You have the following data in relation to a large supermarket business: 31/12/202031/12/2019 £million £million Inventories 900 775 Trade 687.5 617.5 receivables Cash 525 562.5 Total current 2,112.5 1,955 assets Trade payables 2,800 2,625 Total current 2,800 2,625 liabilities 31/12/202031/12/2019 £million £million Revenue 16,350 15,050 Cost of Sales 14,793.25 13,800 Operating Profit 962.5 945 Your task: (a) Calculate the operating cash cycle in days for the year ending 31st December 2020. (b) Comment on your findings and explain whether this is typical for this type of business and why this is the case.

You have the following data in relation to a large supermarket business: 31/12/202031/12/2019 £million £million Inventories 900 775 Trade 687.5 617.5 receivables Cash 525 562.5 Total current 2,112.5 1,955 assets Trade payables 2,800 2,625 Total current 2,800 2,625 liabilities 31/12/202031/12/2019 £million £million Revenue 16,350 15,050 Cost of Sales 14,793.25 13,800 Operating Profit 962.5 945 Your task: (a) Calculate the operating cash cycle in days for the year ending 31st December 2020. (b) Comment on your findings and explain whether this is typical for this type of business and why this is the case.

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Hi, I need help with this. It is just for practice for myself

Transcribed Image Text:# Financial Analysis for a Large Supermarket Business

The data provided represents the financial information of a large supermarket business for the years ending 31st December 2020 and 31st December 2019.

## Current Assets and Liabilities

**As of 31/12/2020:**

- **Inventories:** £900 million

- **Trade Receivables:** £687.5 million

- **Cash:** £525 million

- **Total Current Assets:** £2,112.5 million

**As of 31/12/2019:**

- **Inventories:** £775 million

- **Trade Receivables:** £617.5 million

- **Cash:** £562.5 million

- **Total Current Assets:** £1,955 million

**Liabilities for Both Years:**

- **Trade Payables (31/12/2020):** £2,800 million

- **Trade Payables (31/12/2019):** £2,625 million

- **Total Current Liabilities (Both Years):** Remains £2,800 million and £2,625 million respectively

## Revenue and Profit

**As of 31/12/2020:**

- **Revenue:** £16,350 million

- **Cost of Sales:** £14,793.25 million

- **Operating Profit:** £962.5 million

**As of 31/12/2019:**

- **Revenue:** £15,050 million

- **Cost of Sales:** £13,800 million

- **Operating Profit:** £945 million

## Your Task

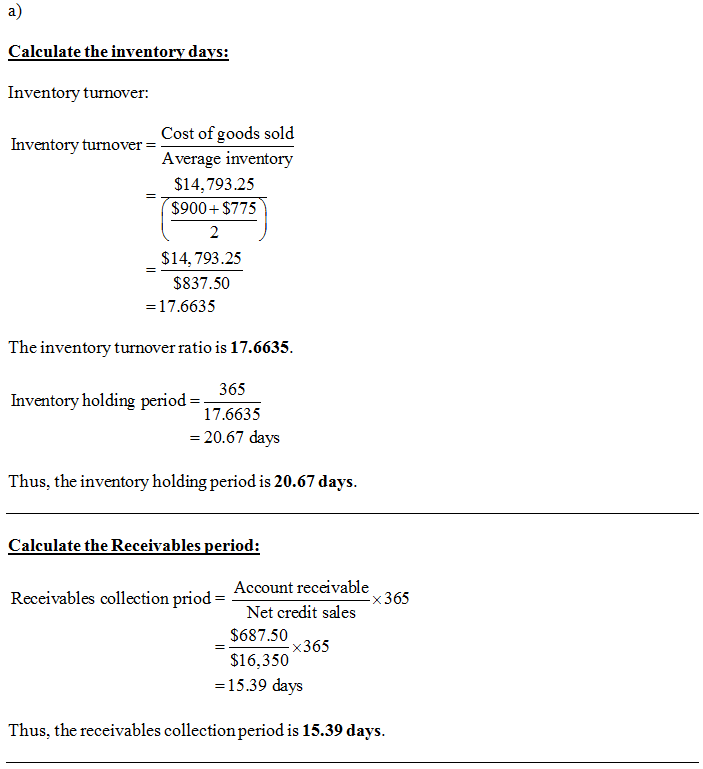

### (a) Calculate the Operating Cash Cycle in Days for the Year Ending 31st December 2020

The operating cash cycle (OCC) is a measure of how long a company takes to turn its inventories into cash. It is calculated using the following components:

- Inventory Days

- Receivables Days

- Payables Days

### (b) Comment on Your Findings and Explain Whether This is Typical for This Type of Business and Why

Consider the nature of supermarket businesses which generally have fast inventory turnover due to the sale of perishable goods. Reflect on the impact of fast inventory turnover and efficient receivable management on the operating cash cycle. Analyze if the OCC aligns with industry standards for supermarkets and explain the reasons behind your findings.

Expert Solution

Step 1

Inventory: It refers to the items held by an organization which were in various forms like raw material, work-in process, and finished goods. The inventory is generally held for resale or to use in the production process.

Accounts receivable: It is a current asset of an organization. It is the amount due from customers for sale of merchandise or for providing services on credit to them.

Accounts payable: It is the current liability to an organization. It is the amount payable to the suppliers, payable towards outstanding dues etc.

Step 2

Step by step

Solved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education