What is the profit/loss for stock from the following information? Stock price jan- 102.03 Stock pric april- 86.19 option price jan- (-5.46) option price april- 1.93 *Buying 100 shares

What is the

Stock price jan- 102.03

Stock pric april- 86.19

option price jan- (-5.46)

option price april- 1.93

*Buying 100 shares

Option is the derivative instrument used by investors. It gives the right to an investor not an obligation to buy or sell the stock at future date or maturity date. Options are classified as call option and put option. Call option gives the right to buy at future date whereas put option gives the right to sell the stock in future.

Given Information:

Assume 100 shares were bought

Stock price January is 102.03

Stock price April is 86.19

Option price January is (-5.46)

Option price April is 1.93

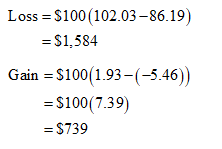

Calculation of the profit and loss:

The prices of the option are increasing which means the investor will buy the put option. A loss from the shares and gain from put option is as follows:

Step by step

Solved in 5 steps with 2 images