Win's Companies Balance Sheet May 31, 2018 and 2017 Assets Liabilities 2018 2017 2018 2017 Cash %24 2,300 $ 1,300 Total Current Liabilities %24 22,000 $ 12,900 Short-term Ivestments 29,000 13,000 Long-term Liabilities 12,200 11,300 Accounts Receivable 7,300 5,400 Total Liabilities 34,200 24,200 Merchandise Inventory 7,000 5,900 Stockholders Equity Other Current Assets 9,000 1,800 Common Stock 8,000 8,000 40,400 18,200 Tot Current Assets 54,600 27,400 Retained Earnings All Other Assets 28,000 23,000 Total Equity 48,400 26,200 Total Assets $4 82,600 $ 50,400 %24 Total Liabilities and Equity 82,600 $ 50,400

Win's Companies Balance Sheet May 31, 2018 and 2017 Assets Liabilities 2018 2017 2018 2017 Cash %24 2,300 $ 1,300 Total Current Liabilities %24 22,000 $ 12,900 Short-term Ivestments 29,000 13,000 Long-term Liabilities 12,200 11,300 Accounts Receivable 7,300 5,400 Total Liabilities 34,200 24,200 Merchandise Inventory 7,000 5,900 Stockholders Equity Other Current Assets 9,000 1,800 Common Stock 8,000 8,000 40,400 18,200 Tot Current Assets 54,600 27,400 Retained Earnings All Other Assets 28,000 23,000 Total Equity 48,400 26,200 Total Assets $4 82,600 $ 50,400 %24 Total Liabilities and Equity 82,600 $ 50,400

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Practice Pack

![### Win's Companies Financial Analysis

**Overview:**

Win's Companies, a home improvement store chain, has provided summarized financial figures for the years ended May 31, 2018, and 2017. The company has 20,000 common shares outstanding as of 2018.

**Objective:**

Compute Win's Companies' current ratio as of May 31, 2018, and 2017. Utilize the formula to calculate the current ratio, then enter the amounts to determine the ratios for both years. Answers should be rounded to two decimal places.

**Financial Details (Income Statement):**

#### Income Statement for the Years Ended May 31, 2018, and 2017

- **2018:**

- Net Sales Revenue: $57,200

- Cost of Goods Sold: $22,500

- Interest Expense: $500

- All Other Expenses: $5,800

- **Net Income:** $28,400

- **2017:**

- Net Sales Revenue: $39,800

- Cost of Goods Sold: $25,500

- Interest Expense: $320

- All Other Expenses: $6,500

- **Net Income:** $7,480

### Calculation

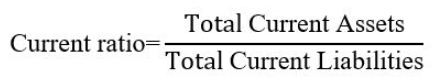

The current ratio can be computed using the formula:

\[ \text{Current Ratio} = \frac{\text{Current Assets}}{\text{Current Liabilities}} \]

This calculation provides insights into the company's short-term financial health and ability to cover its short-term liabilities with its short-term assets.

(Note: Balance sheet figures for current assets and liabilities are needed to compute the current ratio, which are not provided in this document.)](/v2/_next/image?url=https%3A%2F%2Fcontent.bartleby.com%2Fqna-images%2Fquestion%2F560e0a1a-05b0-4147-b2d2-445e55f36447%2F0b2fbbb4-72ab-43af-b659-bf930f8de30a%2Fqf4il8_processed.jpeg&w=3840&q=75)

Transcribed Image Text:### Win's Companies Financial Analysis

**Overview:**

Win's Companies, a home improvement store chain, has provided summarized financial figures for the years ended May 31, 2018, and 2017. The company has 20,000 common shares outstanding as of 2018.

**Objective:**

Compute Win's Companies' current ratio as of May 31, 2018, and 2017. Utilize the formula to calculate the current ratio, then enter the amounts to determine the ratios for both years. Answers should be rounded to two decimal places.

**Financial Details (Income Statement):**

#### Income Statement for the Years Ended May 31, 2018, and 2017

- **2018:**

- Net Sales Revenue: $57,200

- Cost of Goods Sold: $22,500

- Interest Expense: $500

- All Other Expenses: $5,800

- **Net Income:** $28,400

- **2017:**

- Net Sales Revenue: $39,800

- Cost of Goods Sold: $25,500

- Interest Expense: $320

- All Other Expenses: $6,500

- **Net Income:** $7,480

### Calculation

The current ratio can be computed using the formula:

\[ \text{Current Ratio} = \frac{\text{Current Assets}}{\text{Current Liabilities}} \]

This calculation provides insights into the company's short-term financial health and ability to cover its short-term liabilities with its short-term assets.

(Note: Balance sheet figures for current assets and liabilities are needed to compute the current ratio, which are not provided in this document.)

Transcribed Image Text:**Win's Companies Balance Sheet: May 31, 2018 and 2017**

**Assets**

| | 2018 | 2017 |

|----------------|----------|----------|

| **Cash** | $2,300 | $1,300 |

| **Short-term Investments** | $29,000 | $13,000 |

| **Accounts Receivable** | $7,300 | $5,400 |

| **Merchandise Inventory** | $7,000 | $5,900 |

| **Other Current Assets** | $9,000 | $1,800 |

| **Total Current Assets** | $54,600 | $27,400 |

| **All Other Assets** | $28,000 | $23,000 |

| **Total Assets** | $82,600 | $50,400 |

**Liabilities**

| | 2018 | 2017 |

|--------------------------------------|----------|----------|

| **Total Current Liabilities** | $22,000 | $12,900 |

| **Long-term Liabilities** | $12,200 | $11,300 |

| **Total Liabilities** | $34,200 | $24,200 |

**Stockholders' Equity**

| | 2018 | 2017 |

|-------------------|---------|---------|

| **Common Stock** | $8,000 | $8,000 |

| **Retained Earnings** | $40,400 | $18,200 |

| **Total Equity** | $48,400 | $26,200 |

**Total Liabilities and Equity**: $82,600 for 2018 and $50,400 for 2017.

This balance sheet provides a summary of the financial position of Win's Companies as of May 31, 2018, and 2017. It includes assets such as cash, investments, and inventory, liabilities consisting of current and long-term obligations, and stockholders' equity reflecting common stock and retained earnings. The balance of assets equals the total of liabilities and equity for both years.

Expert Solution

Step 1

Current ratio: The financial ratio which evaluates the ability of a company to pay off the debt obligations which mature within one year or within completion of operating cycle is referred to as current ratio. This ratio assesses the liquidity of a company.

Learn your way

Includes step-by-step video

Step by step

Solved in 2 steps with 2 images

Better your learning with

Practice Pack

Better your learning with

Practice Pack

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education