Principles of Accounting

12th Edition

ISBN: 9781133626985

Author: Belverd E. Needles, Marian Powers, Susan V. Crosson

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 1, Problem 10AP

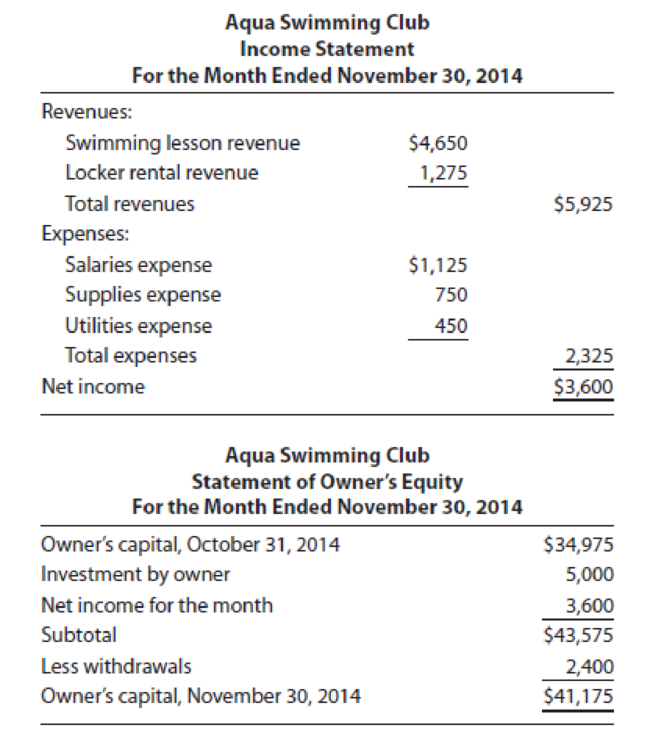

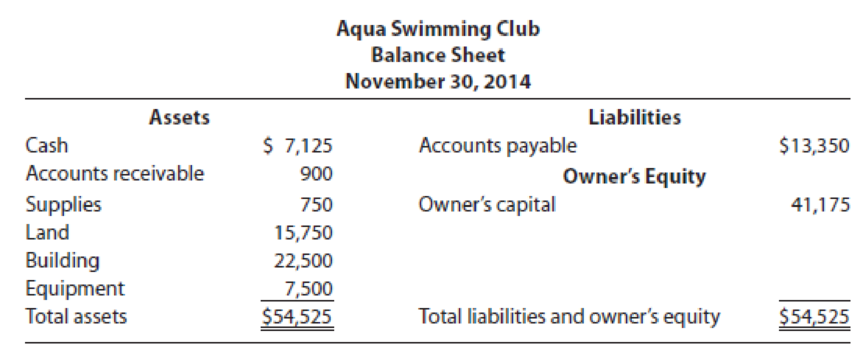

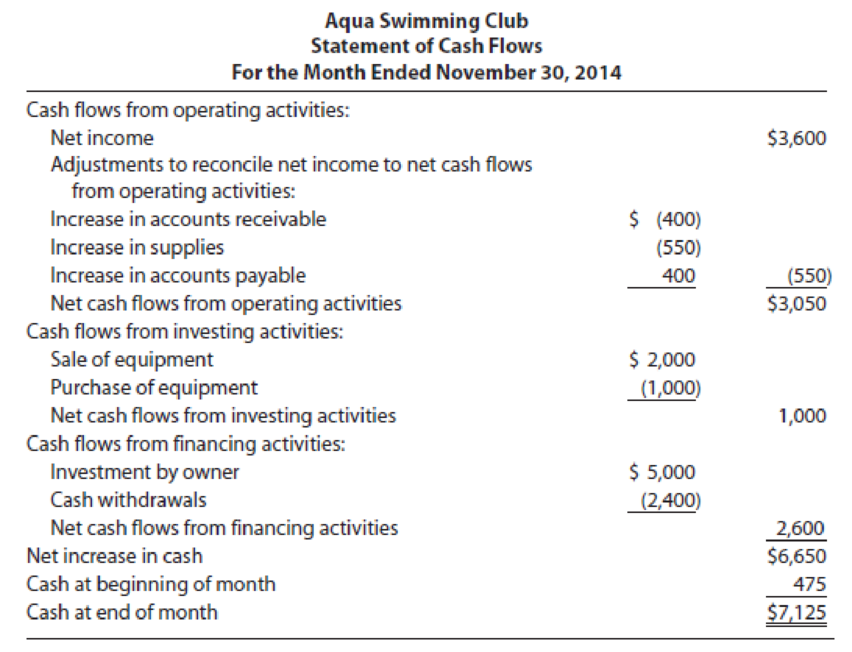

Aqua Swimming Club’s financial statements follow.

REQUIRED

- 1. ACCOUNTING CONNECTION ▶ Explain how Aqua Swimming Club’s four statements relate to each other.

- 2. BUSINESS APPLICATION ▶ Which statements are most closely associated with the goals of liquidity and profitability? Why?

- 3. BUSINESS APPLICATION ▶ If you were the owner of this business, how would you evaluate the company’s performance? Give specific examples.

- 4. ACCOUNTING CONNECTION ▶ If you were a banker considering Aqua Swimming Club for a loan, why might you want the company to be audited by an independent CPA? What would the audit tell you?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Neither Joe nor Jessie is blind or over age 65, and they plan to file as married joint. Assume that the employer portion of the self-employment tax on Jessie's income is $831. Joe and Jessie have summarized the income and expenses they expect to report this year as follows:

Income:

Joe's salary

$ 144,100

Jessie's craft sales

18,400

Interest from certificate of deposit

1,650

Interest from Treasury bond funds

716

Interest from municipal bond funds

920

Expenditures:

Federal income tax withheld from Joe's wages

$ 13,700

State income tax withheld from Joe's wages

6,400

Social Security tax withheld from Joe's wages

7,482

Real estate taxes on residence

6,200

Automobile licenses (based on weight)

310

State sales tax paid

1,150

Home mortgage interest

26,000

Interest on Masterdebt credit card

2,300

Medical expenses (unreimbursed)

1,690

Joe's employee expenses (unreimbursed)

2,400

Cost of…

Need General Accounting Question solution

Give me correct option? General accounting question

Chapter 1 Solutions

Principles of Accounting

Ch. 1 - What makes accounting a valuable discipline?Ch. 1 - Prob. 2DQCh. 1 - Prob. 3DQCh. 1 - How are expenses and withdrawals similar, and how...Ch. 1 - How do generally accepted accounting principles...Ch. 1 - Why do managers in governmental and not-for-profit...Ch. 1 - Prob. 1SECh. 1 - Match the descriptions that follow with the...Ch. 1 - Determine the amount missing from each accounting...Ch. 1 - Use the accounting equation to answer each...

Ch. 1 - Use the accounting equation to answer each...Ch. 1 - Prob. 6SECh. 1 - Use the following accounts and balances to prepare...Ch. 1 - Randall Company engaged in activities during the...Ch. 1 - Prob. 9SECh. 1 - Prob. 10SECh. 1 - Prob. 1EACh. 1 - Financial accounting uses money measures to gauge...Ch. 1 - You have been asked to compare the sales and...Ch. 1 - Use the accounting equation to answer each...Ch. 1 - Daiichi Companys total assets and liabilities at...Ch. 1 - 1. Indicate whether each of the following accounts...Ch. 1 - Listed in random order are some of Oxford Services...Ch. 1 - Dukakis Company had the following accounts and...Ch. 1 - Prob. 9EACh. 1 - Prob. 10EACh. 1 - Complete the financial statements that follow by...Ch. 1 - Prob. 12EACh. 1 - Match the terms that follow with the appropriate...Ch. 1 - Prob. 14EACh. 1 - Prob. 15EACh. 1 - Prob. 1PCh. 1 - The following three independent sets of financial...Ch. 1 - Fuel Designs financial accounts follow. The...Ch. 1 - The accounts of Frequent Ad, an agency that...Ch. 1 - Athena Riding Clubs financial statements follow.Ch. 1 - A list of financial statement items follows....Ch. 1 - Three independent sets of financial statements...Ch. 1 - Prob. 8APCh. 1 - Prob. 9APCh. 1 - Aqua Swimming Clubs financial statements follow....Ch. 1 - Costco Wholesale Corporation is Americas largest...Ch. 1 - Prob. 2CCh. 1 - Prob. 3CCh. 1 - Prob. 4CCh. 1 - Refer to the CVS annual report and the financial...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Need Answer of this General Accounting Question solutionarrow_forwardHow does stewardship accounting differ from traditional ownership accounting? a) Management decisions have no impact b) Legal ownership determines all treatments c) Resource management priorities supersede ownership rights d) Only shareholders matterarrow_forwardWhat are total assets at the end of the year on these financial accounting question?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

ACCOUNTING BASICS: Debits and Credits Explained; Author: Accounting Stuff;https://www.youtube.com/watch?v=VhwZ9t2b3Zk;License: Standard Youtube License