Computing missing information using accounting knowledge

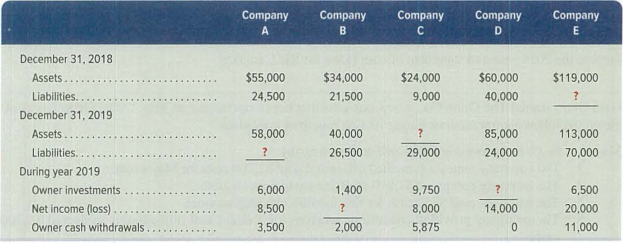

The following financial statement information is from five separate companies.

Required

1. Answer the following questions about Company A.

a. What is the amount of equity on December 31, 2018?

b. What is the amount of equity on December 31, 2019?

c. What is the amount of liabilities on December 3 I, 2019?

2. Answer the following questions about Company B.

a. What is the amount of equity on December 31, 2018?

b. What is the amount of equity on December 31, 2019?

c. What is net income for year 2019?

3. Compute the amount of assets for Company Con December 31,2019.

4. Compute the amount of owner investments for Company D during year 2019.

5. Compute the amount of liabilities for Company Eon December 31, 20 I 8.

1)

Calculate (a) the value of equity on December 31, 2018 (b) value of equity on December 31, 2019 (c) value of liabilities on December 31, 2019 for Company A.

Explanation of Solution

Liabilities:

Liabilities are an obligation of the business to pay to the creditors in future for the goods and services purchased on account or any for other financial benefit received. It can be current liabilities or a non-current liabilities depending upon the time period in which it is paid.

(a)

Calculate the value of equity on December 31, 2018.

Therefore, the value of equity as on December 31, 2018 is $30,500.

(b)

Calculate the value of equity on December 31, 2019.

Therefore, the value of equity as on December 31, 2019 is $41,500.

(c)

Calculate the value of liabilities on December 31, 2019.

Therefore, the value of liabilities as on December 31, 2019 is $16,500.

2)

Calculate (a) the value of equity on December 31, 2018 (b) value of equity on December 31, 2019 (c) value of net income for the year 2019 for Company B.

Explanation of Solution

(a)

Calculate the value of equity on December 31, 2018.

Therefore, the value of equity as on December 31, 2018 is $12,500.

(b)

Calculate the value of equity on December 31, 2019.

Therefore, the value of equity as on December 31, 2019 is $13,500.

(c)

Calculate the value of net income for the year 2019 for Company B.

Therefore, net income of Company B reported an amount of $1,600 during the year 2019.

3)

Calculate (a) the value of assets on December 31, 2019 for Company C.

Explanation of Solution

Calculate the value of assets on December 31, 2019 for Company C.

Therefore, the value of assets as on December 31, 2019 is $55,875.

Working notes:

Calculate the value of equity on December 31, 2018 of Company C.

Calculate the ending balance of equity of Company C.

4)

Calculate the Value of stock issuance during the year 2019 for Company D.

Explanation of Solution

Calculate the value of stock issuance of Company D for the year 2019.

Therefore, stock issuance of Company D reported an amount of $27,000 during the year 2018.

Working notes:

Calculate the value of equity on December 31, 2018 of Company D.

Calculate the ending balance of equity of Company D.

5)

Calculate the value of liabilities for December 31, 2018 for Company E.

Explanation of Solution

Calculate the value of liabilities of Company E for December 31, 2016.

Therefore, the value of liabilities as on December 31, 2018 is $91,500.

Working notes:

Calculate the value of equity on December 31, 2019.

Calculate the ending balance of equity.

Want to see more full solutions like this?

Chapter 1 Solutions

Principles of Financial Accounting.

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning  Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub

Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning