Your firm has the following structure: you own all the shares of the Dixit paper cup company. Dixit has $2,000,000 of outstanding perpetual debt with a 10% coupon selling at par. Dixit is currently selling paper cups which produce earnings before interest of $210,000 per year. You receive the following offer from your engineer friend. He would help you liquidate Dixit’s assets and with the proceeds you could build solar powered scooters. Your financing would remain the same. You believe that there is a 75% chance that solar powered scooters would not be particularly successful. In this case they would generate only $100/year. However, there is a 25% chance that solar powered scooters would be very successful. In this case they would generate $500,000 per year. Assume your equity discount rate is 15%. Assume the firm pays no taxes. b) What is the value of the solar powered scooters investment assuming a 15% discount rate? c) What is the value of your equity under each of these projects? d) Does undertaking the scooter project increase your equity value? e) What type of covenants will your creditors demand next time they lend you money

) Your firm has the following structure: you own all the shares of the Dixit paper cup company. Dixit has $2,000,000 of outstanding perpetual debt with a 10% coupon selling at par. Dixit is currently selling paper cups which produce earnings before interest of $210,000 per year. You receive the following offer from your engineer friend. He would help you liquidate Dixit’s assets and with the proceeds you could build solar powered scooters. Your financing would remain the same. You believe that there is a 75% chance that solar powered scooters would not be particularly successful. In this case they would generate only $100/year. However, there is a 25% chance that solar powered scooters would be very successful. In this case they would generate $500,000 per year. Assume your equity discount rate is 15%. Assume the firm pays no taxes.

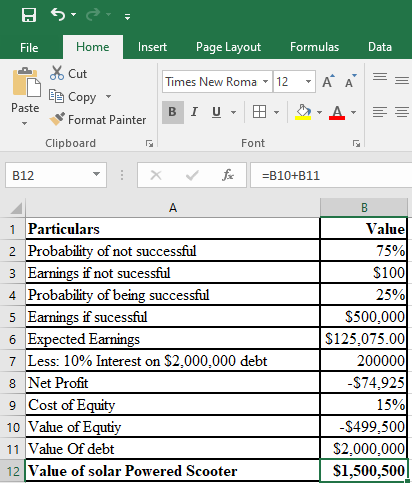

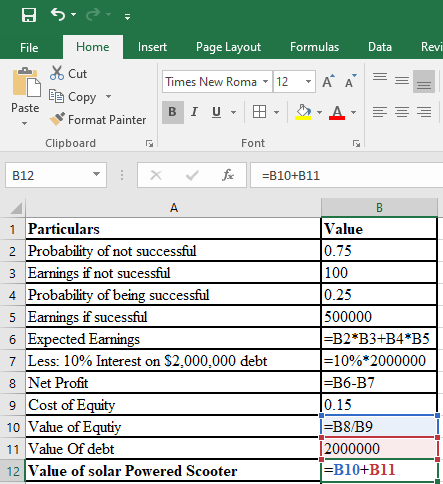

b) What is the value of the solar powered scooters investment assuming a 15% discount rate?

c) What is the value of your equity under each of these projects?

d) Does undertaking the scooter project increase your equity value?

e) What type of covenants will your creditors demand next time they lend you money?

Hello. Since your question has multiple sub-parts, we will solve first three sub-parts for you. If you want remaining sub-parts to be solved, then please resubmit the whole question and specify those sub-parts you want us to solve.

Value of the Solar Powered Scooters is shown below:

Formula sheet for the above calculation is shown below:

Step by step

Solved in 4 steps with 4 images