Managerial Accounting: Tools for Business Decision Making 7e + WileyPLUS Registration Card

7th Edition

ISBN: 9781119036432

Author: Jerry J. Weygandt, Paul D. Kimmel, Donald E. Kieso

Publisher: Wiley (WileyPLUS Products)

expand_more

expand_more

format_list_bulleted

Textbook Question

thumb_up100%

Chapter 1, Problem 1.9E

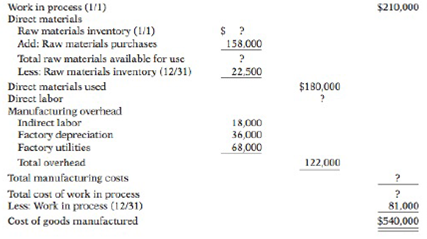

An incomplete cost of goods manufactured schedule is presented below.

HOBBIT COMPANY

Cost of Goods Manufactured Schedule

For the Year Ended December 31, 2017

Instructions

Complete the cost of goods manufactured schedule for Hobbit Company.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

general account

correct answer please

correct answer please help me

Chapter 1 Solutions

Managerial Accounting: Tools for Business Decision Making 7e + WileyPLUS Registration Card

Ch. 1 - Prob. 1QCh. 1 - Distinguish between managerial and financial...Ch. 1 - How do the content of reports and the verification...Ch. 1 - Prob. 4QCh. 1 - Decision-making is managements most important...Ch. 1 - Explain the primary difference between line...Ch. 1 - Prob. 7QCh. 1 - Prob. 8QCh. 1 - How are manufacturing costs classified?Ch. 1 - Mel Finney claims that the distinction between...

Ch. 1 - Tina Burke is confused about the differences...Ch. 1 - Identify the differences in the cost of goods sold...Ch. 1 - The determination of the cost of goods...Ch. 1 - Sealy Company has beginning raw materials...Ch. 1 - Tate Inc. has beginning work in process 26,000,...Ch. 1 - Using the data in Question 15, what are (a) the...Ch. 1 - In what order should manufacturing inventories be...Ch. 1 - How does the output of manufacturing operations...Ch. 1 - Discuss whether the product costing techniques...Ch. 1 - What is the value chain? Describe, in sequence,...Ch. 1 - What is an enterprise resource planning (HRP)...Ch. 1 - Why is product quality important for companies...Ch. 1 - Explain what is meant by balanced in the balanced...Ch. 1 - In what ways can the budgeting process create...Ch. 1 - What new rules were enacted under the...Ch. 1 - What is activity-based costing, and what are its...Ch. 1 - Distinguish between managerial and financial...Ch. 1 - Prob. 1.2BECh. 1 - Determine whether each of the following costs...Ch. 1 - Prob. 1.4BECh. 1 - Identify whether each of the following costs...Ch. 1 - Presented below are Rook Companys monthly...Ch. 1 - Francum Company has the following data: direct...Ch. 1 - In alphabetical order below are current asset...Ch. 1 - Presented below are incomplete manufacturing cost...Ch. 1 - Use the same data from BE1-9 above and the data...Ch. 1 - Prob. 1.11BECh. 1 - Prob. 1.1DICh. 1 - Identify managerial cost classifications. (LO 2),...Ch. 1 - The following information is available for Tomlin...Ch. 1 - Match the descriptions that follow with the...Ch. 1 - Justin Bleeber has prepared the following list of...Ch. 1 - Presented below is a list of costs and expenses...Ch. 1 - Trak Corporation incurred the following costs...Ch. 1 - Determine the total amount of various types of...Ch. 1 - Gala Company is a manufacturer of laptop...Ch. 1 - Prob. 1.6ECh. 1 - National Express reports the following costs and...Ch. 1 - Lopez Corporation incurred the following costs...Ch. 1 - An incomplete cost of goods manufactured schedule...Ch. 1 - Manufacturing cost data for Copa Company are...Ch. 1 - Incomplete manufacturing cost data for Horizon...Ch. 1 - Cepeda Corporation has the following cost records...Ch. 1 - Keisha Tombert, the bookkeeper for Washington...Ch. 1 - The following information is available for Aikman...Ch. 1 - University Company produces collegiate apparel....Ch. 1 - An analysis of the accounts of Roberts Company...Ch. 1 - McQueen Motor Company manufactures automobiles....Ch. 1 - The following is a list of terms related to...Ch. 1 - Prob. 1.1APCh. 1 - Bell Company, a manufacturer of audio systems,...Ch. 1 - Incomplete manufacturing costs, expenses, and...Ch. 1 - Prepare a cost of goods manufactured schedule, a...Ch. 1 - Empire Company is a manufacturer of smart phones....Ch. 1 - Prob. 1.1WPCh. 1 - Prob. 1.1BYPCh. 1 - Tenrack is a fairly large manufacturing company...Ch. 1 - Prob. 1.4BYPCh. 1 - The primary purpose of managerial accounting is to...Ch. 1 - As noted in this chapter, because of global...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Linden Corporation uses a predetermined overhead rate of $18.75 per direct labor hour. This predetermined rate was based on a cost formula that estimated $225,000 of total manufacturing overhead for an estimated activity level of 12,000 direct labor hours. During the period, the company incurred actual total manufacturing overhead costs of $210,000 and 11,200 total direct labor hours worked. Required: Determine the amount of manufacturing overhead that would have been applied to all jobs during the period.helparrow_forwardprovide correct answerarrow_forwardfinancial accountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Job Cost Sheet - Job Cost Accounting System; Author: Accounting Instruction, Help, & How To;https://www.youtube.com/watch?v=ElD8nKNXE1I;License: Standard Youtube License