Survey of Accounting - With CengageNOW 1Term

8th Edition

ISBN: 9781337379823

Author: WARREN

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 1, Problem 1.4.1MBA

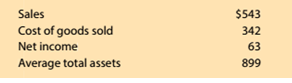

Return on assets

The following data (in millions) were adapted from recent financial statements of Tootsie Roll Industries Inc. (TR):

What is Tootsie Roll’s percent of the cost of sales to sales? Round to one decimal place.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Hello tutor please provide this question solution general accounting

Tip Top Coro ABC Answer

What is the amount of the ending inventory?

Chapter 1 Solutions

Survey of Accounting - With CengageNOW 1Term

Ch. 1 - Prob. 1SEQCh. 1 - The resources owned by a business are called: A....Ch. 1 - A listing of a business entity’s assets,...Ch. 1 - If total assets are $20,000 and total liabilities...Ch. 1 - Prob. 5SEQCh. 1 - Prob. 1CDQCh. 1 - Prob. 2CDQCh. 1 - Prob. 3CDQCh. 1 - Prob. 4CDQCh. 1 - Prob. 5CDQ

Ch. 1 - Prob. 6CDQCh. 1 - Prob. 7CDQCh. 1 - Prob. 8CDQCh. 1 - Prob. 9CDQCh. 1 - Prob. 10CDQCh. 1 - Briefly describe the nature of the information...Ch. 1 - Prob. 12CDQCh. 1 - What particular item of financial or operating...Ch. 1 - Prob. 14CDQCh. 1 - On October 1, Wok Repair Service extended an offer...Ch. 1 - Prob. 16CDQCh. 1 - Prob. 1.1ECh. 1 - Prob. 1.2ECh. 1 - accounting equation The total assets and total...Ch. 1 - accounting equation The total assets and total...Ch. 1 - accounting equation Determine the missing amount...Ch. 1 - accounting equation Determine the missing amounts...Ch. 1 - Net income and dividends The income statement of a...Ch. 1 - Net income and stockholders’ equity for four...Ch. 1 - Accounting equation and Income statement Staples,...Ch. 1 - Prob. 1.10ECh. 1 - Income statement items Based on the data presented...Ch. 1 - Financial statement items Identify each of the...Ch. 1 - Statement of stockholders’ equity Financial...Ch. 1 - Income statement Maynard Services was organized on...Ch. 1 - Prob. 1.15ECh. 1 - Balance sheets, net income Financial information...Ch. 1 - Financial statements Each of the following items...Ch. 1 - Statement of cash flows Indicate whether each of...Ch. 1 - Prob. 1.19ECh. 1 - Statement of cash flows Looney Inc. was organized...Ch. 1 - Prob. 1.21ECh. 1 - Financial statement items Amazon.com, Inc., (AMZN)...Ch. 1 - Income statement Based on the Amazon.com, Inc.,...Ch. 1 - Financial statement items Though the McDonald’s...Ch. 1 - Financial statements Outlaw Realty, organized...Ch. 1 - Accounting concepts Match each of the following...Ch. 1 - Prob. 1.27ECh. 1 - Income statement, retained earnings statement, and...Ch. 1 - Income statement, retained earnings statement, and...Ch. 1 - Income statement, retained earnings statement, and...Ch. 1 - Prob. 1.2.1PCh. 1 - Missing amounts from financial statements Obj.4...Ch. 1 - Income statement, retained earnings statement, and...Ch. 1 - Income statement, retained earnings statement, and...Ch. 1 - Income statement, retained earnings statement, and...Ch. 1 - Statement of cash flows The following cash data...Ch. 1 - Financial statements, including statement of cash...Ch. 1 - Financial statements, including statement of cash...Ch. 1 - Financial statements, including statement of cash...Ch. 1 - Financial statements, including statement of cash...Ch. 1 - Quantitative metrics Interpublic Group of...Ch. 1 - Prob. 1.1.2MBACh. 1 - Quantitative metrics JetBlue Airways Corporation...Ch. 1 - Prob. 1.2.2MBACh. 1 - Return on assets The financial statements of The...Ch. 1 - Prob. 1.3.2MBACh. 1 - Prob. 1.3.3MBACh. 1 - Prob. 1.3.4MBACh. 1 - Return on assets The financial statements of The...Ch. 1 - Return on assets The financial statements of The...Ch. 1 - Return on assets The financial statements of The...Ch. 1 - Return on assets The following data (in millions)...Ch. 1 - Return on assets The following data (in millions)...Ch. 1 - Return on assets The following data (in millions)...Ch. 1 - Prob. 1.4.4MBACh. 1 - Return on assets The following data (in millions)...Ch. 1 - Return on assets Pfizer Inc. (PFE) discovers,...Ch. 1 - Return on assets Pfizer Inc. (PFE) discovers,...Ch. 1 - Prob. 1.5.3MBACh. 1 - Prob. 1.6.1MBACh. 1 - Return on assets ExxonMobil Corporation (XOM)...Ch. 1 - Return on assets ExxonMobil Corporation (XOM)...Ch. 1 - Return on assets Tiffany & Co. (TIF) designs and...Ch. 1 - Return on assets Tiffany & Co. (TIF) designs and...Ch. 1 - Prob. 1.1CCh. 1 - Ethics and professional conduct in business...Ch. 1 - Prob. 1.2.2CCh. 1 - How businesses make money Assume that you are the...Ch. 1 - How businesses make money Assume that you are the...Ch. 1 - How businesses make money Assume that you are the...Ch. 1 - Prob. 1.4CCh. 1 - The accounting equation Review financial...Ch. 1 - Prob. 1.6C

Additional Business Textbook Solutions

Find more solutions based on key concepts

How is activity-based costing useful for pricing decisions?

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Fundamental and Enhancing Characteristics. Identify whether the following items are fundamental characteristics...

Intermediate Accounting (2nd Edition)

Much of risk management consists of reducing risky behavior. What kinds of risky behavior have you observed amo...

Understanding Business

The Warm and Toasty Heating Oil Company used to deliver heating oil by sending trucks that printed out a ticket...

Essentials of MIS (13th Edition)

To what does the lifetime value of the customer refer, and how is it calculated?

MARKETING:REAL PEOPLE,REAL CHOICES

A case study in this chapter discusses the federal minimum-wage law. a. Suppose the minimum wage is above the e...

Principles of Economics (MindTap Course List)

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Markup and Markdown; Author: GreggU;https://www.youtube.com/watch?v=EFtodgI46UM;License: Standard Youtube License