Concept explainers

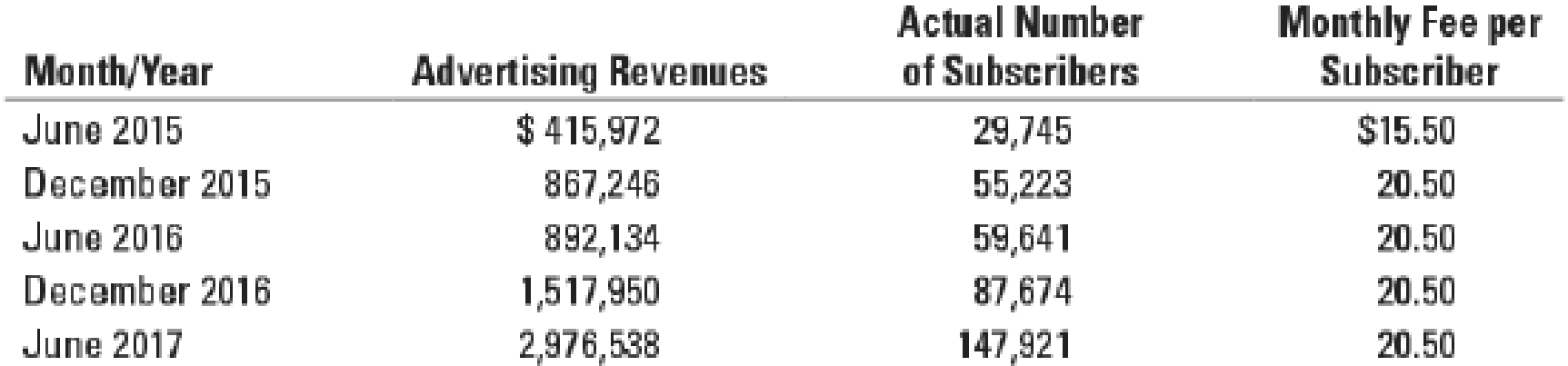

Planning and control decisions, Internet company. PostNews.com offers its subscribers several services, such as an annotated TV guide and local-area information on weather, restaurants, and movie theaters. Its main revenue sources are fees for banner advertisements and fees from subscribers. Recent data are as follows:

The following decisions were made from June through October 2017:

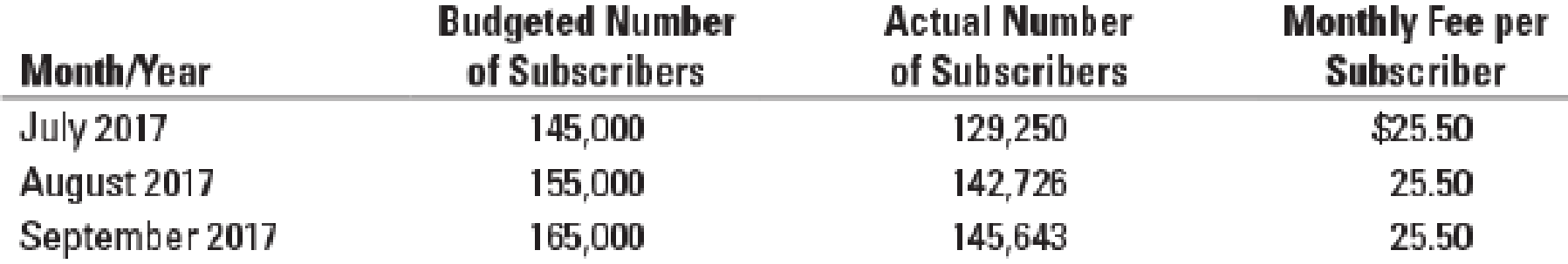

- a. June 2017: Raised subscription fee to $25.50 per month from July 2017 onward. The budgeted number of subscribers for this monthly fee is shown in the following table.

- b. June 2017: Informed existing subscribers that from July onward, monthly fee would be $25.50.

- c. July 2017: Offered e-mail service to subscribers and upgraded other online services.

- d. October 2017: Dismissed the vice president of marketing after significant slowdown in subscribers and subscription revenues, based on July through September 2017 data in the following table.

- e. October 2017: Reduced subscription fee to $22.50 per month from November 2017 onward.

Results for July-September 2017 are as follows:

- 1. Classify each of the decisions (a–e) as a planning or a control decision.

Required

- 2. Give two examples of other planning decisions and two examples of other control decisions that may be made at PostNews.com.

Want to see the full answer?

Check out a sample textbook solution

Chapter 1 Solutions

EBK HORNGREN'S COST ACCOUNTING

Additional Business Textbook Solutions

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Marketing: An Introduction (13th Edition)

Essentials of Corporate Finance (Mcgraw-hill/Irwin Series in Finance, Insurance, and Real Estate)

Intermediate Accounting (2nd Edition)

Horngren's Accounting (12th Edition)

Financial Accounting, Student Value Edition (5th Edition)

- Need help with this financial accounting questionarrow_forwardGary Watson, a graduating business student at a small college, is currently interviewing for a job. Gary was invited by both Tilly Manufacturing Company and Watson Supply Company to travel to a nearby city for an interview. Both companies have offered to pay Gary's expenses. His total expenses for the trip were $96 for mileage on his car and $45 for meals. As he prepares the letters requesting reimbursement, he is considering asking for the total amount of the expenses from both employers. His rationale is that if he had taken separate trips, each employer would have had to pay that amount. Who are the parties that are directly affected by this ethical dilemma? multiple choice 1 Tilly Manufacturing Company Watson Supply Company Both the employers Are the other students at the college potentially affected by Gary's decision? multiple choice 2 Yes No Are the professors at the college potentially affected by Gary's decision? multiple choice 3 Yes No…arrow_forwardSolve with accounting explanationarrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning