EBK COLLEGE ACCOUNTING: A CAREER APPROA

13th Edition

ISBN: 9781337516525

Author: Scott

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 1, Problem 2PB

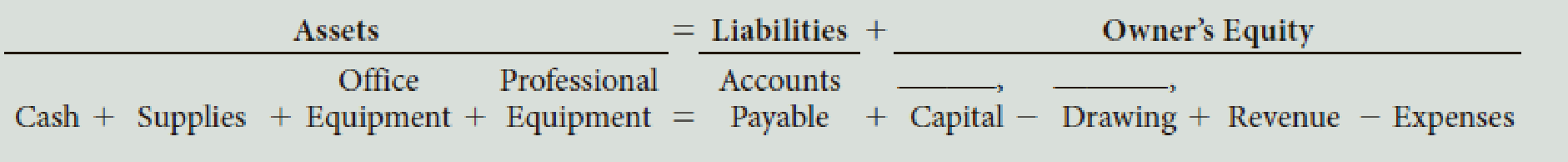

In March, K. Haas, M.D., established the Haas Sports Injury Clinic. The clinic’s account headings are presented below. Transactions completed during the month of March follow.

- a. Haas deposited $48,000 in a bank account in the name of the business.

- b. Paid the rent for the month, $2,200, Ck. No. 1000.

- c. Bought supplies for cash from Medco Co., $2,138.

- d. Bought professional equipment on account from Med-Tech Company, $18,000.

- e. Bought office equipment on account from Equipment Depot, $1,955.

- f. Sold professional services for cash, $8,960.

- g. Paid on account to Med-Tech Company, $3,000, Ck. No. 1001.

- h. Received and paid the bill for utilities, $472, Ck. No. 1002.

- i. Paid the salary of the assistant, $1,738, Ck. No. 1003.

- j. Sold professional services for cash, $10,196.

- k. Haas withdrew cash for personal use, $3,500, Ck. No. 1004

Required

- 1. Record the transactions and the balance after each transaction.

- 2. Total the left side of the

accounting equation (left side of the equal sign), then total the right side of the accounting equation (right side of the equal sign). If the two totals are not equal, check the addition and subtraction. If you still cannot find the error, re-analyze each transaction.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Novak supply company a newly formed corporation , incurred the following expenditures related to the land , to buildings, and to machinery and equipment.

abstract company's fee for title search $1,170

architect's fee $7,133

cash paid for land and dilapidated building thereon $195,750

removal of old building $45,000

LESS: salvage $12,375 $32,625

Interest on short term loans during construction…

Year

Cash Flow

0

-$ 27,000

1

11,000

2

3

14,000

10,000

What is the NPV for the project if the required return is 10 percent?

Note: Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.

NPV

$ 1,873.28

At a required return of 10 percent, should the firm accept this project?

No

Yes

What is the NPV for the project if the required return is 26 percent?

The following were selected from among the transactions completed by Babcock Company during November of the current year:

Nov.

3

Purchased merchandise on account from Moonlight Co., list price $85,000, trade discount 25%, terms FOB destination, 2/10, n/30.

4

Sold merchandise for cash, $37,680. The cost of the goods sold was $22,600.

5

Purchased merchandise on account from Papoose Creek Co., $47,500, terms FOB shipping point, 2/10, n/30, with prepaid freight of $810 added to the invoice.

6

Returned merchandise with an invoice amount of $13,500 ($18,000 list price less trade discount of 25%) purchased on November 3 from Moonlight Co.

8

Sold merchandise on account to Quinn Co., $15,600 with terms n/15. The cost of the goods sold was $9,400.

13

Paid Moonlight Co. on account for purchase of November 3, less return of November 6.

14

Sold merchandise with a list price of $236,000 to customers who used VISA and who redeemed $8,000 of pointof- sale coupons. The cost…

Chapter 1 Solutions

EBK COLLEGE ACCOUNTING: A CAREER APPROA

Ch. 1 - Prob. 1QYCh. 1 - Prob. 2QYCh. 1 - Which of the following accounts would increase...Ch. 1 - Which of the following statements is true? a....Ch. 1 - M. Parish purchased supplies on credit. What is...Ch. 1 - Define assets, liabilities, owners equity,...Ch. 1 - Prob. 2DQCh. 1 - How do Accounts Payable and Accounts Receivable...Ch. 1 - Describe two ways to increase owners equity and...Ch. 1 - What is the effect on the fundamental accounting...

Ch. 1 - When an owner withdraws cash or goods from the...Ch. 1 - Define chart of accounts and identify the...Ch. 1 - What account titles would you suggest for the...Ch. 1 - Prob. 1ECh. 1 - Determine the following amounts: a. The amount of...Ch. 1 - Dr. L. M. Patton is an ophthalmologist. As of...Ch. 1 - Describe a business transaction that will do the...Ch. 1 - Describe a transaction that resulted in each of...Ch. 1 - Label each of the following accounts as asset (A),...Ch. 1 - Describe a transaction that resulted in the...Ch. 1 - Describe the transactions that are recorded in the...Ch. 1 - On June 1 of this year, J. Larkin, Optometrist,...Ch. 1 - On July 1 of this year, R. Green established the...Ch. 1 - S. Davis, a graphic artist, opened a studio for...Ch. 1 - On March 1 of this year, B. Gervais established...Ch. 1 - In April, J. Rodriguez established an apartment...Ch. 1 - In July of this year, M. Wallace established a...Ch. 1 - In March, K. Haas, M.D., established the Haas...Ch. 1 - P. Schwartz, Attorney at Law, opened his office on...Ch. 1 - In March, T. Carter established Carter Delivery...Ch. 1 - In October, A. Nguyen established an apartment...Ch. 1 - Why Does It Matter? MACS CUSTOM CATERING, Eugene,...Ch. 1 - What Would You Say? A friend of yours wants to...Ch. 1 - Prob. 3A

Additional Business Textbook Solutions

Find more solutions based on key concepts

E6-14 Using accounting vocabulary

Learning Objective 1, 2

Match the accounting terms with the corresponding d...

Horngren's Accounting (12th Edition)

Opportunity cost of capital Which of the following statements are true? The opportunity cost of capital:

Equals...

PRIN.OF CORPORATE FINANCE

The flowchart for the process at the local car wash. Introduction: Flowchart: A flowchart is a visualrepresenta...

Principles of Operations Management: Sustainability and Supply Chain Management (10th Edition)

Explain how to derive a total expenditures (TE) curve.

Macroeconomics

Describe and evaluate what Pfizer is doing with its PfizerWorks.

Management (14th Edition)

Assume you are a CFO of a company that is attempting to race additional capital to finance an expansion of its ...

Financial Accounting, Student Value Edition (5th Edition)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY