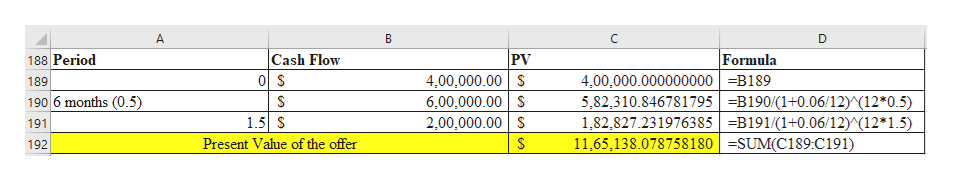

Coming Up Roses has grown into a very successful business and you have just received an offer from someone to purchase the business from you for $1.2 million. The potential buyer has offered you $400,000 at the time of sale, $600,000 at the end of the growing season, in 6 months, and the balance, $200,000 in 1.5 years from now. What is the present value of this offer if you could invest at 6% compounding monthly?

Coming Up Roses has grown into a very successful business and you have just received an offer from someone to purchase the business from you for $1.2 million. The potential buyer has offered you $400,000 at the time of sale, $600,000 at the end of the growing season, in 6 months, and the balance, $200,000 in 1.5 years from now. What is the present value of this offer if you could invest at 6% compounding monthly?

Chapter5: The Time Value Of Money

Section: Chapter Questions

Problem 22P

Related questions

Question

Coming Up Roses has grown into a very successful business and you have just received an offer from someone to purchase the business from you for $1.2 million. The potential buyer has offered you $400,000 at the time of sale, $600,000 at the end of the growing season, in 6 months, and the balance, $200,000 in 1.5 years from now.

- What is the

present value of this offer if you could invest at 6% compounding monthly?

Expert Solution

Step 1

Present Value of the cash flows can be calculated using the interest rate of 6% which is compounded monthly (6%/12 = 0.5%).

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:

9781337514835

Author:

MOYER

Publisher:

CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 2

Accounting

ISBN:

9781947172609

Author:

OpenStax

Publisher:

OpenStax College