a.

The

a.

Answer to Problem 27PSB

Option 1

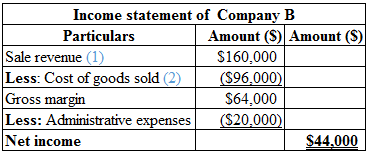

Calculation of income statement of Company B is as follows:

Table (1)

Hence, the net income of Company B is $44,000.

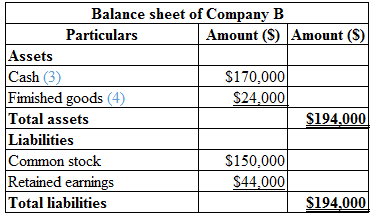

Calculation of balance sheet of Company B is as follows:

Table (2)

Option 2

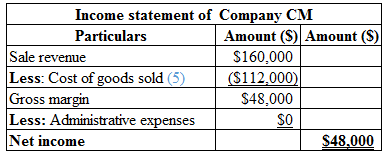

Calculation of income statement of Company B is as follows:

Table (3)

Hence, the net income of Company CM is $32,000.

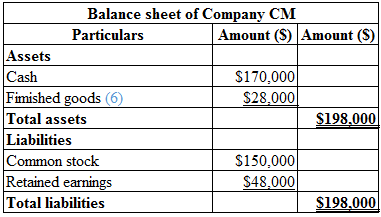

Calculation of balance sheet of Company B is as follows:

Table (4)

Explanation of Solution

Income statement:

Income statement is the financial statement of a company that shows all the revenues earned and expenses incurred by the company over a period of time.

Balance sheet:

Balance sheet is one of the financial statements that summarizes the assets, the liabilities, and the shareholder’s equity of a company at a given date. It is also known as the statement of financial status of the business.

Working notes:

Calculate the sale revenue:

Hence, the sales revenue is $160,000.

(1)

Calculate the cost per unit:

Hence, the cost per unit is $12.

Calculate the cost of goods sold:

Hence, the cost of goods sold is $96,000.

(2)

Calculate the total cash:

Hence, the total cash is $170,000.

(3)

Calculate the total finished goods:

Hence, the finished goods is $24,000.

(4)

Calculate the cost per unit:

Hence, the cost per unit is $14.

Calculate the cost of goods sold:

Hence, the cost of goods sold is $112,000.

(5)

Calculate the total finished goods:

Hence, the finished goods is $28,000.

(6)

b.

The option in the financial statement that gives a favourable image to the creditors and investors.

b.

Answer to Problem 27PSB

Option 2 is the financial statement that gives a favorable impression to the creditors and investors with a greater net income of $4,000 than option 1’s net income.

Explanation of Solution

Income statement:

Income statement is the financial statement of a company that shows all the revenues earned and expenses incurred by the company over a period of time.

Balance sheet:

Balance sheet is one of the financial statements that summarizes the assets, the liabilities, and the shareholder’s equity of a company at a given date. It is also known as the statement of financial status of the business.

The option that gives a favorable image to the creditors and investors is as follows:

Option 2 provides the financial statement that gives a favorable image to the creditors and investors because the net income in option 2 is greater than the net income in option 1.

c.

The amount of bonus under each option and recognize the option that provides the higher bonus.

c.

Answer to Problem 27PSB

Option 2 provides the president with a higher bonus of $4,800.

Explanation of Solution

Income statement:

Income statement is the financial statement of a company that shows all the revenues earned and expenses incurred by the company over a period of time.

Balance sheet:

Balance sheet is one of the financial statements that summarizes the assets, the liabilities, and the shareholder’s equity of a company at a given date. It is also known as the statement of financial status of the business.

Calculation of bonus under option 1 is as follows:

Hence, the bonus received by the president under option 1 is $4,400.

Calculation of bonus under option 2 is as follows:

Hence, the bonus received by the president under option 2 is $4,800.

d.

The amount of tax rate under each option and recognize which option pays less tax.

d.

Answer to Problem 27PSB

Option 1 minimizes the cost of income tax expenses for the company by $15,400.

Explanation of Solution

Calculation of income tax under option 1 is as follows:

Hence, the income tax expenses under option 1 is $15,400.

Calculation of income tax under option 2 is as follows:

Hence, the bonus received by the president under option 2 is $16,800.

e.

Comment on the conflict between the company’s president as determined by requirement c and the owner-based requirement d, and define an incentive compensation plan that would avoid the conflict.

e.

Explanation of Solution

The conflicts between the owner and the president are as follows:

Option 2 provides the president with a higher bonus of $4,800. Option 1 minimizes the cost of income tax expenses for the company by $15,400. These are the two conflicts between the owner and the president.

The reasons to avoid these conflicts are as follows:

- The bonus plans of the company can be tied up with the company’s stock price, instead of net income.

Market efficiency increases; as a result, the performance of the company increases, which creates a value to the company’s stock price.

Want to see more full solutions like this?

Chapter 1 Solutions

Fundamental Managerial Accounting Concepts

- PLEASE HELParrow_forwardOne company might depreciate a new computer over three years while another company might depreciate the same model computer over five years...and both companies are right. True Falsearrow_forwardno chatgpAccumulated Depreciation will appear as a deduction within the section of the balance sheet labeled as Property, Plant and Equipment. True Falsearrow_forward

- No ai Depreciation Expense is shown on the income statement in order to achieve accounting's matching principle. True Falsearrow_forwardno aiOne company might depreciate a new computer over three years while another company might depreciate the same model computer over five years...and both companies are right. True Falsearrow_forwardno ai An asset's useful life is the same as its physical life? True Falsearrow_forward

- no ai Depreciation Expense reflects an allocation of an asset's original cost rather than an allocation based on the economic value that is being consumed. True Falsearrow_forwardThe purpose of depreciation is to have the balance sheet report the current value of an asset. True Falsearrow_forwardDepreciation Expense shown on a company's income statement must be the same amount as the depreciation expense on the company's income tax return. True Falsearrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education