She is the daughter of a Canadian High Commissioner serving in that country. However, Ms. Washton is now working in Prague, Czech Republic. The only income that she earns in the year is from her Prague marketing job, $55,000 annually, and is subject to income tax in Czech Republic. She has never visited Canada. Determine the residency status of Sharon Washtonarrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning