Concept explainers

Cost Data for Managerial Purposes

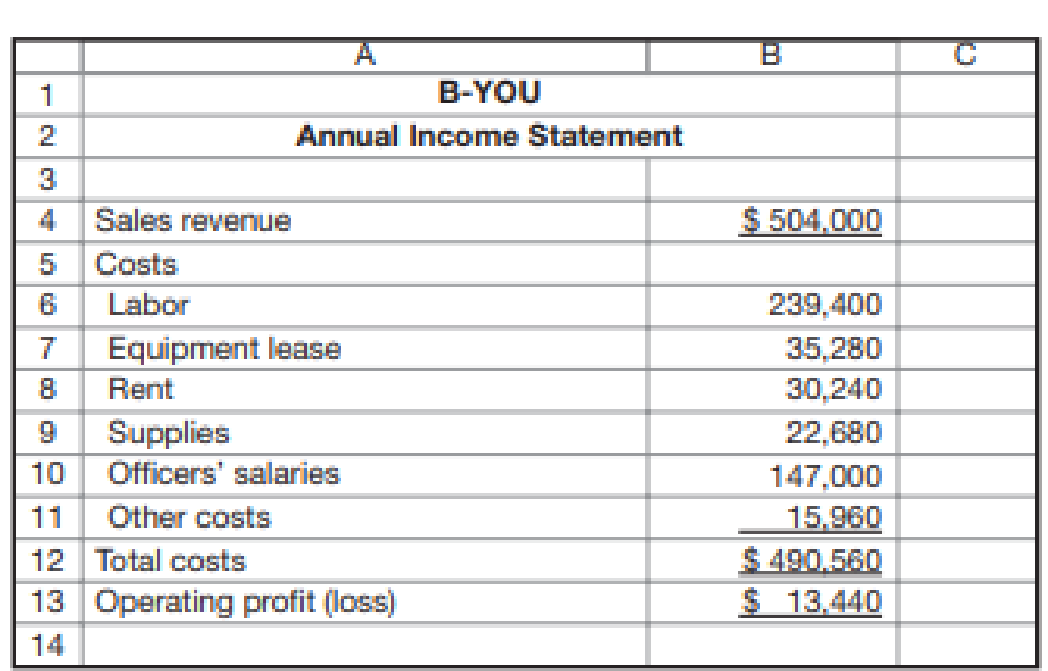

B-You is a consulting firm that works with managers to improve their interpersonal skills. Recently, a representative of a high-tech research firm approached B-You’s owner with an offer to contract for one year with B-You to improve the interpersonal skills of a newly hired manager. B-You reported the following costs and revenues during the past year:

If B-You decides to take the contract to help the manager, it will hire a full-time consultant at $85,000. Equipment lease will increase by 5 percent. Supplies will increase by an estimated 10 percent and other costs by 15 percent. The existing building has space for the new consultant. No new offices will be necessary for this work.

Required

- a. What are the differential costs that would be incurred as a result of taking the contract?

- b. If the contract will pay $90,000, should B-You accept it?

- c. What considerations, other than costs, do you think are necessary before making this decision?

Want to see the full answer?

Check out a sample textbook solution

Chapter 1 Solutions

COST ACCOUNTING W/CONNECT

Additional Business Textbook Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Intermediate Accounting (2nd Edition)

Financial Accounting, Student Value Edition (5th Edition)

Essentials of MIS (13th Edition)

Horngren's Accounting (12th Edition)

Management (14th Edition)

- If $27,000 was generated from operations, $15,000 was used for investing activities, and $11,000 was provided by financing activities, the cash balance would:arrow_forwardWhat is its ROE? Provide answer general accountingarrow_forwardhello teacher please solve questions financial accountingarrow_forward

- Nonearrow_forwardIf $27,000 was generated from operations, $15,000 was used for investing activities, and $11,000 was provided by financing activities, the cash balance would: help mearrow_forwardA stock is expected to pay a dividend of $2.75 at the end of the year and it should continue to grow at a constant rate of 5% a year. If its required return is 15%, what is the stock’s expected price 3 years from now? Carnes Cosmetics Co.’s stock price is $30, and it recently paid a dividend of $1.00. This dividend is expected to grow by 30% for the next three years, then grow forever at a constant rate of g%. If the company’s required rate of return is 9%, at what constant rate is the stock expected to grow after three years? Foodpanda is expected to pay the following dividends over the next four years: $5, $7, $3.75, and $4.26. Afterwards, the company pledges to maintain a constant 4.25% growth in dividends forever. If the required return on the stock is 9%, what is the current share price? Cardinal Corporation just paid a dividend of $15. However, the management expects to reduce the payout by 2% per year, indefinitely. If you require a return of 10% on this stock, how…arrow_forward

Essentials Of Business AnalyticsStatisticsISBN:9781285187273Author:Camm, Jeff.Publisher:Cengage Learning,

Essentials Of Business AnalyticsStatisticsISBN:9781285187273Author:Camm, Jeff.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning