You are an active investor in the securities market and you have established an investment portfolio of two stock A and B five years ago. Required: a)If your portfolio has provided you with returns of 9.7%, -6.2%, 12.1%, 11.5% and 13.3% over the past five years, respectively. Calculate the geometric average returnof the portfolio for this period? ? b)Assume that expected return of the stock A in your portfolio is 14.6%. The risk premium on the stocks of the same industry are 5.8%, the risk-free rate of return is 5.9% and the inflation rate was 2.7. Calculate beta of thisstock using Capital Asset Pricing Model(CAPM) ? c)Assume that you bought 200 stock B in your portfolio for total investment of $1200, now the market price of the stock is $75, the dividend paid for this stock is $2 each year. How much is the capital gain of this stock ? d)Assume that the following data available for the portfolio, calculate the expected return, variance and standard deviation of the portfolio given stock A accounts for 45% and stock B accounts for 55% of your portfolio? A B Expected return 12.5 % 18.5 % Standard deviation of return 15 % 20 % Coefficient of correlation 0.4

You are an active investor in the securities market and you have established an investment portfolio of two stock A and B five years ago.

Required:

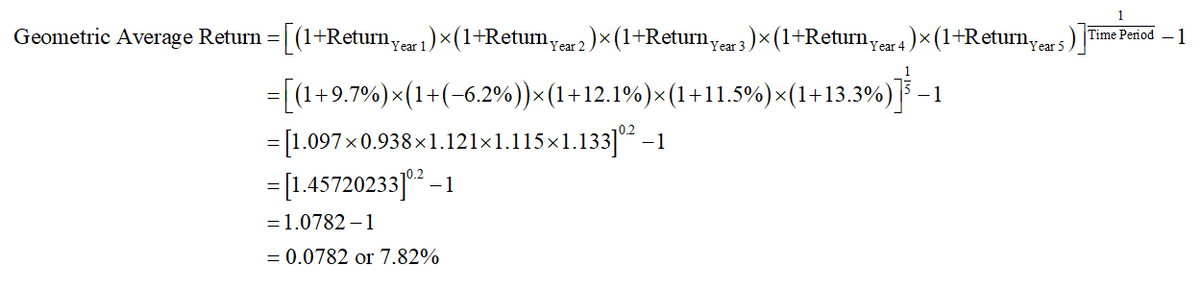

a)If your portfolio has provided you with returns of 9.7%, -6.2%, 12.1%, 11.5% and 13.3% over the past five years, respectively.

Calculate the geometric average returnof the portfolio for this period? ?

b)Assume that expected return of the stock A in your portfolio is 14.6%. The risk premium on the stocks of the same industry are 5.8%, the risk-free

Calculate beta of thisstock using

c)Assume that you bought 200 stock B in your portfolio for total investment of $1200, now the market price of the stock is $75, the dividend paid for this stock is $2 each year. How much is the

d)Assume that the following data available for the portfolio, calculate the expected return, variance and standard deviation of the portfolio given stock A accounts for 45% and stock B accounts for 55% of your portfolio?

| A | B | |

| Expected return | 12.5 % | 18.5 % |

| Standard deviation of return | 15 % | 20 % |

| Coefficient of correlation | 0.4 |

Since you have posted a question with multiple sub-parts, we will solve the first three sub-parts for you. To get the remaining sub-part solved please repost the complete question and mention the sub-parts to be solved.

A combination of the different types of funds and securities for the investment is term as the portfolio.

a)

Computation of the geometric average return:

Hence, the geometric average return is 7.82%.

Step by step

Solved in 5 steps with 3 images