Concept explainers

Transactions; financial statements

D’Lite Dry Cleaners is owned and operated by Joel Palk. A building and equipment are currently being rented, pending expansion to new facilities. The actual work of dry cleaning is done by another company at wholesale rates. The assets, liabilities, and common stock of the business on July 1, 2018, are as follows: Cash, $45,000;

- A. Joel Palk invested additional cash in exchange for common stock with a deposit of $35,000 in the business bank account.

- B. Paid $50,000 for the purchase of land adjacent to land currently owned by D'Lite Dry Cleaners as a future building site.

C. Received cash from customers for dry cleaning revenue, $32,125.

- D. Paid rent for the month, $6,000.

- E. Purchased supplies on account, $2,500.

- F. Paid creditors on account, $22,800.

- G. Charged customers for dry cleaning revenue on account, $84,750.

- H. Received monthly invoice for dry cleaning expense for July (to be paid on August 10), $29,500.

- I. Paid the following: wages expense, $7,500; truck expense, $2,500; utilities expense, $ 1,300; miscellaneous expense, $2,700.

J. Received cash from customers on account $88,000.

K. Determined that the cost of supplies on hand was $5,900; therefore, the cost of supplies used during the month was $3,600.

L. Paid dividends, $ 12,000.

Instructions

1. Determine the amount of

2. State the assets, liabilities, and stockholders’ equity as of July 1 in equation form similar to that shown in this chapter. In tabular form below the equation, indicate increases and decreases resulting from each transaction and the new balances after each transaction.

3. Prepare an income statement for July, a retained earnings statement for July, and a

4. (Optional) Prepare a statement of

a)

Accounting equation: Accounting equation is an accounting tool expressed in the form of equation, by creating a relationship between the resources or assets of a company, and claims on the resources by the creditors and the owners. Accounting equation is expressed as shown below:

Assets = Liabilities + Shareholders Equity

The retained earnings for DD Cleaners as on July 1, 2018.

Explanation of Solution

Calculate the retained earnings for DD Cleaners as on July 1, 2018.

The retained earnings, for DD Cleaners as on July 1, 2018 are $120,000.

b)

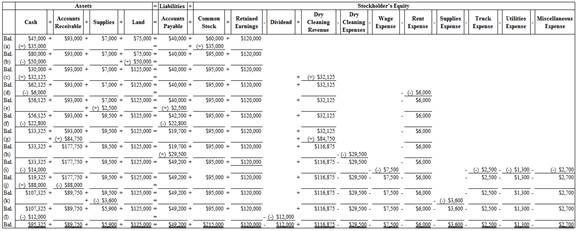

To Indicate: The effect of each given transaction of DD Cleaners on the accounting equation.

Explanation of Solution

Business transaction: Business transaction is a record of any economic activity, resulting in the change in the value of the assets, the liabilities, and the Shareholder’s equities, of a business. Business transaction is also referred to as financial transaction.

Indicate the effect of the given transactions of DD Cleaners.

(Figure – 1)

c)

To Prepare: The financial statements for DD Cleaners for the month ended July 31, 2018.

Explanation of Solution

Financial statements: Financial statements refer to those statements, which are prepared by the Company according to particular formats in accounting to show its financial position.

Financial statements include the following statements:

Income statement: Income statement is a financial statement that shows the net income or net loss by deducting the expenses from the revenues and vice versa.

Prepare the income statement of DD Cleaners for the month ended July 31, 2018.

| DD Cleaners | ||

| Income Statement | ||

| For the month ended July 31, 2018 | ||

| Particulars | Amount ($) | Amount ($) |

| Revenues | ||

| Dry cleaning revenue | $116,875 | |

| Expenses | ||

| Dry Cleaning expense | $29,500 | |

| Wages expense | $7,500 | |

| Rent expense | $6,000 | |

| Supplies expense | $3,600 | |

| Truck expense | $2,500 | |

| Utilities expense | $1,300 | |

| Miscellaneous expense | $2,700 | |

| Total expenses | $53,100 | |

| Net income | $63,775 | |

Table (1)

Hence, the net income of DD Cleaners for the month ended July 31, 2018 is $63,775.

Statement of Retained Earnings: Statement of retained earnings shows, the changes in the retained earnings, and the income left in the company after payment of the dividends, for the accounting period.

Prepare the statement of Retained earnings for DD Cleaners for the month ended July 31, 2018.

| DD Cleaners | ||

| Statement of Retained Earnings | ||

| For the month ended July 31, 2018 | ||

| Particulars | Amount ($) | Amount ($) |

| Retained earnings, July 1, 2018 | $120,000 | |

| Net income for the year | $63,775 | |

| Deduct - Dividends | $12,000 | |

| Increase in Retained earnings | $51,775 | |

| Retained earnings, April 30, 2018 | $171,775 | |

Table (2)

Hence, the retained earnings of DD Cleaners for the month ended July 31, 2018 are $171,775.

Balance Sheet: Balance Sheet summarizes the assets, the liabilities, and the Shareholder’s equity of a company at a given date. It is also known as the statement of financial status of the business.

Prepare the balance sheet of DD Cleaners for the month ended July 31, 2018.

| DD Cleaners | ||

| Balance Sheet | ||

| July 31, 2018 | ||

| Particulars | Amount ($) | Amount ($) |

| Assets | ||

| Current Assets | ||

| Cash | $95,325 | |

| Accounts receivable | $89,750 | |

| Supplies | $5,900 | |

| Land | $125,000 | |

| Total current assets | $315,975 | |

| Liabilities and Stockholders’ Equity | ||

| Liabilities | ||

| Accounts payable | $49,200 | |

| Owner's equity | ||

| Common Stock | $95,000 | |

| Retained earnings | $171,775 | |

| Total liabilities and stockholders’ equity | $315,975 | |

Table (3)

The balance sheet of DD Cleaners shows asset balance of $315,975 which is same as the balance of liabilities and owner's equity.

d)

To Prepare: The statement of cash flow for DD Cleaners for the month ended July 31, 2018.

Answer to Problem 1.5APR

Statement of cash flows: This statement reports all the cash transactions which are responsible for inflow and outflow of cash, and result of these transactions is reported as ending balance of cash at the end of reported period.

Prepare the statement of cash flows for DD Cleaners for the month ended July 31, 2018.

| DD Cleaners | ||

| Statement of Cash Flows | ||

| For the month ended July 31, 2018 | ||

| Particulars | Amount ($) | Amount ($) |

| Cash flows from operating activities: | ||

| Cash receipts from customers | $120,125 | |

| Cash payments for expenses (1) | $20,000 | |

| Payments to creditors | $22,800 | $42,800 |

| Net cash flow used for operating activities | $77,325 | |

| Cash flows from investing activities: | ||

| Cash payment for purchase of land | (-) $50,000 | |

| Cash flows from financing activities: | ||

| Cash receipt of owner’s investment | $35,000 | |

| Deduct - Withdrawals | (-) $12,000 | |

| Net cash flow from financing activities | $23,000 | |

| Net Increase in cash during July | $50,325 | |

| Cash Balance on July 1, 2018 | $45,000 | |

| Cash Balance on July 31, 2018 | $95,325 | |

Table (4)

The statement of cash flows for DD Cleaners for the month ended July 31, 2018, shows cash balance of $95,325 on July 31, 2018

Explanation of Solution

Working Note:

Calculate the expenses made through cash payments.

Want to see more full solutions like this?

Chapter 1 Solutions

Working Papers for Warren/Reeve/Duchac's Corporate Financial Accounting, 14th

- Give correct Answer! If image is blurr or data is unclear then plz comment i will write values or upload a new image. i will give unhelpful if you will use incorrect data.arrow_forwardAbbott Company uses the allowance method of accounting for uncollectible receivables. Abbott estimates that 3% of credit sales will be uncollectible. On January 1, Allowance for Doubtful Accounts had a credit balance of $3,300. During the year, Abbott wrote off accounts receivable totaling $2,100 and made credit sales of $113,000. After the adjusting entry, the December 31 balance in Bad Debt Expense will be .... a. 3300 b. 3390 c. 4590 d. 6690arrow_forwardDo fast answer of this accounting questionsarrow_forward

- Need help with this question solution general accountingarrow_forwardSunshine Blender Company sold 7,000 units in October at a sales price of $40 per unit. The variable cost is $25 per unit. Calculate the total contribution margin. OA. $280,000 OB. $105,000 OC. $87,500 OD. $175,000arrow_forwardI want to correct answer general accounting questionarrow_forward

- Five I + Beginning Work-in-Process Inventory Cost of Goods Manufactured Cost of Goods Sold Direct Labor Direct Materials Used Ending Work-in-Process Inventory Finished Goods Inventory 4 of 35 > manufactured. Use the followin Process Inventory, $32,800; an Total Manufacturing Costs Incurred during Period Total Manufacturing Costs to Account Forarrow_forwardDon't use ai given answer accounting questionsarrow_forwardRequirement 1. For a manufacturing company, identify the following as either a product cost or a period cost: Period cost Product cost a. Depreciation on plant equipment Depreciation on salespersons' automobiles Insurance on plant building Marketing manager's salary Direct materials used Manufacturing overhead g. Electricity bill for human resources office h. Production employee wagesarrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage