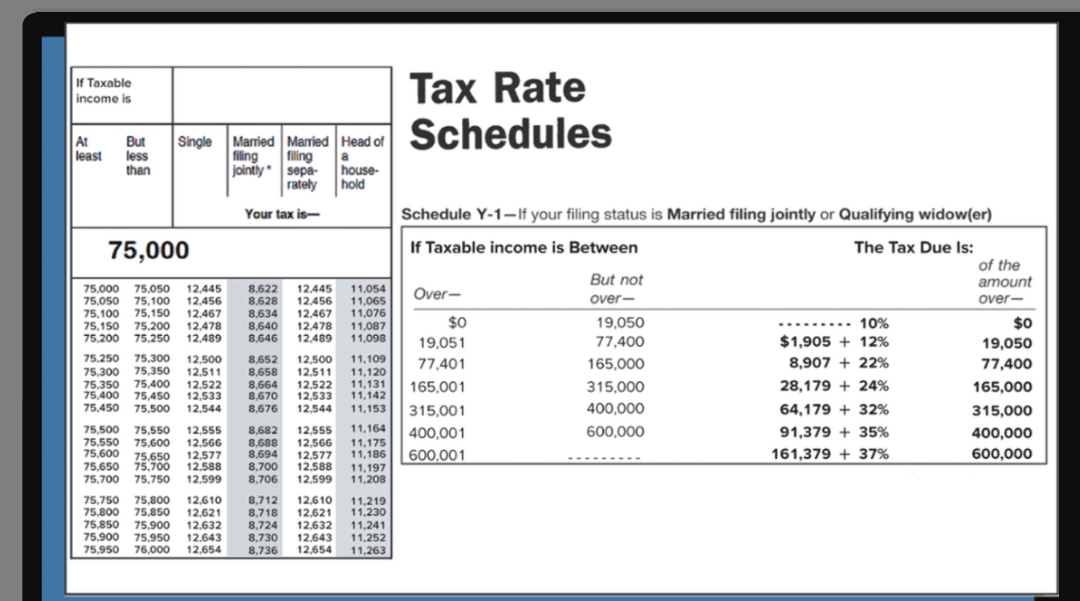

Using the tax table in Exhibit 4-6, determine the amount of taxes for the following situations: Federal Tax Tables a. A head of household with taxable income of $75,762. b. A single person with taxable income of $75,062. c. A married person filing a separate return with taxable income of $75,780.

Using the tax table in Exhibit 4-6, determine the amount of taxes for the following situations: Federal Tax Tables a. A head of household with taxable income of $75,762. b. A single person with taxable income of $75,062. c. A married person filing a separate return with taxable income of $75,780.

Chapter1: Financial Statements And Business Decisions

Section: Chapter Questions

Problem 1Q

Related questions

Question

Transcribed Image Text:Using the tax table in Exhibit 4-6, determine the amount of taxes for the following situations:

Federal Tax Tables

a. A head of household with taxable income of $75,762.

b. A single person with taxable income of $75,062.

c. A married person filing a separate return with taxable income of $75,780.

Transcribed Image Text:Таx Rate

Schedules

If Taxable

income is

Married Married Head of

filing

jointly* sepa-

rately

At

least

Single

But

less

than

filing

a

house-

hold

Your tax is-

Schedule Y-1–If your filing status is Married filing jointly or Qualifying widow(er)

75,000

The Tax Due Is:

of the

If Taxable income is Between

But not

аmount

75,000

75,050

75.100

75,050

75,100

75,150

75,200

75,250

12,445

12,456

12,467

12,478

12,489

8,622

8,628

8.634

12,445

12,456

12,467

12,478

12,489

11,054

11,065

11,076

11,087

11,098

Over-

over-

over-

$0

19,050

10%

$0

75,150

75,200

8,640

8,646

19,051

77,400

$1,905 + 12%

19,050

75,300

75,350

75,400

75,400 75,450

75,500

75,250

8,652

8,658

8,664

8,670

8,676

11,109

12,500

12,511

12,522

12,533

12,544

12,500

12,511

12,522

12,533

12,544

77,401

165,000

8,907 + 22%

77,400

75,300

75,350

11,120

11,131

11,142

11,153

165,001

315,000

28,179 + 24%

165,000

75,450

315,001

400,000

64,179 + 32%

315,000

75,500

11,164

12,555

12,566

12,577

12,588

600,000

75,550

75,600

75,650

75,700

75,750

12,555

12,566

12,577

12,588

12,599

8,682

8,688

8,694

8,700

8,706

400,001

91,379 + 35%

400,000

75,550

75,600

75.650

11,175

11,186

600,001

161,379 + 37%

600,000

11,197

11,208

75,700

12,599

75,800

75,850

8,712

8,718

8,724

12,610

12,621

12,632

12,643

12,654

75,750

75,800

12,610

12,621

12,632

11,219

11,230

75,850

75,900

75,900

75,950

76,000

12,643

12,654

11,241

11,252

11,263

8,730

75,950

8,736

Expert Solution

Step 1

Table used:

Trending now

This is a popular solution!

Step by step

Solved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Recommended textbooks for you

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Accounting

Accounting

ISBN:

9781337272094

Author:

WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:

Cengage Learning,

Accounting Information Systems

Accounting

ISBN:

9781337619202

Author:

Hall, James A.

Publisher:

Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis…

Accounting

ISBN:

9780134475585

Author:

Srikant M. Datar, Madhav V. Rajan

Publisher:

PEARSON

Intermediate Accounting

Accounting

ISBN:

9781259722660

Author:

J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:

McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:

9781259726705

Author:

John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:

McGraw-Hill Education