YouOwnlt, Inc. Balance Sheet December 31, 20Y7 Assets Current assets $15,000,000 Property, plant, and equipment Total assets ... 22,500,000 ... $37,500,000 Liabilities and Stockholders' Equity $ 11,250,000 Liabilities.... Common stock, $10 .... 4,000,000 Paid-in capital in excess of par Retained earnings...... 500,000 ... 21,750,000 $ 37,500,000 Total liabilities and stockholders' equity

You hold a 25% common stock interest in YouOwnIt, a family-owned construction equipment company. Your sister, who is the manager, has proposed an expansion of plant facilities at an expected cost of $26,000,000. Two alternative plans have been suggested as methods of financing the expansion. Each plan is briefly described as follows:

Plan 1. Issue $26,000,000 of 20-year, 8% notes at face amount

Plan 2. Issue an additional 550,000 shares of $10 par common stock at $20 per share, and $15,000,000 of 20-year, 8% notes at face amount

The

Please see the attachment for details:

Net income has remained relatively constant over the past several years. The expansion program is expected to increase yearly income before bond interest and income tax from $2,667,000 in the previous year to $5,000,000 for this year. Your sister has asked you, as the company treasurer, to prepare an analysis of each financing plan.

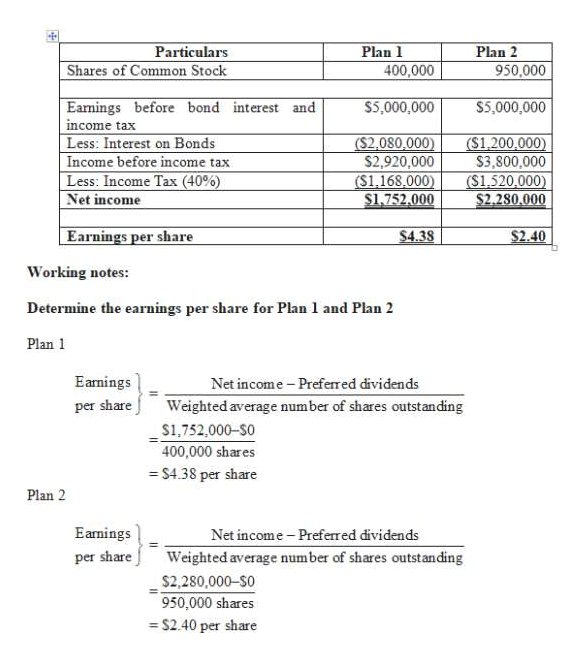

1. Prepare a table indicating the expected earnings per share on the common stock under each plan. Assume an income tax rate of 40%. Round to the nearest cent.

2. a. Discuss the factors that should be considered in evaluating the two plans.

b. Which plan offers greater benefit to the present stockholders? Give reasons for your opinion.

1.

Prepare a table indicating the expected earnings per share on the common stock under each plan.

2.a.

The factors that should be considered in evaluating the two plans are discussed below:

- A corporation has a liability of paying interest on bonds. However, it does not any definite obligation of paying dividends to its common stockholders. Thus, if there is a substantial decrease in the net income, it would be difficult to pay the interest expense. Hence, in such case, the issuance of common stock is better than bonds.

- On issuance of bonds, there is a definite obligation of repaying the principal amount of the bonds in 20 years. Moreover, in case of liquidation, the claims of the bondholders are to be settled before the claims of the common stockholders.

- The existing common stockholders should buy new shares if they intend to have their proportionate authority and the financial interest in the corporation.

Step by step

Solved in 3 steps with 1 images