You are given the following data for rates of return on a risky asset, a risk free rate and a market rate of return. Your aim is to calculate a regression line and estimate beta from the capital asset pricing for the rates of return on Asset Y. Task One Copy the table below into Excel and calculate the excess returns for risky Asset Y and the Market X. Year 2 30 day Treasury Bill Rate 15 Excess return on Market 2.0 15 2.0 15 Natural logarithm of returns Asset Year 20.7 46.8 14.5 17.2 Market rate of return 12.5 Excess return on Asset 24.2 2.3 7.6 Task Two Create a scatter diagram from the data and calculate the following for Y and X (the excess returns). 1. The mean 2. The median 3. The standard deviation 4. The correlation coefficient between Y and X Summarise your findings in a short note of approximately 100 words in length. Asset Task Three In the table below, input the missing values using the data from the table above. You will need to insert the excess return for the asset and the market that you calculated earlier. Excess return on Market Excess Returns Market X², ΣΧΥ,

You are given the following data for rates of return on a risky asset, a risk free rate and a market rate of return. Your aim is to calculate a regression line and estimate beta from the capital asset pricing for the rates of return on Asset Y. Task One Copy the table below into Excel and calculate the excess returns for risky Asset Y and the Market X. Year 2 30 day Treasury Bill Rate 15 Excess return on Market 2.0 15 2.0 15 Natural logarithm of returns Asset Year 20.7 46.8 14.5 17.2 Market rate of return 12.5 Excess return on Asset 24.2 2.3 7.6 Task Two Create a scatter diagram from the data and calculate the following for Y and X (the excess returns). 1. The mean 2. The median 3. The standard deviation 4. The correlation coefficient between Y and X Summarise your findings in a short note of approximately 100 words in length. Asset Task Three In the table below, input the missing values using the data from the table above. You will need to insert the excess return for the asset and the market that you calculated earlier. Excess return on Market Excess Returns Market X², ΣΧΥ,

MATLAB: An Introduction with Applications

6th Edition

ISBN:9781119256830

Author:Amos Gilat

Publisher:Amos Gilat

Chapter1: Starting With Matlab

Section: Chapter Questions

Problem 1P

Related questions

Question

100%

Transcribed Image Text:You are given the following data for rates of return on a risky asset, a risk free rate and a

market rate of return. Your aim is to calculate a regression line and estimate beta from the

capital asset pricing for the rates of return on Asset Y.

Task One

Copy the table below into Excel and calculate the excess returns for risky Asset Y and the

Market X.

Year

1

2

3

30 day Treasury

Bill Rate

15

2.0

Excess return

on Market

X

15

2.0

15

Year

T

Natural logarithm of returns

1

Asset

2

20.7

3

46.8

8.6

14.5

17,2

Market rate of return

12.5

24.2

Excess return

on Asset

Y

2.3

Task Two

Create a scatter diagram from the data and calculate the following for Y and X (the excess

returns).

1. The mean

2.

The median

3. The standard deviation

4. The correlation coefficient between Y and X

Summarise your findings in a short note of approximately 100 words in length.

7.6

8.4

Task Three

In the table below, input the missing values using the data from the table above. You will

need to insert the excess return for the asset and the market that you calculated earlier.

Asset

Y

Excess Returns

Excess return

on Market

Market

Xx

X²

ΣΧΥ,

Transcribed Image Text:medi

3. The standard deviation

4. The correlation coefficient between Y and X

Summarise your findings in a short note of approximately 100 words in length.

Task Three

In the table below, input the missing values using the data from the table above. You will

need to insert the excess return for the asset and the market that you calculated earlier.

Excess return

on Market

B₁ =

Year

T

=

1

2

3

5

Sum

Mean

Excess return

on Asset

Excess return

on Market

Use the following expressions to calculate estimates for the regression line.

ΣXtYt - TXY

Σ(XtX) (Yt-Y)

Σ(Xt-X)²

Σ(X)² – TX²

X²,

=

ΣΧΥ,

Bo =Y - BiX

Once you have results for the regression line, put your results together in a narrative with the

two tables you completed. Your narrative should outline the capital asset pricing model and

what your estimate of one means in the context of the model.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by step

Solved in 6 steps with 6 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

kindly help

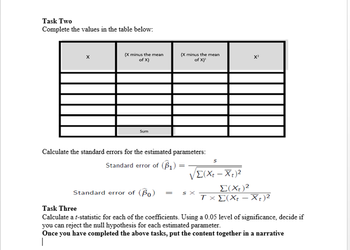

Transcribed Image Text:Task Two

Complete the values in the table below:

X

(X minus the mean

of X)

Sum

(X minus the mean

of X)'

Calculate the standard errors for the estimated parameters:

Standard error of (B₁) =

Standard error of (Bo)

X²

S

V Σ(Χ. – Χ.)2

Σ(Χ)2

sx Tx E(XtXt)²

Task Three

Calculate a t-statistic for each of the coefficients. Using a 0.05 level of significance, decide if

you can reject the null hypothesis for each estimated parameter.

Once you have completed the above tasks, put the content together in a narrative

|

Transcribed Image Text:Using the data you constructed in the previous activity and the linear regression line you

produced when estimating the parameters associated with the capital asset pricing model for

Asset Y, complete the tasks below. You will recall that you are interested in the following:

E(R) - rf

Y

B₁

These are the hypotheses:

Actual value for

excess return for

Asset

ß(E(Rm) – rf)

Bo+B1(X)

equals E(R) - rf

equals E(Rm) - rf

equals & the estimate of riskiness

Ho

B₁0 versus H₂ : B₁

Ho: Po 0 versus H₂ : Bo

Excess return

on Market

X

Task One

Using the data from the previous activity, complete the table below:

Fitted value for

excess return for

Asset Y

Sum

0

Calculate the sample variance.

0

Estimated residual

squared

Solution

Recommended textbooks for you

MATLAB: An Introduction with Applications

Statistics

ISBN:

9781119256830

Author:

Amos Gilat

Publisher:

John Wiley & Sons Inc

Probability and Statistics for Engineering and th…

Statistics

ISBN:

9781305251809

Author:

Jay L. Devore

Publisher:

Cengage Learning

Statistics for The Behavioral Sciences (MindTap C…

Statistics

ISBN:

9781305504912

Author:

Frederick J Gravetter, Larry B. Wallnau

Publisher:

Cengage Learning

MATLAB: An Introduction with Applications

Statistics

ISBN:

9781119256830

Author:

Amos Gilat

Publisher:

John Wiley & Sons Inc

Probability and Statistics for Engineering and th…

Statistics

ISBN:

9781305251809

Author:

Jay L. Devore

Publisher:

Cengage Learning

Statistics for The Behavioral Sciences (MindTap C…

Statistics

ISBN:

9781305504912

Author:

Frederick J Gravetter, Larry B. Wallnau

Publisher:

Cengage Learning

Elementary Statistics: Picturing the World (7th E…

Statistics

ISBN:

9780134683416

Author:

Ron Larson, Betsy Farber

Publisher:

PEARSON

The Basic Practice of Statistics

Statistics

ISBN:

9781319042578

Author:

David S. Moore, William I. Notz, Michael A. Fligner

Publisher:

W. H. Freeman

Introduction to the Practice of Statistics

Statistics

ISBN:

9781319013387

Author:

David S. Moore, George P. McCabe, Bruce A. Craig

Publisher:

W. H. Freeman