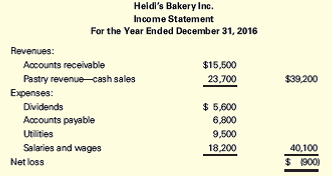

Corrected Financial Statements

Heidi’s Bakery Inc. operates a small pastry business. The company has always maintained a complete and accurate set of records. Unfortunately, the company’s accountant left in a dispute with the president and took the 2016 financial statements with her. The following

The president is very disappointed with the net loss for the year because net income has averaged $21,000 over the last ten years. He has asked for your help in determining whether the reported net loss accurately reflects the profitability of the company and whether the balance sheet is prepared correctly.

Required

- Prepare a corrected income statement for the year ended December 31, 2016.

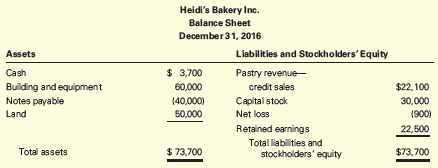

- Prepare a statement of

retained earnings for the year ended December 31, 2016. (The actual amount of retained earnings on January 1, 2016, was $39,900. The December 31, 2016, Retained Earnings balance shown is incorrect. The president simply “plugged in” this amount to make the balance sheet balance.) - Prepare a corrected balance sheet at December 31, 2016.

- Draft a memo to the president explaining the major differences between the income statement he prepared and the one you prepared.

Trending nowThis is a popular solution!

Chapter 1 Solutions

Bundle: Financial Accounting: The Impact on Decision Makers, Loose-Leaf Version, 10th Edition + LMS Integrated for CengageNOWv2â„¢, 1 term Printed Access Card

- Step 5. Determining goodwill or a gain on bargain purchase. At the acquisition date, the acquirer should recognize goodwill arising in a business combination. Goodwill is measured as the excess of (a) over (b) below: (a) the fair value of purchase considerations/cost of business combination transferred by the acquirer; (b) the net amount of identifiable assets acquired and the liabilities assumed at the acquisition-date. The excess of the cost of business combination over the fair value of net assets acquired represents goodwill. After initial recognition, goodwill is not subject to amortization. The standard-setting bodies consider that the useful life of acquired goodwill and the pattern in which it diminishes are not possible to predict, and thus the amount of goodwill amortized in any given period is an arbitrary estimate. Amortizing goodwill over an arbitrary period fails to provide useful information. Therefore, goodwill should not be amortized; rather it should be subject to an…arrow_forwardThe beginning inventory must have been__.arrow_forwardI want correct answer to this financial accounting questionarrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning