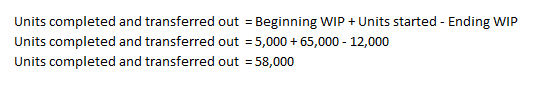

Whilewells Ltd had at the beginning of 2019 a work in progress of 5,000 units. During 2019, 65,000 additional units were started into production. Ending work in progress on 31st December, 2019, was 12,000 units. The beginning work in progress was 100% complete as to direct materials and 50% complete as to conversion costs. The ending work in progress was 100% complete as to direct materials and 80% complete as to conversion costs. Total direct materials put into work in progress cost £77,500. Total conversion costs put into process costs were £105,375. Beginning work in progress cost £33,500, of which £20,250 was for materials and £13,250 for conversion. All materials are added at the start of the production process, and conversion costs are incurred uniformly throughout manufacturing. Whilewells Ltd uses a weighted-average process cost system. What is the total cost assigned to Whilewells Ltd’s ending work in progress inventory at the end of 2019? a. £33,619 b. £33,100 c. £37,357 d. £31,875

Whilewells Ltd had at the beginning of 2019 a work in progress of 5,000 units. During 2019, 65,000 additional units were started into production. Ending work in progress on 31st December, 2019, was 12,000 units. The beginning work in progress was 100% complete as to direct materials and 50% complete as to conversion costs. The ending work in progress was 100% complete as to direct materials and 80% complete as to conversion costs. Total direct materials put into work in progress cost £77,500. Total conversion costs put into process costs were £105,375. Beginning work in progress cost £33,500, of which £20,250 was for materials and £13,250 for conversion. All materials are added at the start of the production process, and conversion costs are incurred uniformly throughout manufacturing. Whilewells Ltd uses a weighted-average

What is the total cost assigned to Whilewells Ltd’s ending work in progress inventory at the end of 2019?

| a. |

£33,619 |

|

| b. |

£33,100 |

|

| c. |

£37,357 |

|

| d. |

£31,875 |

Step by step

Solved in 2 steps with 3 images