a.

The

a.

Answer to Problem 27PSA

Option 1

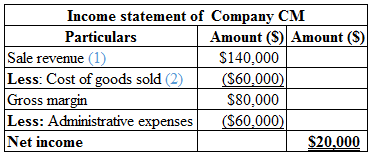

Calculation of income statement of Company CM is as follows:

Table (1)

Hence, the net income of Company CM is $20,000.

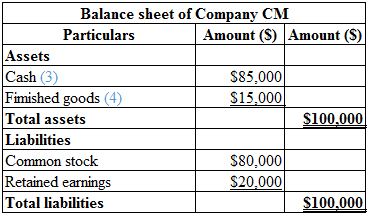

Calculation of balance sheet of Company CM is as follows:

Table (2)

Option 2

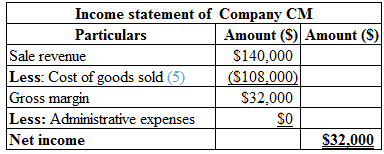

Calculation of income statement of Company CM is as follows:

Table (3)

Hence, the net income of Company CM is $32,000.

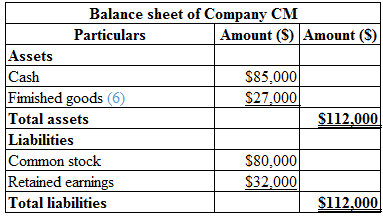

Calculation of balance sheet of Company CM is as follows:

Table (4)

Explanation of Solution

Income statement:

It is the financial statement of a company that shows all the incomes earned and expenditures incurred by the company for a particular period of time.

Balance sheet:

Balance sheet is one of the financial statements that summarizes the assets, the liabilities, and the shareholder’s equity of a company at a given date. It is also known as the statement of financial status of the business.

Working notes:

Calculate the sale revenue:

Sales revenue=Number of units sold×Price of each =4000 units×$35=$140,000

Hence, the sales revenue is $140,000.

(1)

Calculate the cost per unit:

Cost per unit=Materials+Labor+Overheads Total number of units produced=$75,0005000 units=$15

Hence, the cost per unit is $15.

Calculate the cost of goods sold:

Cost of goods sold=Cost per unit×Number of goods sold=$15×4,000 units=$60,000

Hence, the cost of goods sold is $60,000.

(2)

Calculate the total cash:

Total cash=Acquired capital+Sales revenue−Product cost−Planning cost=$80,000+$140,000−$75,000−$60,000 =$220,000−135,000=$85,000

Hence, the total cash is $85,000.

(3)

Calculate the total finished goods:

Finished goods=Cost per unit×Completed goods−Number of goods sold=$15×5,000 units−4,000 units=$15×1,000 units=$15,000

Hence, the finished goods is $15,000.

(4)

Calculate the cost per unit:

Cost per unit=Materials+Labor+Overheads+Planning cost Total number of units produced=$75,000+$60,0005000 units=$135,0005000 units=$27

Hence, the cost per unit is $27.

Calculate the cost of goods sold:

Cost of goods sold=Cost per unit×Number of goods sold=$27×4,000 units=$108,000

Hence, the cost of goods sold is $108,000.

(5)

Calculate the total finished goods:

Finished goods=Cost per unit×Completed goods−Number of goods sold=$27×5,000 units−4,000 units=$27×1,000 units=$27,000

Hence, the finished goods is $27,000.

(6)

b.

The option in the financial statement that gives a favourable image to the creditors and investors.

b.

Answer to Problem 27PSA

Option 2 is the financial statement that gives a favorable impression to creditors and investors with a greater net income of $12,000 than option 1’s net income.

Explanation of Solution

Income statement:

Income statement is the financial statement of a company that shows all the incomes gained and expenditures incurred by the company for a time period.

Balance sheet:

Balance sheet is one of the financial statements that summarizes the assets, the liabilities, and the shareholder’s equity of a company at a given date. It is also known as the statement of financial status of the business.

The option that gives the favorable image to the creditors and investors is as follows:

Option 2 provides the financial statement that gives a favorable image to the creditors and investors because the net income in option 2 is greater than the net income in option 1.

c.

The amount of bonus under each option and recognize the option that provides a higher bonus.

c.

Answer to Problem 27PSA

Option 2 provides the president with a higher bonus of $6,400.

Explanation of Solution

Income statement:

Income statement is the financial statement of a company that shows all the revenues earned and expenses incurred by the company over a period of time.

Balance sheet:

Balance sheet is one of the financial statements that summarizes the assets, the liabilities, and the shareholder’s equity of a company at a given date. It is also known as the statement of financial status of the business.

Calculation of bonus under option 1 is as follows:

Bonus=Net income×20% on net income=$20,000×20%=$4,000

Hence, the bonus received by the president under option 1 is $4,000.

Calculation of bonus under option 2 is as follows:

Bonus=Net income×20% on net income=$32,000×20%=$6,400

Hence, the bonus received by the president under option 2 is $6,400.

d.

The amount of tax rate under each option and recognize which option pays less tax.

d.

Answer to Problem 27PSA

Option 1 minimizes the cost of income tax expenses for the company by $6,000.

Explanation of Solution

Calculation of income tax under option 1 is as follows:

Bonus=Net income×30% income tax rate=$20,000×30%=$6,000

Hence, the income tax expenses under option 1 is $6,000.

Calculation of income tax under option 2 is as follows:

Bonus=Net income×30% income tax rate=$32,000×30%=$9,600

Hence, the bonus received by the president under option 2 is $9,600

e.

Comment on the conflict among the company’s president as determined in requirement c and the owner-based requirement d, and define an incentive compensation plan that will neglect the conflict.

e.

Explanation of Solution

The conflicts between the owner and the president are as follows:

Option 2 provides the president with a higher bonus of $6,400. Option 1 minimizes the cost of income tax expenses for the company by $6,000. These are the two conflicts between the owner and the president.

The reasons to avoid these conflicts are as follows:

- The bonus plans of the company can be tied up with the company’s stock price, instead of net income.

Market efficiency increases; as a result, the performance of the company increases, which creates a value to the company’s stock price.

Want to see more full solutions like this?

Chapter 1 Solutions

Fundamental Managerial Accounting Concepts

- Please show me how to solve this financial accounting problem using valid calculation techniques.arrow_forwardCould you help me solve this financial accounting question using appropriate calculation techniques?arrow_forwardCan you explain this general accounting question using accurate calculation methods?arrow_forward

- how much overhead cost would be assigned to product G98X using the activity based costing system ?arrow_forwardThe closing price of a stock is $74.55, and the net earnings per share are $3.50. The stock's P/E ratio is .arrow_forwardI need guidance with this general accounting problem using the right accounting principles.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education